The United States has imposed a 50% tariff on semi-finished copper imports, effective August 1, 2025, citing national security concerns. While India’s $360 million copper exports to the US will become more expensive, the impact is expected to be limited due to uniform application across all countries.

Copper Tariffs: What Does This Mean for India?

The world of trade can be a tempestuous sea, and the latest ripples are coming from across the Pacific. The United States has just levied a hefty 50% tariff on certain copper imports, a move that’s got industries worldwide taking notice. But what exactly does this mean, especially for India? Let’s dive in.

The White House recently issued an order slapping a 50% tariff on specific forms of copper entering the US market. The focus? Semi-finished copper products. That encompasses a range of goods that have undergone some processing but aren’t quite ready for their final use. Think copper rods, wire, and certain plates. These are the building blocks for everything from electrical wiring to plumbing, making this tariff a potentially significant event for manufacturers who rely on these imported materials.

Now, the immediate question is: why this sudden move? The official justification revolves around protecting domestic copper producers in the US. The idea is that by making imported copper more expensive, American companies will be able to compete more effectively, preserving jobs and boosting the local economy. This is a classic example of protectionist trade policy at play.

But what impact will this have on India? While the initial reports suggest a limited direct impact, the situation is more nuanced than it appears at first glance. India isn’t a major exporter of these specific semi-finished copper products to the US. Other countries, such as those in Europe and Asia, are likely to feel the pinch more acutely.

However, “limited impact” doesn’t mean “no impact.” The global economy is interconnected. When one major player like the US shifts its trade policy, the reverberations can be felt far and wide. For example, if other countries who previously exported semi-finished copper to the US now look to alternative markets, it could increase competition for Indian copper producers in those markets. This ripple effect could squeeze profit margins and force Indian companies to adapt.

Furthermore, even if India’s direct exports to the US aren’t huge, Indian companies might be part of global supply chains that are affected. A manufacturer in, say, Germany, might source components from India that ultimately end up in a product sold in the US. The increased cost of copper in the US could impact the competitiveness of that final product, indirectly affecting the Indian supplier.

The Bigger Picture: Copper Prices and Global Trade

Beyond the immediate tariff implications, this move highlights the broader importance of copper in the global economy. Copper is an essential metal, used in everything from electronics and construction to transportation and renewable energy. As the world transitions to a greener economy, the demand for copper is only set to increase. This increased demand coupled with any artificial supply constraints introduced by things like these tariffs, could certainly impact copper prices.

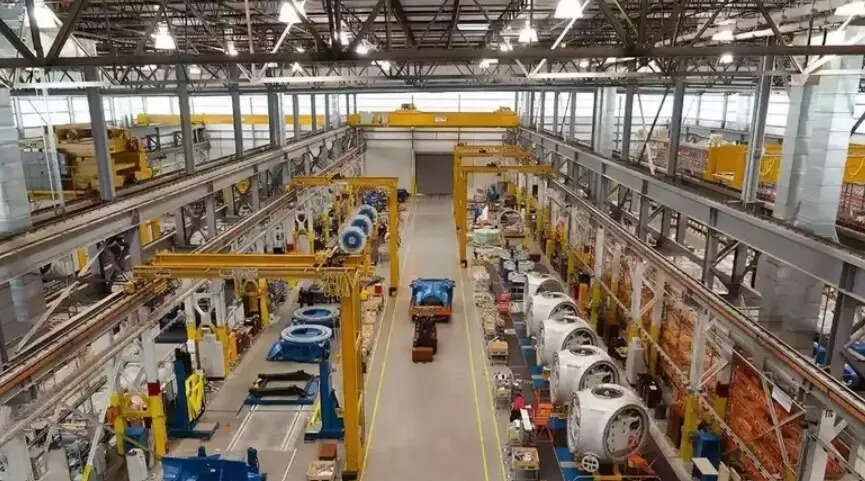

Any change in copper trade policies has the potential to impact companies involved in cable manufacturing. Check out this article on the cable industry for further reading.

This tariff could be a precursor to further trade restrictions on other commodities. It serves as a stark reminder for Indian businesses to stay agile and diversify their export markets. Relying too heavily on a single country or region can leave them vulnerable to sudden policy changes.

While India might not be in the direct line of fire this time, the US copper tariff is a wake-up call. It’s a reminder that in the interconnected world of trade, every action, no matter how seemingly localized, can have unforeseen consequences. It also underscores the need for Indian businesses to strengthen their competitiveness and explore new opportunities in a dynamic and uncertain global landscape. Indian companies should explore avenues like value addition and specializing in niche high-quality copper products.

Ultimately, the long-term effects of this tariff remain to be seen. However, one thing is clear: businesses need to stay informed, be adaptable, and strategically position themselves to navigate the ever-changing currents of global trade. The future belongs to those who can anticipate and adapt.