The finance ministry reported a significant 45% increase in foreign asset and income disclosures, with 2.3 lakh taxpayers reporting in 2023-24. Amidst reports of increased Indian deposits in Swiss banks, the ministry clarified that the amount includes funds from companies, banks, and individuals. CBDT is actively reviewing returns and verifying information through multiple channels, including inquiries and searches.

Digging Deeper: Are We Finally Getting a Handle on Foreign Assets?

Okay, so let’s talk money. Specifically, money stashed away in accounts overseas. It’s a topic that’s always been a little bit shrouded in mystery, whispered about in hushed tones, and frankly, one that’s been incredibly difficult to get a clear picture of. But, the latest news from the Finance Ministry hints at a possible shift.

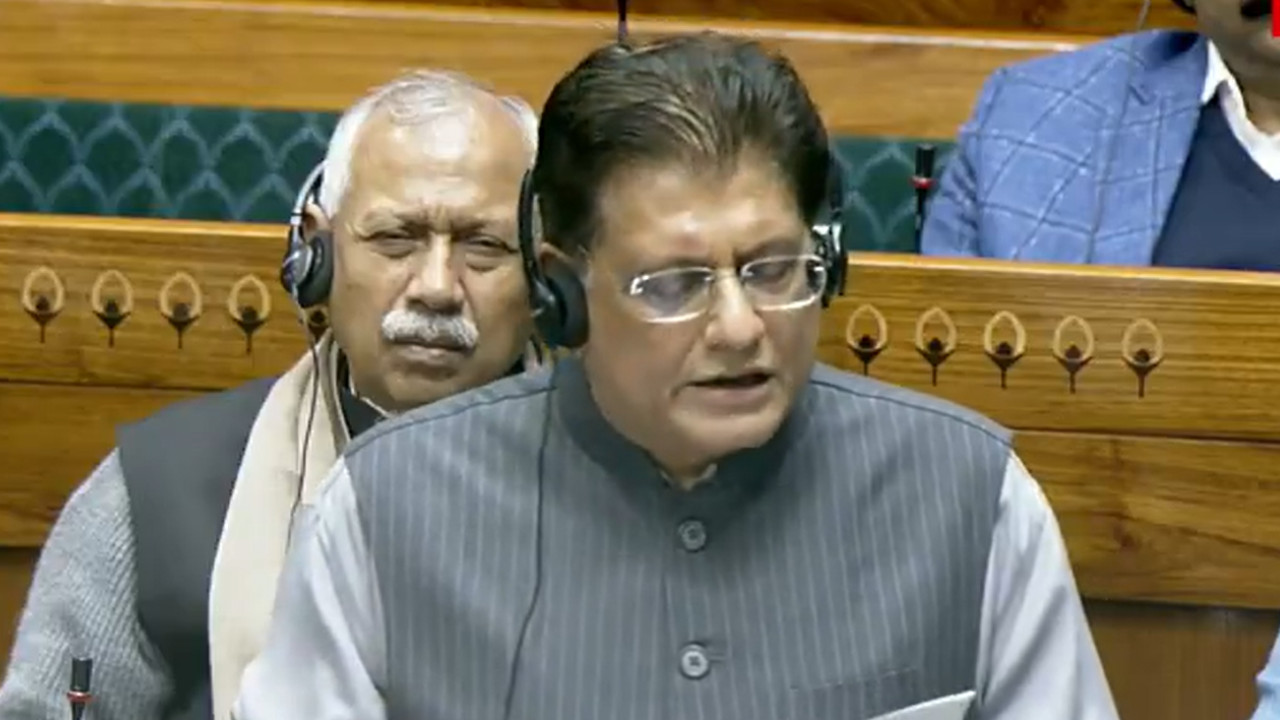

Our Finance Minister just announced a significant increase in the reporting of foreign assets and income for FY24. Now, on the surface, that sounds pretty dry. Reporting’s up? So what? But trust me, peel back a layer, and this could signify something much bigger than just ticking boxes on tax forms. It could indicate a growing transparency, a willingness (or perhaps a necessity) to bring those previously hidden assets into the light.

Think about it. For years, the lure of offshore accounts has been strong. Promises of tax havens, greater privacy, and diversification – the reasons have been varied and, for some, compelling. But times, they are a-changin’.

The global landscape is becoming increasingly interconnected, and governments worldwide are cracking down on tax evasion and illicit financial flows. Think of initiatives like the Common Reporting Standard (CRS), where countries automatically exchange financial account information. It’s become much harder to keep these assets completely hidden from the taxman.

So, is this increased reporting a direct result of these global pressures? Most likely, yes. It’s a classic case of ” adapt or be caught”. People are realizing that the risks associated with undeclared foreign assets are simply outweighing the perceived benefits. Penalties can be hefty, and the reputational damage? Irreparable.

But beyond the global pressure cooker, there’s perhaps another factor at play: a growing awareness and acceptance of tax compliance. India, in particular, has seen a significant push towards financial inclusion and digital literacy. More people are participating in the formal economy, and there’s a growing understanding of the importance of paying taxes for nation-building. This shift in mindset, though subtle, can’t be discounted.

Now, let’s not get carried away and declare victory just yet. An increase in reporting doesn’t automatically translate into a complete eradication of illicit wealth. There’s undoubtedly still a significant amount of money lurking in the shadows, cleverly hidden behind complex structures and nominee accounts. This is a cat-and-mouse game, and the “mice” are often incredibly resourceful.

The real question is, how effective are the authorities in tracking down these hidden assets and ensuring that the appropriate taxes are paid? Increased reporting is just the first step. What about robust investigation, prosecution, and enforcement? Are the mechanisms in place to deal with the complexities of international tax laws and cross-border financial transactions? That’s where the real battle lies.

Furthermore, it’s important to remember that not all foreign assets are ill-gotten. Many individuals and businesses legitimately hold assets overseas for legitimate reasons – investments, business operations, or even simply diversifying their portfolio. It’s crucial to distinguish between genuine financial planning and deliberate tax evasion. A blanket approach could stifle legitimate international business and investment.

So, what does this all mean for the average person? Well, it reinforces the importance of transparency and compliance. For those who genuinely haven’t been aware of their reporting obligations, this should serve as a wake-up call. It’s time to get your house in order and ensure that you’re fully compliant with all relevant tax laws. The risks of non-compliance are simply too high.

For the government, this signals an opportunity to further strengthen its enforcement mechanisms and continue its efforts to promote financial literacy and tax compliance. Investing in advanced data analytics and international cooperation can help them stay one step ahead of those trying to game the system.

Ultimately, the increase in reporting of foreign assets is a positive step in the right direction. It suggests a growing awareness of the need for transparency and a willingness to comply with tax laws. But it’s just one piece of the puzzle. The journey towards a truly transparent and equitable financial system is a long and complex one, and it requires sustained effort, vigilance, and a commitment from all stakeholders. Let’s hope this momentum continues and that future reports paint an even brighter picture.