Prime Minister Modi spoke of upcoming GST reforms, effective September 22, 2025, calling it ‘GST Bachat Utsav’. The revised tax structure features only 5% and 18% slabs, reducing prices on everyday items. Income up to ₹12 lakh is now tax-exempt, creating a ‘double bonanza’ for the middle class.

Pocketbook Perks: How Income Tax Relief and GST Tweaks Are Shaping India’s Financial Future

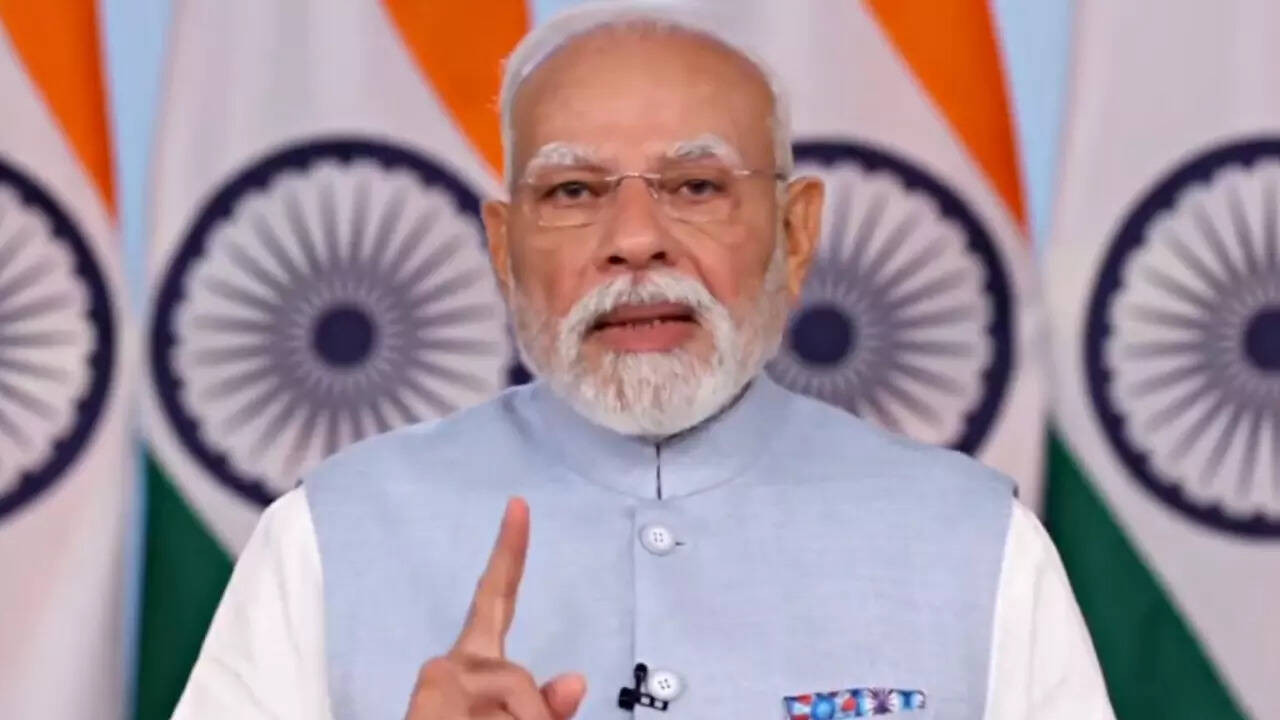

The air crackled with anticipation as Prime Minister Modi addressed the nation, and the message he delivered resonated directly with the wallets of everyday Indians. Forget dry policy pronouncements; this was about tangible relief, about seeing the fruits of economic growth reflected in personal savings. The headline? Income tax relief and strategic GST rate cuts are poised to inject a massive ₹2.5 lakh crore back into the economy. That’s a figure that demands attention, promising to reshape spending habits and investment strategies across the board.

Deciphering the Impact of Income Tax Relief

For many, the most immediate impact comes from the revisions to income tax slabs. These aren’t just numbers on paper; they represent the potential to save a significant chunk of your hard-earned money. That extra cash flow can then be directed towards building a more secure future – perhaps through investments, education, or finally tackling that home renovation project you’ve been putting off. The real magic lies in understanding how these changes apply to your specific financial situation. Taking the time to analyze your tax bracket and deductions is crucial to maximizing the benefits. Are you leveraging all available avenues for tax savings? This is the moment to double-check and ensure you’re keeping more of what you earn.

GST Rates: A Ripple Effect Across Sectors

Beyond income tax, strategic tweaks to Goods and Services Tax (GST) rates are generating waves across various sectors. Lowering GST on certain goods and services isn’t just about making them cheaper; it’s about boosting demand, encouraging consumption, and ultimately fueling economic growth. Consider the impact on small and medium-sized enterprises (SMEs). Reduced tax burdens can free up crucial capital for reinvestment, innovation, and expansion, allowing them to compete more effectively in the marketplace. This, in turn, can lead to job creation and a stronger, more resilient economy. Sectors reliant on specific materials or services subject to GST adjustments will likely see a direct benefit, impacting pricing strategies and overall profitability.

Swadeshi Pride: A Call to Action

The Prime Minister’s address wasn’t solely about numbers and figures. It included a passionate call to embrace “Swadeshi” – a renewed sense of pride in domestically produced goods. This isn’t simply about patriotism; it’s about recognizing the economic benefits of supporting local businesses and industries. Choosing Indian-made products strengthens the nation’s manufacturing base, creates jobs, and fosters innovation within our own borders. It is about understanding that our consumer choices can have a powerful impact on the overall health and stability of the Indian economy. By consciously opting for Swadeshi goods, we contribute to a virtuous cycle of growth and prosperity.

Capitalizing on the Opportunity: What’s Next?

The key takeaway from the Prime Minister’s address is clear: India’s economic landscape is shifting, presenting both challenges and opportunities. While tax breaks and lowered GST provide a financial boost, individuals and businesses alike must strategically leverage these advantages. It’s about more than just saving money; it’s about making informed decisions that contribute to long-term financial security and economic growth. Are you ready to revisit your budget, explore new investment opportunities, or perhaps even launch that small business you’ve always dreamed of? The time to act is now.

For those looking to further optimize their financial strategies, explore this helpful guide on [managing your personal finances effectively](/personal-finance-tips). Understanding how to manage your money strategically is even more important when income tax relief provides extra funds to invest.

In conclusion, the recent announcements regarding income tax relief and GST rate cuts represent a significant step towards empowering Indian citizens and fostering a more robust economy. By understanding the implications of these changes and embracing a spirit of “Swadeshi,” we can collectively contribute to a brighter financial future for all. The ₹2.5 lakh crore infusion is more than just a number; it’s a catalyst for positive change.