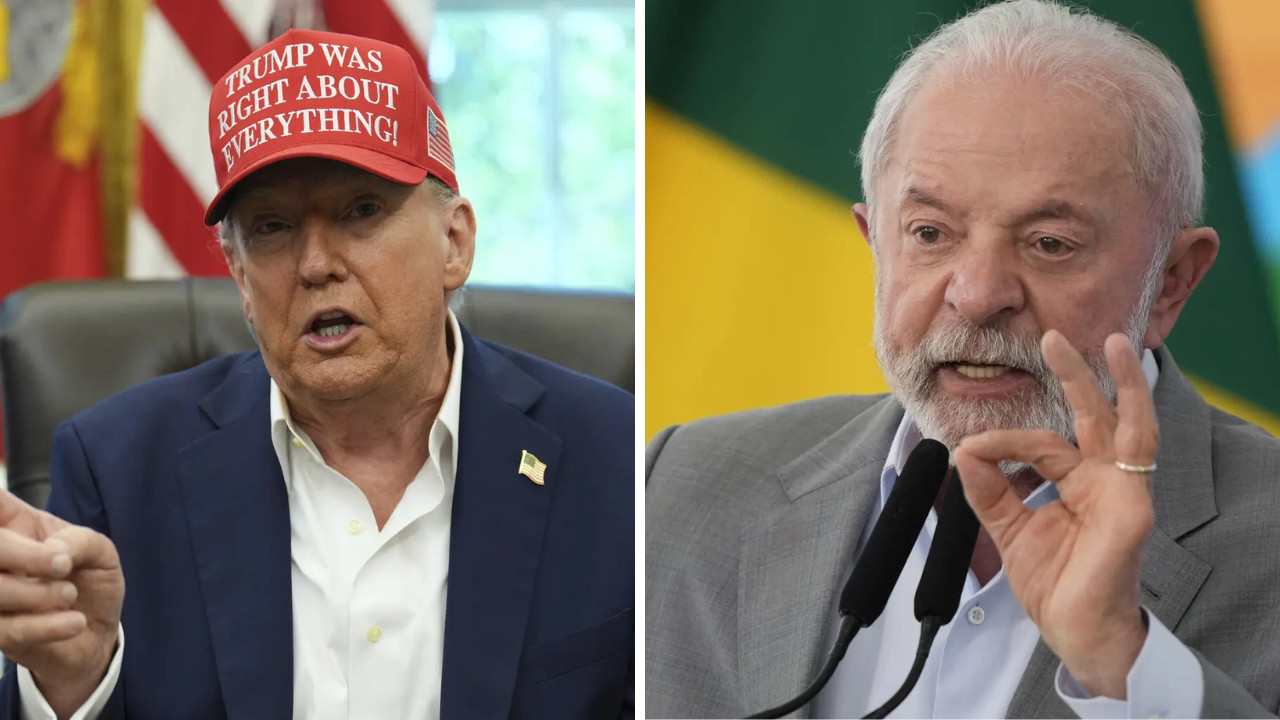

Brazil Flexes Financial Muscle: A Bold Move to Shield Exporters

The winds of global trade are rarely steady, and Brazilian exporters have recently found themselves facing a particularly stiff headwind: U.S. tariffs. But Brazil isn’t one to stand still and watch its economic engines sputter. Instead, the country’s development bank, BNDES, has stepped up with a substantial $1.85 billion credit line, a strategic maneuver designed to keep Brazilian exports flowing strong. This isn’t just about short-term survival; it’s about building resilience and diversifying markets in a world increasingly prone to protectionist measures.

This injection of capital comes at a crucial time. U.S. tariffs, while often targeted, have a ripple effect, impacting industries and businesses far beyond the initial scope. Brazilian exporters, caught in this crossfire, need access to liquidity to weather the storm, maintain production, and explore new markets. BNDES, playing its role as a key player in Brazil’s economic development, is providing that vital lifeline.

Navigating the Tariff Terrain: The Role of the Credit Line

So, how exactly will this massive credit line work? The funds are earmarked to provide working capital to exporters directly impacted by U.S. tariffs. This means companies can access loans to cover day-to-day operational costs, invest in new technologies, or even fund market research to identify alternative export destinations. The goal is to empower these businesses to adapt and thrive, even amidst challenging global conditions.

Furthermore, the credit line isn’t simply about throwing money at a problem. It’s structured to encourage diversification. While the U.S. remains a significant trading partner for Brazil, over-reliance on any single market carries inherent risks. The BNDES initiative aims to incentivize companies to actively seek out new customers in Asia, Europe, and other emerging markets, creating a more balanced and robust export portfolio.

Why This Matters: Beyond the Balance Sheet

The implications of this move extend far beyond individual company balance sheets. A healthy export sector is crucial for Brazil’s overall economic health. It generates jobs, stimulates innovation, and contributes significantly to the country’s GDP. By proactively supporting its exporters, Brazil is safeguarding its economic future and demonstrating a commitment to its businesses.

This action also sends a strong signal to the international community. Brazil is showcasing its ability to respond decisively to external challenges and protect its economic interests. It highlights the strength and sophistication of its financial institutions and its willingness to play an active role in shaping the global trade landscape.

The Bigger Picture: Brazilian Economic Strategy

This $1.85 billion credit line is just one piece of a larger puzzle. Brazil has been actively pursuing a multi-pronged approach to strengthen its economy, including attracting foreign investment, streamlining regulations, and investing in infrastructure development. Supporting exporters through initiatives like this complements these broader efforts, fostering a more competitive and resilient economy overall. The focus on Brazilian exports is a keystone of their economic strategy.

The current global economic climate demands agility and adaptability. By providing targeted support to its exporters, Brazil is demonstrating precisely those qualities. This isn’t just about mitigating the immediate impact of U.S. tariffs; it’s about building a stronger, more diversified, and more resilient economy for the long term. The success of this initiative will depend on how effectively Brazilian exporters leverage these resources to innovate, diversify, and conquer new markets. Only time will tell the full impact, but the initial signals are promising.