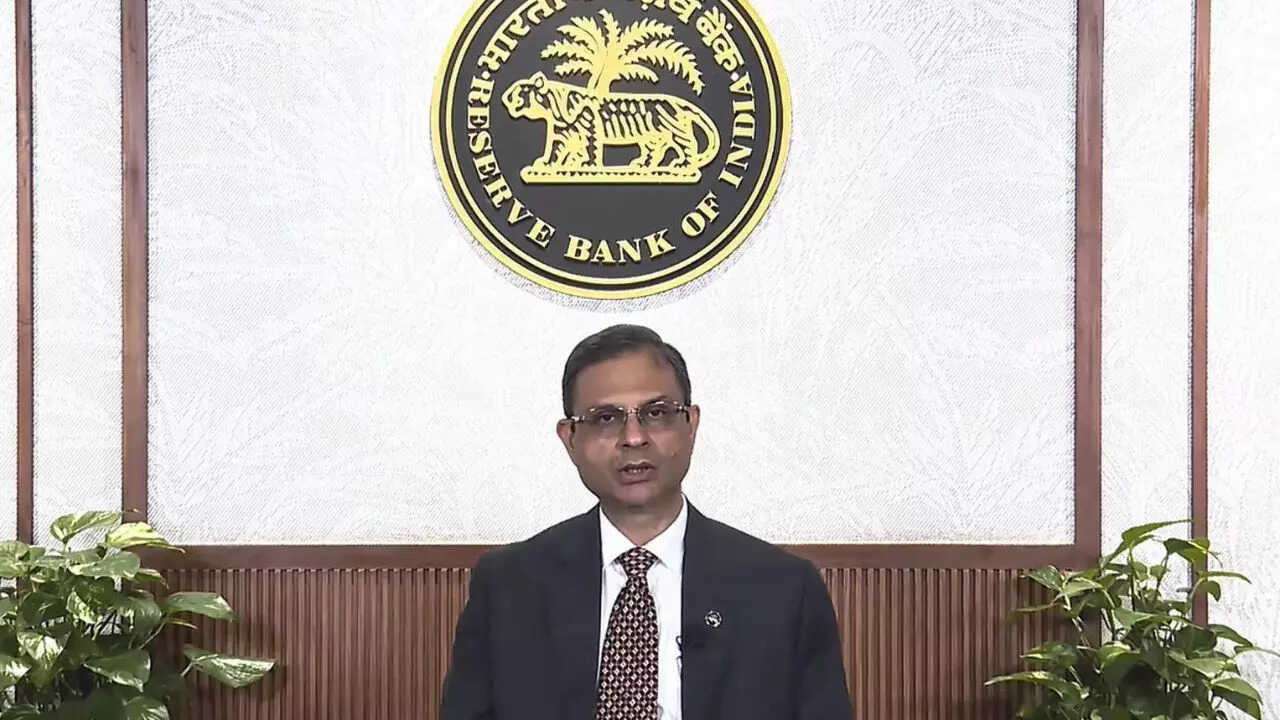

RBI Governor announced measures to simplify claim settlements for deceased customers’ accounts and lockers, alongside a re-KYC drive for PMJDY accounts via panchayat-level camps. The Retail Direct platform will now offer SIPs in treasury bills. Bank credit growth slowed to 12.1% in FY25, but total financial resource flow to the commercial sector increased.

Making Banking Easier After Loss: RBI Simplifies Claims for Deceased Customers

Losing a loved one is undoubtedly one of life’s most difficult experiences. Navigating the complexities of their financial affairs afterward can feel like adding insult to injury. The Reserve Bank of India (RBI) recognizes this burden and is taking significant steps to ease the process of claiming funds from deceased individuals’ bank accounts. This initiative promises to reduce the bureaucratic hurdles and emotional stress faced by grieving families.

Streamlining the Claims Process: A Welcome Change

Imagine having to deal with a mountain of paperwork and confusing procedures while mourning. The current system for claiming funds from deceased accounts can often feel this way. The RBI’s proposed simplification aims to cut through the red tape, making the process more transparent and user-friendly. While specific details are still unfolding, the overarching goal is clear: to make it easier for nominees and legal heirs to access the funds they are rightfully entitled to. This might involve standardized claim forms, clearer guidelines on required documentation, and potentially even online submission options. Ultimately, it is designed to lighten the load during an already challenging time.

One hopes that this push for simplification will extend beyond just the initial claim submission. Quicker processing times and more efficient communication from banks would be invaluable. Imagine a scenario where a bereaved spouse can quickly access funds to cover immediate expenses, rather than waiting months for the claim to be processed. This is the kind of positive impact the RBI’s initiative could have.

Re-KYC Drive for Jan Dhan Accounts: Boosting Financial Inclusion

Beyond easing the claims process, the RBI is also focused on strengthening financial inclusion through a re-KYC (Know Your Customer) drive for Jan Dhan accounts. Launched in 2014, the Pradhan Mantri Jan Dhan Yojana (PMJDY) aimed to provide access to banking services for all citizens, particularly those in underserved communities. However, over time, some accounts may have incomplete or outdated KYC information.

The re-KYC drive seeks to rectify this. Banks are actively reaching out to Jan Dhan account holders to update their information, ensuring that these accounts remain active and compliant. This not only helps prevent fraudulent activities but also allows beneficiaries to fully utilize the various government schemes and financial services linked to their accounts.

Why is Re-KYC Important?

Think of your KYC information as your digital identity within the banking system. It’s how banks verify who you are and ensure that your account is legitimate. Outdated or incomplete KYC can lead to various issues, including restrictions on transactions and even account closures. By updating their KYC, Jan Dhan account holders can avoid these disruptions and continue to enjoy the benefits of financial inclusion. This proactive step ensures the integrity of the financial system and protects vulnerable populations from potential misuse of their accounts. You can read more about the importance of maintaining updated financial information here.

A Step in the Right Direction for Banking

The RBI’s dual focus on simplifying claims for deceased customers and strengthening Jan Dhan accounts demonstrates a commitment to making banking more accessible and user-friendly for all. These initiatives are not just about streamlining processes; they are about recognizing the human element in banking and providing support during vulnerable moments. By removing unnecessary hurdles and ensuring that everyone has access to essential financial services, the RBI is helping to build a more inclusive and equitable financial system. The effect this will have on Indian families, and the financial sector as a whole, remains to be seen, but early indications suggest that this will have a positive, tangible impact.

Ultimately, these moves reflect a forward-thinking approach that prioritizes customer needs and fosters trust in the banking sector. As the details of these initiatives unfold, it’s clear that the RBI is striving to create a financial landscape that is both efficient and compassionate.