The independence of the US Federal Reserve is under scrutiny. President Trump has pressured the Fed to cut interest rates. He even called for a governor’s resignation. Fed Chair Jerome Powell is trying to balance inflation and economic growth. Economists warn that political influence could harm markets. Powell’s upcoming speech is crucial for the Fed’s future.

Is the Fed’s Independence Really at Stake? The High-Wire Act of Monetary Policy

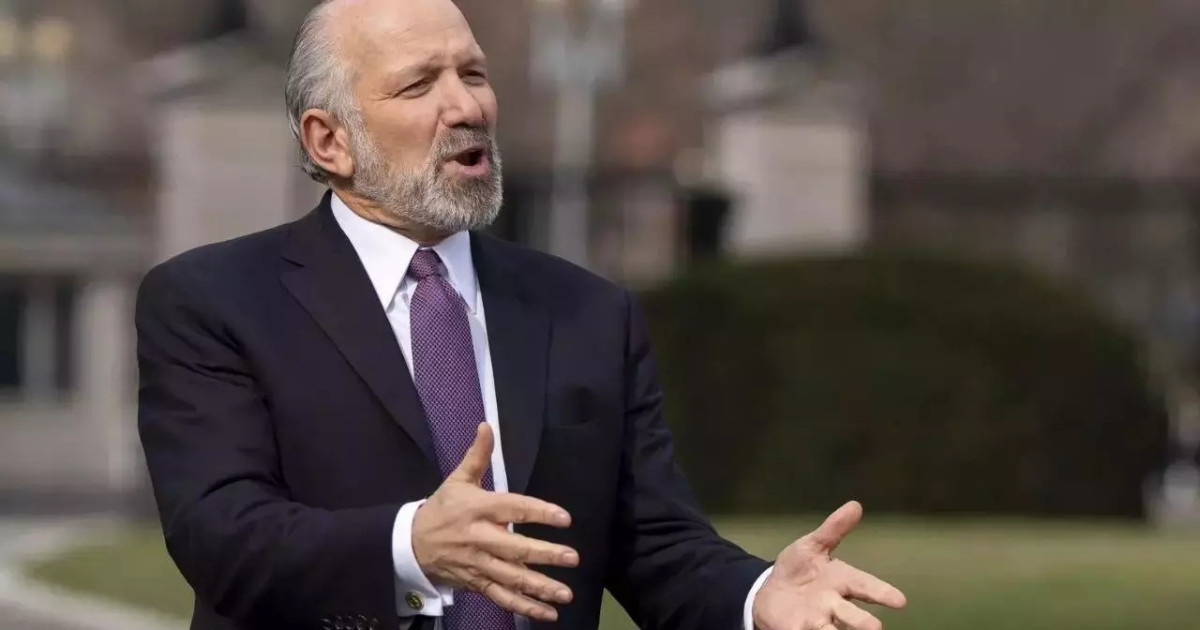

The air around Jackson Hole is always charged with anticipation this time of year. It’s where central bankers, economists, and financial gurus gather to chew over the global economic landscape. This year, however, the stakes feel different. As Federal Reserve Chairman Jerome Powell prepares to speak, the usual economic musings are tinged with a sharper note: the very independence of the US Central Bank is being questioned.

Why this heightened scrutiny? Let’s rewind. Former President Trump has been vocal in his criticism of Powell, and by extension, the Fed’s policies. He believes the Fed’s decisions have hampered economic growth, and this criticism shines a spotlight on a crucial, often overlooked, aspect of monetary policy: its independence from political interference.

But does the Fed’s freedom really matter? Absolutely. Imagine a scenario where interest rate decisions are dictated by political expediency rather than economic data. Picture lower rates before an election, designed to boost short-term growth, even if it risks long-term inflation. That’s a recipe for economic instability, and that’s precisely what central bank independence is designed to prevent.

The Importance of Fed Independence: It’s about more than just resisting pressure from the White House. It’s about fostering credibility in the eyes of investors, businesses, and consumers. When the Fed can operate free from political pressure, its pronouncements carry more weight. Markets are more likely to react predictably, and businesses are more likely to make long-term investments, knowing that monetary policy won’t be subject to sudden, politically motivated shifts. It provides a layer of stability that encourages sustained economic growth.

Historically, countries where central banks are subject to significant government control often struggle with higher inflation and greater economic volatility. Argentina, with its history of central bank manipulation, offers a stark lesson on the dangers of political interference. In contrast, nations with independent central banks, such as Germany with its Bundesbank tradition, have generally enjoyed greater price stability and economic prosperity. You can read more about factors influencing global markets here.

Navigating the Political Minefield: Maintaining this distance isn’t easy. Central bankers aren’t immune to public pressure, and politicians will always be tempted to weigh in on monetary policy. The key lies in establishing clear mandates and robust institutional safeguards. The Fed’s mandate, as set by Congress, is to promote maximum employment and price stability. This provides a framework for decision-making that is grounded in economic principles rather than political agendas.

However, the lines can get blurry. What constitutes “maximum employment”? How much inflation is acceptable? These are questions that require judgment calls, and those judgment calls inevitably become subject to debate and scrutiny. It’s a constant balancing act, requiring transparency, clear communication, and a willingness to explain the rationale behind policy decisions.

Jackson Hole and the Future of Monetary Policy: As Powell takes the stage in Jackson Hole, he faces a delicate task. He must reaffirm the Fed’s commitment to its mandate of price stability while also navigating the current political climate. He’ll need to signal a path forward on interest rates, providing clarity for markets and businesses alike. Perhaps most importantly, he’ll need to underscore the importance of maintaining the Fed’s independence, not as a matter of institutional pride, but as a cornerstone of a healthy and stable economy.

The whispers surrounding the Fed’s independence serve as a crucial reminder: monetary policy is not just about numbers and models; it’s about trust, credibility, and the long-term health of the economy. Striking the right balance between these elements is paramount to a stable economic future.