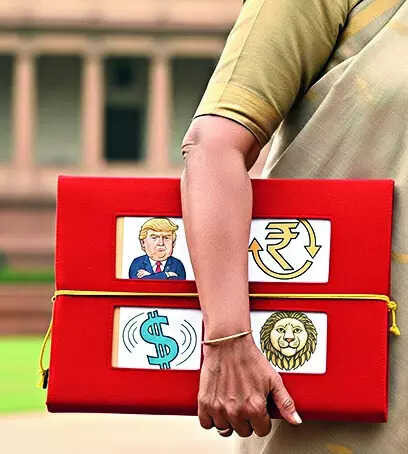

Donald Trump’s proposed 50% tariff on Indian exports casts a shadow over Indian stock markets, impacting sectors like textiles and auto ancillaries. While export-oriented businesses face challenges, analysts suggest focusing on domestic consumption-driven sectors. A potential market dip presents a buying opportunity for long-term investors, leveraging India’s resilient economy.

Navigating the Tariff Tightrope: What Trump’s Trade Measures Could Mean for Your Portfolio

The winds of international trade can shift quickly, and recently, those winds have picked up strength, particularly with the potential return of Donald Trump to the US political stage. Whispers of reintroduced tariffs, specifically a blanket 50% tariff on imports from countries like India, have sent ripples through the stock market. But before you start hitting the panic button and rearranging your investment strategy, let’s unpack what this could mean and how to think about navigating this uncertain landscape.

The Tariff Terrain: A Lay of the Land

The idea of a 50% tariff sounds dramatic, and frankly, it is. The impact of such a hefty tax on imported goods would be significant. Essentially, it would make Indian goods much more expensive for American consumers. This, in turn, could lead to decreased demand, impacting Indian companies that rely heavily on exports to the US. Sectors like pharmaceuticals, textiles, and engineering goods, all significant contributors to India’s export basket, could feel the pinch. A diversified portfolio is helpful, but not entirely protective in cases like this.

Impact on the Indian Stock Market:

Predicting the precise movements of the stock market is a fool’s errand. However, we can make educated assessments. The immediate reaction to talk of such tariffs would likely be negative. Investor sentiment, a fickle beast, could turn sour, leading to a sell-off in stocks of companies heavily exposed to the US market. The Nifty 50 and Sensex, key indicators of the Indian stock market’s health, could experience volatility. The degree of volatility, however, depends on several factors, including the credibility investors give to the tariff threat, the broader global economic climate, and the Indian government’s response. Remember, markets hate uncertainty, and tariffs inject a heavy dose of just that.

Your Investment Strategy: To Panic or Not to Panic?

That is the million-dollar question, isn’t it? The short answer is almost certainly not to panic. Knee-jerk reactions rarely lead to sound investment decisions. Instead, consider a more measured approach.

Firstly, assess your portfolio’s exposure. How much of your investments are tied to companies that heavily rely on exports to the US? If the exposure is minimal, there’s likely no need for drastic action. If your portfolio is heavily concentrated in these sectors, it might be wise to rebalance and diversify.

Secondly, consider the long-term picture. Investment is rarely a sprint and almost always a marathon. Tariffs, while impactful, are not necessarily permanent. Political landscapes shift, trade agreements evolve, and companies adapt. Don’t let short-term anxieties derail your long-term financial goals.

Thirdly, stay informed. Keep abreast of developments in trade policy and the potential impacts on specific sectors. Reliable financial news sources and consultations with a qualified financial advisor are invaluable in navigating these turbulent times. Consider reading related content on managing risk in volatile markets.

Beyond the Bottom Line: A Broader Perspective

The potential for tariffs extends beyond just the stock market. It could impact trade relations between the US and India, potentially leading to retaliatory measures. It could also impact the global economy, disrupting supply chains and increasing inflationary pressures. While investors are naturally focused on their portfolios, it’s important to be aware of the broader geopolitical and economic context.

The Silver Linings, If Any:

While the prospect of tariffs is generally unwelcome, there could be some unexpected silver linings. It might encourage Indian companies to diversify their export markets, reducing their reliance on the US. It could also incentivize domestic manufacturing, boosting local economies and creating jobs. The best-case scenario would be a renewed focus on innovation and competitiveness, making Indian industries more resilient in the face of global challenges.

Future-Proofing Your Portfolio in an Uncertain World

Predicting the future is impossible, but preparing for multiple scenarios is not. Diversification remains your best friend. A well-diversified portfolio, spread across different asset classes and geographies, can help cushion the blow from unexpected shocks. Consider investing in companies with strong fundamentals, a proven track record, and a focus on innovation. And, perhaps most importantly, maintain a long-term perspective, remembering that market fluctuations are a normal part of the investment journey. A clear long-term investment strategy is the best defense against short-term market wobbles.