State Bank of India’s analysis suggests that the recent US tariffs on Indian goods could negatively impact the American economy. The report projects a potential 40-50 basis point reduction in US GDP and increased inflationary pressures. Import-dependent sectors in the US are already feeling the strain.

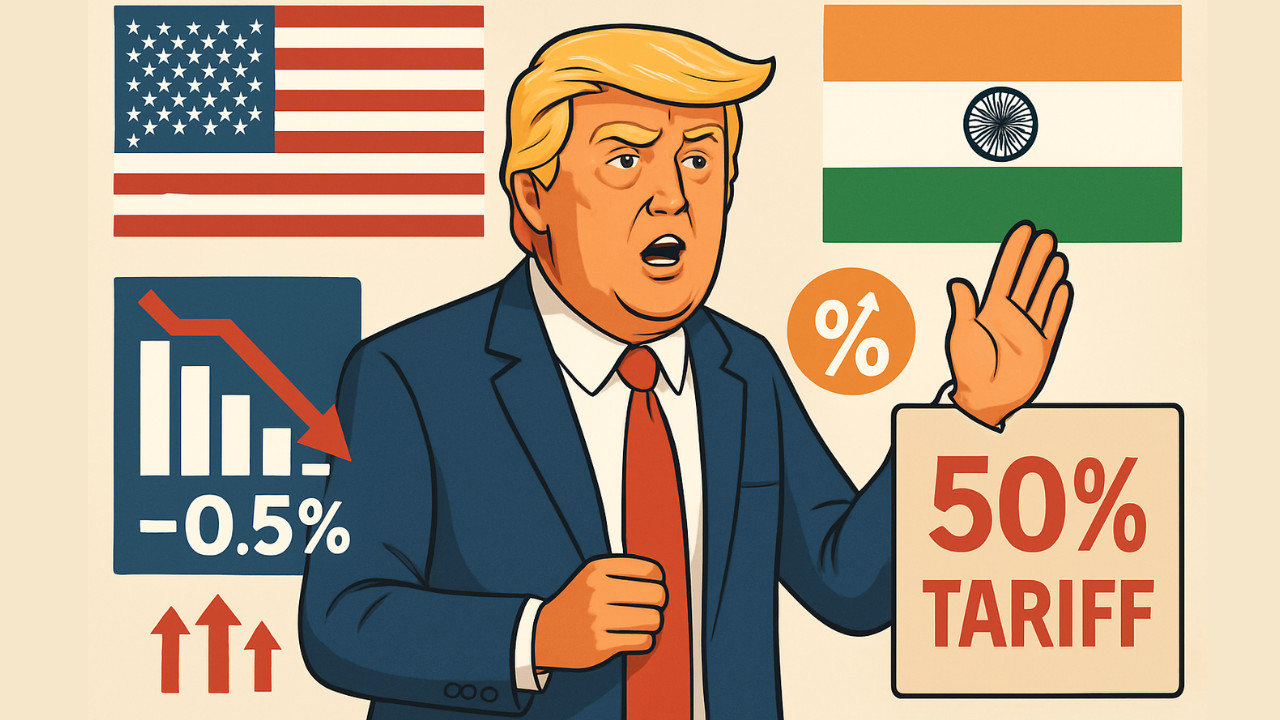

The Tariff Tango: How Slapping Duties on India Could Sting the US Economy

Remember playground tussles where the bully ends up tripping over their own feet? That’s the vibe I’m getting from the latest tariff kerfuffle brewing between the US and India. The US, contemplating hiking tariffs on roughly 50 Indian products, might be setting itself up for a rather uncomfortable fall, if recent analysis holds true.

It’s easy to see the surface logic. A domestic industry is struggling, so tariffs are imposed to make foreign goods more expensive, thereby boosting demand for homegrown products. But economics rarely works in such a straightforward manner. The ripple effects of tariffs are complex and can have unintended consequences, like a boomerang hitting the thrower squarely in the face.

Why Higher Tariffs on India Could Backfire

The core of the issue is this: slapping tariffs on imports doesn’t just hurt the exporting country. American consumers and businesses also feel the pinch. Think higher prices at the checkout, increased costs for manufacturers who rely on imported components, and generally a less competitive economic landscape.

A recent report suggests that a significant increase in tariffs on Indian goods could actually shave off a considerable chunk of the US GDP – we’re talking about a potential reduction of 40-50 basis points. That’s not pocket change. It’s a noticeable slowdown that could impact job growth, investment, and overall economic prosperity.

<img src="image-url/india-tariffs.jpg" alt="Illustration of the US and Indian flags intertwined, highlighting the potential negative impacts of higher tariffs on India on the US economy.” width=”600″ height=”400″>

Furthermore, the report paints a concerning picture of inflationary pressures. Tariffs essentially act as a tax on imports, driving up the cost of goods. In an already inflationary environment, adding fuel to the fire with increased tariffs could exacerbate the problem, making life even more expensive for American families. We’re already seeing inflation concerns, and protectionist measures like this risk making things worse.

The Inflationary Tightrope Walk

One of the biggest challenges facing the US economy right now is managing inflation without triggering a recession. The Federal Reserve is walking a tightrope, trying to cool down the economy with interest rate hikes without sending it tumbling into a downturn. Throwing trade wars into the mix just makes the balancing act even more precarious.

Tariffs, while potentially benefiting specific domestic industries in the short term, create a ripple effect that impacts the entire economy. They can disrupt supply chains, increase input costs for businesses, and ultimately lead to higher prices for consumers.

Beyond the Numbers: The Human Cost

It’s tempting to get lost in the economic jargon of GDP points and inflation rates. However, it’s crucial to remember that behind these numbers are real people. Increased tariffs translate into higher prices for groceries, clothes, and other essential goods. This disproportionately impacts low-income families, who already struggle to make ends meet. The promise of job creation in protected industries must be weighed against the potential for job losses in other sectors that rely on affordable imports.

We also need to consider the impact on small businesses. Many small businesses rely on imported materials or products to operate. Increased tariffs can squeeze their profit margins, forcing them to raise prices or even close their doors.

This isn’t just about trade statistics; it’s about the real-world consequences for American families and businesses. For a broader look at the complexities of global trade and its impact on local economies, read our article on [the challenges and opportunities of globalization](link-to-related-article).

A More Nuanced Approach to Trade

Ultimately, the decision to impose tariffs is a complex one with far-reaching implications. While the intention might be to protect domestic industries and create jobs, the reality is often more complicated. A more nuanced approach to trade, one that considers the potential for unintended consequences and prioritizes the long-term health of the economy, is essential. Dialogue, negotiation, and strategic partnerships are far more effective tools than blunt instruments like across-the-board tariffs.

The potential for these higher tariffs on India to negatively affect the US economy underscores the interconnectedness of the global marketplace. Instead of isolationist policies, perhaps focusing on boosting American competitiveness through investment in education, infrastructure, and innovation would provide more sustainable and mutually beneficial results.