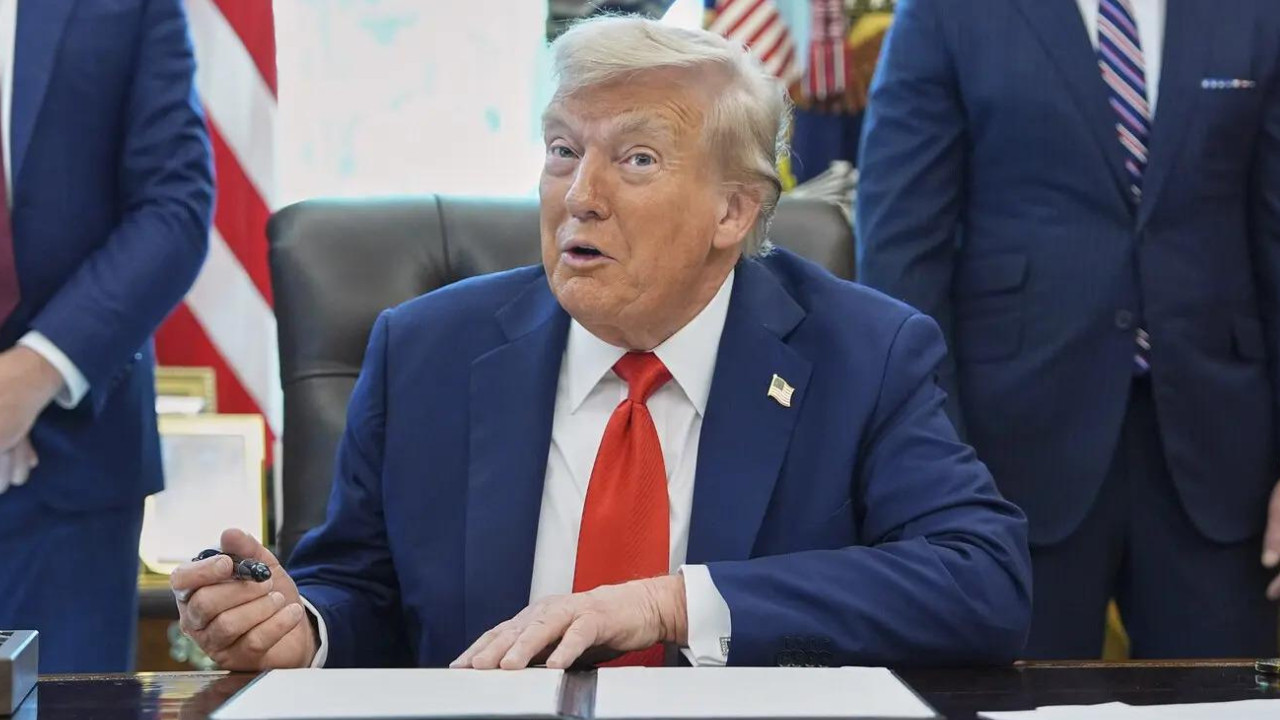

President Trump asserted the U.S. holds significant leverage over China, hinting at the potential to severely damage their economy if necessary, during a meeting with South Korean President Lee Jae Myung. He mentioned ongoing trade disputes and recent conversations with President Xi Jinping, considering a trip to Beijing.

Could a Rare Earths Tariff War Erupt Between the US and China?

The global trade landscape just got a whole lot more interesting, and potentially, a whole lot more volatile. Donald Trump, never one to shy away from bold statements, recently hinted at the possibility of imposing tariffs on rare earth minerals imported from China. This isn’t just a minor skirmish in a trade dispute; it could trigger a major reshuffling of global supply chains and have significant ramifications for industries worldwide.

Rare earth elements (REEs) might not be a household name, but they are the unsung heroes powering modern technology. From smartphones and electric vehicles to wind turbines and advanced defense systems, these 17 elements are essential ingredients. And right now, China dominates the global market, controlling a lion’s share of both mining and processing.

Trump’s comments, delivered during a recent interview, suggested a willingness to ramp up trade pressure on China, even to the point of considering tariffs as high as 200% on rare earth imports. He stated he could ‘destroy’ China’s economy, a claim that might be hyperbole, but certainly underscores the gravity of the situation. But what led to this potentially explosive situation, and what could the consequences be?

Why Rare Earths Matter: The Core of the Issue

The heart of the matter is dependence. The US, along with many other nations, relies heavily on China for these crucial elements. This dependence creates vulnerabilities, giving China considerable leverage in trade negotiations and potentially impacting national security. For example, if China decided to restrict rare earth exports, industries reliant on these materials could face significant disruptions and price spikes. It’s a scenario that keeps policymakers awake at night.

The Trump administration previously explored ways to reduce this reliance, recognizing the strategic importance of a secure rare earth supply chain. The current administration has also prioritized bolstering domestic production and seeking alternative sources. The challenge, however, lies in the time and investment required to develop these capabilities. Mining and processing rare earths is a complex and environmentally challenging process, requiring specialized expertise and infrastructure.

The Potential Impact of Tariffs on the Rare Earth Supply Chain

So, what would happen if the US imposed tariffs on Chinese rare earths? The immediate effect would likely be an increase in the cost of these materials for American manufacturers. This could translate to higher prices for consumers and reduced competitiveness for businesses.

However, the longer-term implications are more complex. Tariffs could incentivize domestic production of rare earths in the US, as well as encourage the development of alternative sources in countries like Australia, Canada, and even within Europe. This diversification of the supply chain would ultimately reduce reliance on China and strengthen the US’s position.

Furthermore, higher prices could spur innovation in materials science, leading to the development of substitutes for rare earths in certain applications. Companies may invest in research and development to find alternative materials or processes that reduce their dependence on these elements.

China’s Response and the Future of Trade

Of course, any move by the US would likely be met with a response from China. This could include retaliatory tariffs on US exports, restrictions on the export of other critical materials, or even currency manipulation. The potential for escalation is real, and a full-blown trade war could have significant consequences for the global economy. You can learn more about previous trade disputes and their impact on our economic outlook.

The situation is further complicated by the fact that China’s dominance in rare earth processing is even greater than its dominance in mining. Even if the US were to significantly increase domestic mining, it would still need to send the raw materials to China for processing, at least in the short term.

Ultimately, the threat of tariffs on rare earths is a strategic move aimed at reducing dependence on China and securing a more stable and resilient supply chain. Whether it will succeed remains to be seen. The outcome will depend on a complex interplay of political and economic factors, including the willingness of both sides to negotiate, the ability of the US to develop alternative sources of supply, and the resilience of the global economy.

The future of rare earth trade is uncertain, but one thing is clear: this issue will continue to be a focal point of international relations and a crucial factor shaping the global economy. As the world becomes increasingly reliant on technology, securing access to these critical elements will only become more important.