Indian real estate has seen about $80 billion in investments in 15 years. Foreign investors contributed a large portion. Domestic capital share increased after Covid. The real estate market could reach $5 trillion to $10 trillion by 2047. Grade A office and industrial stock are expected to cross 2 billion sq ft by 2047.

India’s Real Estate Boom: A Trillion-Dollar Future?

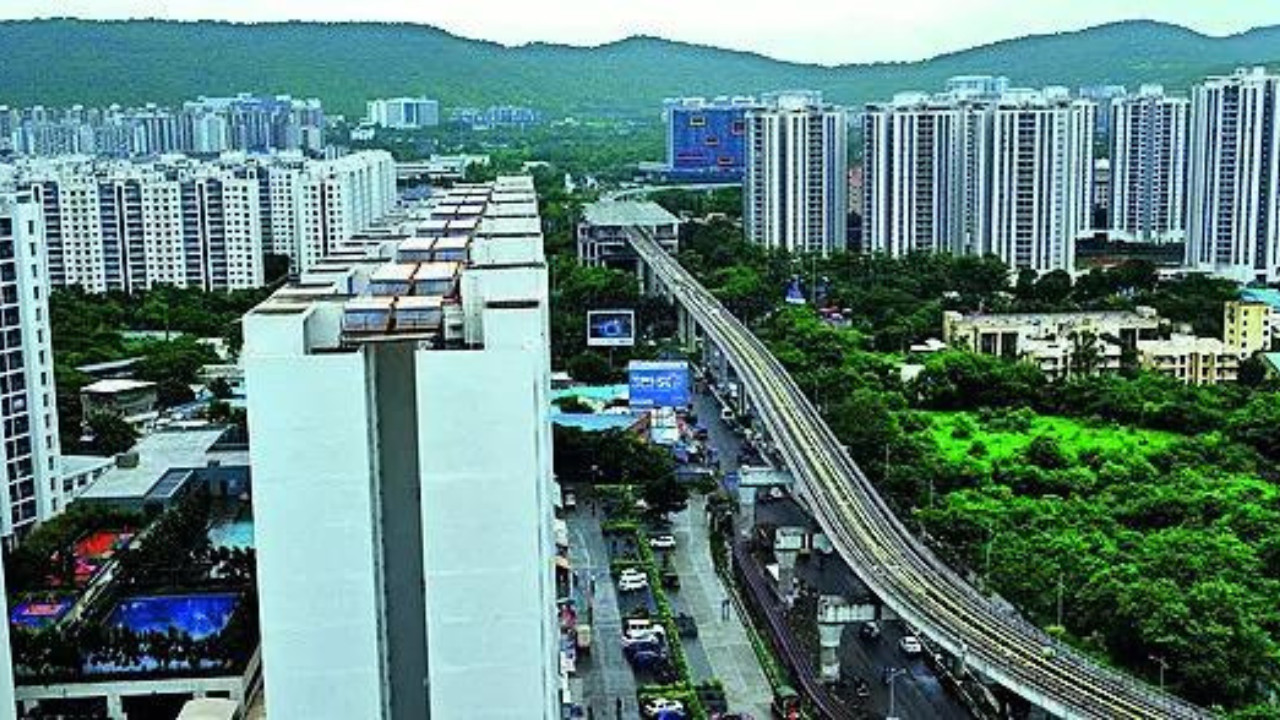

The Indian real estate market is buzzing with activity. Forget the slow and steady growth of yesteryear; we’re talking about a sector poised for explosive expansion. Recent data suggests that since 2010, a staggering $80 billion has poured into the sector via institutional investments, setting the stage for what could be a massive transformation over the next two decades. But what’s driving this surge, and what does it mean for the average Indian?

The Rise of Institutional Investment in Real Estate

The key here is institutional investment. Think of it as the big leagues entering the game. These aren’t individual homebuyers; they’re pension funds, sovereign wealth funds, and real estate investment trusts (REITs), all looking for stable, long-term returns. Their confidence in the Indian market is a major signal, indicating that India is viewed as a lucrative and relatively safe place to park significant capital. This influx has fueled development, modernized construction practices, and brought a new level of professionalism to the industry.

What’s so appealing about India? Several factors are at play. First, a rapidly growing population combined with increasing urbanization means a constant demand for housing and commercial spaces. Second, government policies aimed at streamlining approvals and promoting affordable housing have created a more favorable environment for developers and investors. Third, and perhaps most importantly, India offers a compelling growth story. Compared to more mature markets, the potential for appreciation and rental yields is significant.

Projecting a $5-10 Trillion Market

Industry projections paint an even more impressive picture. Experts suggest that by 2047, the Indian real estate market could swell to a phenomenal $5-10 trillion in size. To put that into perspective, that’s a multiple of its current value, showcasing the immense potential for future growth.

This isn’t just pie-in-the-sky optimism. The projection is based on solid fundamentals: a continued rise in disposable incomes, a young and aspirational workforce, and ongoing government initiatives to improve infrastructure and connectivity. Imagine the impact such growth will have on job creation, economic development, and the overall quality of life for millions of Indians.

Challenges and Opportunities

Of course, no boom comes without its challenges. Land acquisition remains a hurdle, as does navigating complex regulatory frameworks. The industry also needs to focus on sustainability, adopting green building practices and minimizing its environmental footprint. Affordability is another critical issue. While high-end developments are thriving, ensuring that housing is accessible to all income levels is essential for inclusive growth.

Despite these challenges, the opportunities are vast. The demand for commercial office space is soaring, driven by the growth of the IT and services sectors. Warehousing and logistics are booming, fueled by the e-commerce revolution. And the demand for residential properties, particularly in Tier II and Tier III cities, shows no signs of slowing down. This rapid expansion of the Indian real estate market offers substantial opportunities for investors, developers, and homebuyers alike.

What This Means for You

So, what does all this mean for the average Indian? Whether you’re looking to buy your first home, invest in property, or simply benefit from the economic growth that a thriving real estate sector generates, the implications are significant. Increased investment means more construction, more jobs, and potentially more affordable housing options. It also signifies a growing economy, better infrastructure, and a brighter future for generations to come. The booming Indian real estate market is not just about bricks and mortar; it’s about building a better future for India.

Looking Ahead

The Indian real estate sector is on an upward trajectory, fueled by institutional investment and driven by strong economic fundamentals. While challenges remain, the potential for growth is undeniable. As the market matures and becomes more transparent, it’s likely to attract even more capital, further accelerating its expansion. The next two decades promise to be a period of unprecedented growth and transformation, solidifying India’s position as a major player on the global real estate stage.

This growth represents a pivotal moment for India. By embracing sustainable practices, prioritizing affordability, and streamlining regulations, the nation can unlock the full potential of its real estate sector and create a more prosperous and equitable future for all.