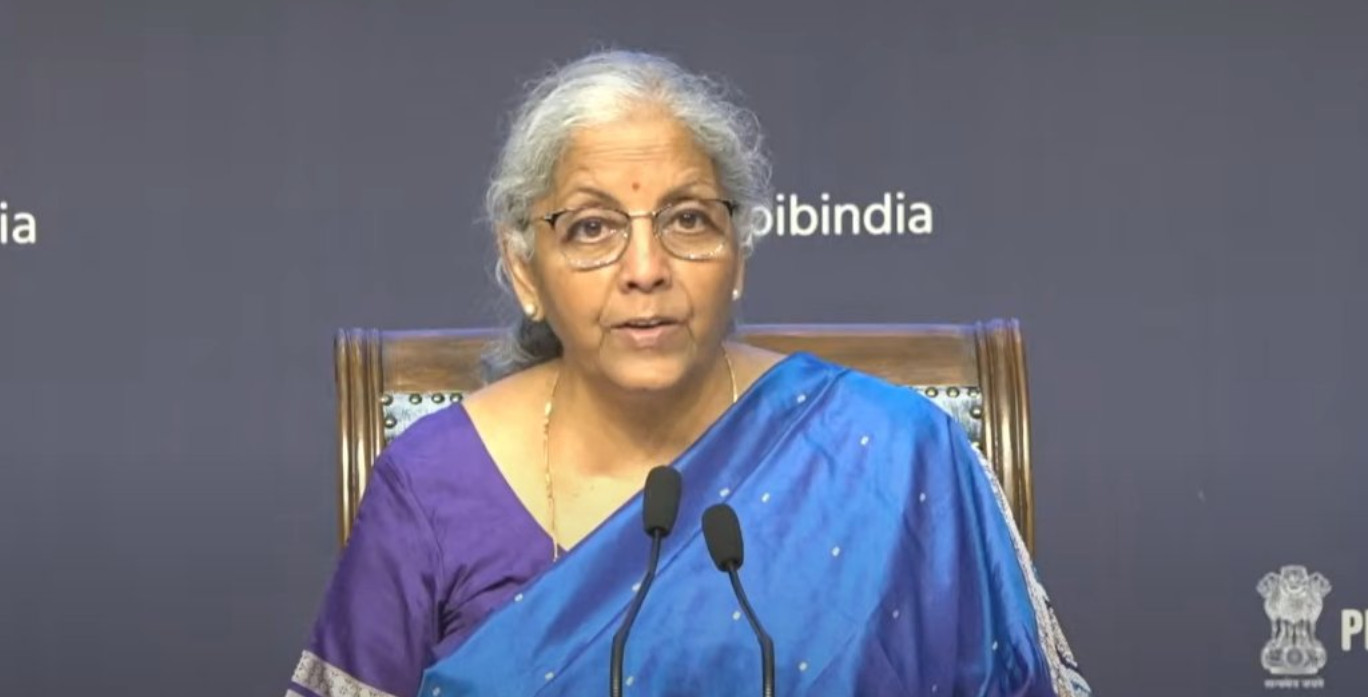

The GST Council has approved a new 40% tax slab for sin and luxury goods, set to replace the existing cess. While the implementation date is pending, 5% and 18% slabs take effect from September 22. Finance Minister Nirmala Sitharaman announced the move, highlighting reduced tax burdens for the common person.

Is a “Sin Tax” the Answer? India Considers a GST Overhaul

The ground is shifting beneath the feet of Indian businesses, as Finance Minister Nirmala Sitharaman has hinted at significant restructuring within the Goods and Services Tax (GST) framework. The whispers in Delhi suggest a potential new tax bracket, one reserved for what are colloquially known as “sin goods”. Could this mean a 40% GST rate looming for items like bidis and tobacco? Let’s dive into what this could mean for the Indian economy and its consumers.

A New Tax Tier: Targeting “Sin Goods”

The idea of a specific tax category for goods deemed detrimental to health or society isn’t new. Many countries employ such mechanisms, often dubbed “sin taxes,” to disincentivize consumption and generate revenue that can be channeled into public health initiatives or other social programs. However, the implementation within the Indian GST system raises complex questions.

Currently, the GST structure comprises several tax slabs: 0%, 5%, 12%, 18%, and 28%. On top of this, a cess is levied on certain goods already falling under the 28% bracket, specifically luxury items and demerit goods. This cess is used to compensate states for revenue losses incurred due to the implementation of GST. A move to introduce a 40% GST slab could dramatically alter the pricing landscape for the targeted items, particularly affecting the bidi and tobacco industries.

Why the Overhaul? Revenue and Regulation

The motivation behind this potential GST revamp seems two-fold: increased revenue generation and stricter regulation of goods with negative externalities. The government is keen to consolidate and streamline the GST system. By creating a dedicated, higher tax slab for “sin goods,” it could potentially unlock substantial revenue streams. This revenue could then be strategically allocated to various developmental projects or used to offset the costs associated with treating illnesses linked to the consumption of these very products.

Furthermore, the move signals a stronger regulatory stance. By making these goods more expensive, the government hopes to curb their consumption, especially among vulnerable populations. Whether this translates into a significant reduction in consumption remains to be seen, as affordability is just one piece of the puzzle.

Implications for Businesses and Consumers

A 40% GST rate would undoubtedly impact the bidi and tobacco industries. These sectors, often characterized by small-scale producers and a large informal workforce, could face considerable challenges. The increased tax burden might lead to reduced production, job losses, and potentially, a rise in illicit trade and smuggling as consumers seek cheaper alternatives.

For consumers, the immediate impact would be higher prices. Whether this price increase deters consumption is debatable. Some argue that demand for these goods is relatively inelastic, meaning that even with higher prices, consumption levels might not drastically change. Others believe that the price hike will push lower-income consumers, who are often the primary consumers of bidis and cheaper tobacco products, to seek even cheaper and potentially more harmful alternatives.

The Road Ahead: Simplicity vs. Complexity

While the stated aim of the GST revamp is simplification, the introduction of a new tax slab could add another layer of complexity. Businesses would need to adapt to the new regulations, and tax authorities would need to ensure proper enforcement. Furthermore, defining “sin goods” can be a contentious issue. Where do you draw the line? Should sugary drinks, processed foods, or even high-emission vehicles be included? The debate is sure to intensify as the government moves closer to implementing these changes. Internal link to further reading about tax implications.

Ultimately, the proposed GST overhaul represents a significant shift in India’s tax policy. Whether it achieves its intended goals of increased revenue, reduced consumption of “sin goods,” and a simplified tax system remains to be seen. The coming months will be crucial in shaping the final contours of this reform and assessing its long-term impact on the Indian economy. The real test will be how effectively the government can balance revenue generation with the potential economic and social consequences of such a drastic tax hike.