Despite EU sanctions imposed in July, Russian-linked Nayara Energy has exported its first gasoline shipment, with the vessel Tempest Dream carrying 43,000 metric tons to Oman. Another sanctioned vessel, Sard, is expected to load diesel at Nayara’s Vadinar port. Facing operational challenges, Nayara is increasing domestic sales through state-owned retailers.

Nayara Energy Navigates the Shifting Sands of Global Fuel Trade

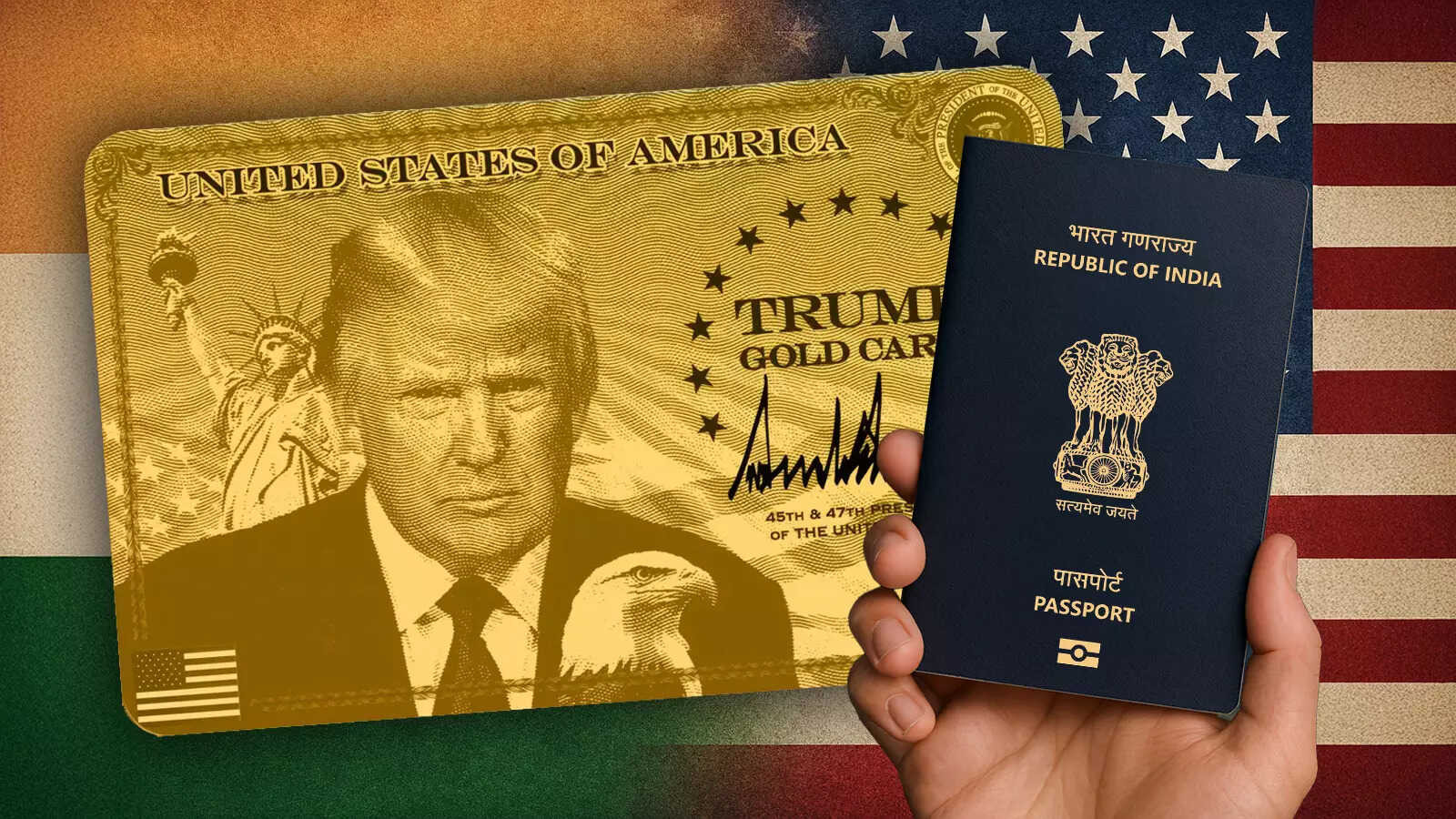

The world of energy is never static. Geopolitical winds shift, sanctions ripple through markets, and companies constantly adapt to maintain supply and demand. One such company navigating these turbulent waters is Nayara Energy, the Russian-backed refinery in India. Recently, they’ve made headlines by exporting its first gasoline shipment since the implementation of stricter EU sanctions on Russian oil products. This marks a significant development, signaling how global trade patterns are evolving in response to the ongoing situation in Europe.

The big question: what exactly does this gasoline shipment signify, and what’s coming next?

A First Gasoline Shipment and a Diesel Promise

The shipment, reportedly heading to Europe, raises eyebrows considering the EU’s restrictions. While not directly violating sanctions (the gasoline isn’t necessarily of Russian origin), it highlights the complex web of international energy trade. The fact that Nayara Energy, with its significant Russian backing, is involved adds another layer of intrigue.

Beyond gasoline, whispers abound about an impending diesel shipment from Nayara Energy as well. This would further solidify the company’s role in the evolving global fuel landscape and demonstrate their ability to continue operating effectively despite the headwinds. These moves suggest Nayara is finding alternative markets and strategies to maintain its export volumes. It also throws into stark relief the difficulties of enforcing sanctions when global demand for energy remains high.

Understanding Nayara Energy’s Position

Nayara Energy operates a large refinery in Vadinar, Gujarat. This refinery is crucial for India’s domestic fuel supply and is also a significant exporter of refined products. Rosneft, the Russian oil giant, holds a major stake in the company, making Nayara a key player in the India-Russia energy relationship. This connection is more important than ever, considering the steep discounts India receives for Russian crude oil.

The EU sanctions, aimed at curbing Russia’s revenue from oil exports, have created a ripple effect throughout the global energy market. Refineries like Nayara are now strategically important in processing crude oil from Russia and supplying refined products to various destinations. It’s a complex dance of supply chains, regulations, and market dynamics.

The Impact on the Global Market for Gasoline

The emergence of Nayara Energy as a gasoline exporter has potential implications for global gasoline prices and supply chains. It demonstrates the resilience of the energy market and its ability to adapt to changing circumstances. While the exact impact is yet to be fully realized, this development signals a potential shift in trade flows, with India becoming an increasingly important hub for refined products.

This also raises questions about the effectiveness of sanctions. While designed to limit Russia’s financial gains, they’ve inadvertently reshaped global trade routes and created opportunities for companies like Nayara Energy to fill the gaps. The longer-term consequences of these shifts remain to be seen, but it’s clear that the energy market is undergoing a profound transformation. This situation could potentially lead to higher gasoline prices in the EU despite sanctions, depending on how these trade routes evolve and are regulated.

Looking Ahead: Adapting to the New Normal

Nayara Energy’s recent activity is a microcosm of the larger shifts occurring in the global energy market. Companies are adapting, trade routes are being redrawn, and the demand for energy remains strong. Navigating this complex landscape requires agility, strategic planning, and a deep understanding of the geopolitical forces at play.

For India, this development strengthens its position as a major refining hub and highlights the importance of its strategic relationship with Russia. For the rest of the world, it serves as a reminder of the interconnectedness of the global energy market and the challenges of enforcing sanctions in a world hungry for fuel.

It’s a reminder that the global energy picture is a constantly evolving puzzle. And companies like Nayara Energy are actively rearranging the pieces. Check out our insights on renewable energy investments to see how the energy landscape is transforming beyond traditional fossil fuels. The road ahead will be defined by continuous adaptation, innovation, and a willingness to navigate uncertainty. The future of gasoline and energy trading rests on these adaptations.