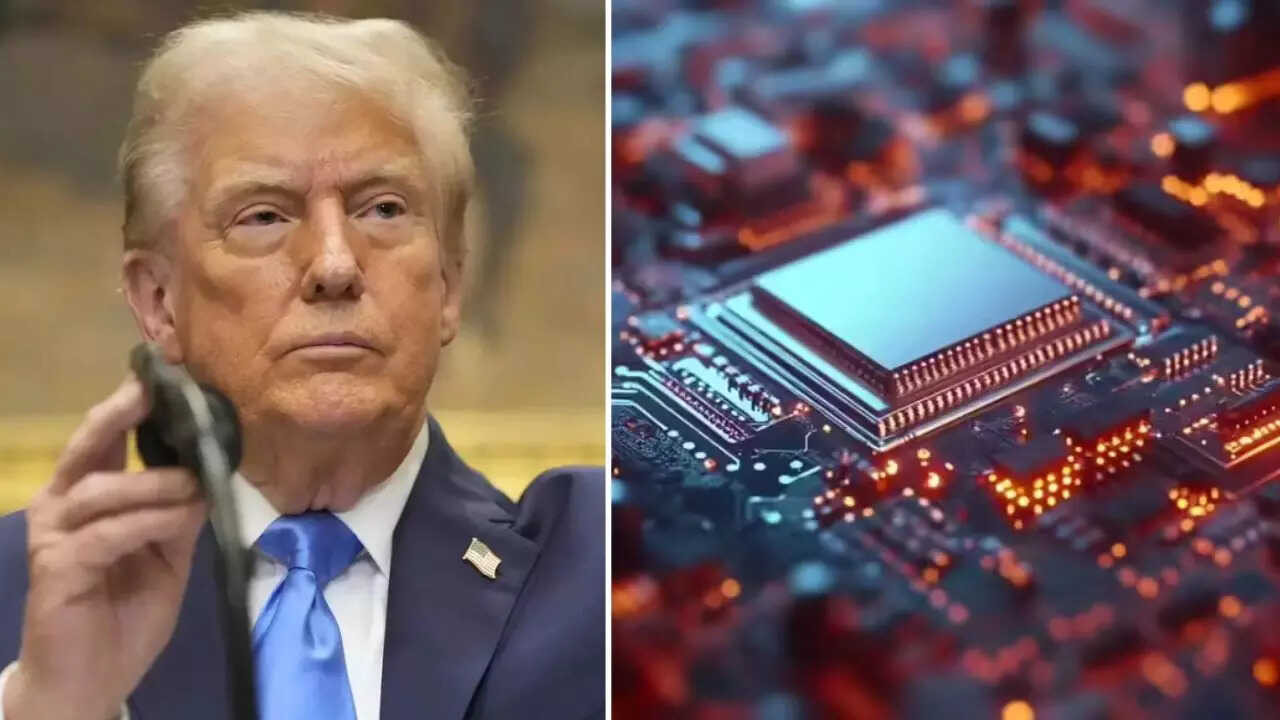

The Trump administration is reportedly planning new tariffs on imported electronics, based on their chip content, to boost US manufacturing. This move could impose a 25% rate on chip value, potentially raising costs for American consumers and worsening inflation. Major chipmakers like TSMC and Samsung might face significant impact, as the policy aims to reshore critical production.

The Semiconductor Showdown: Will Chip Tariffs Reshape Global Tech?

The digital world hums thanks to tiny, intricate semiconductors – the brains of our phones, cars, and everything in between. But what happens when access to these vital components becomes a national security concern? Whispers are circulating in Washington about a potential game-changer: the U.S. government considering tariffs on foreign electronics dependent on these crucial chips. This isn’t just about tweaking trade numbers; it’s a potential seismic shift in the global technology landscape.

Why All the Fuss About Chips?

The heart of the matter lies in supply chain vulnerabilities. Imagine a scenario where geopolitical tensions disrupt the flow of semiconductors. Suddenly, critical industries – defense, communications, healthcare – could grind to a halt. This is a very real worry, and it’s driving a reassessment of how the United States secures its access to these foundational building blocks of modern technology.

The current global chip manufacturing landscape is heavily concentrated. A significant portion originates from overseas, creating a reliance that some policymakers view as a strategic risk. This isn’t just about economics; it’s about national security. Bringing chip production back to U.S. soil, or at least diversifying supply chains to friendly nations, is seen as a crucial step in safeguarding American interests.

How Chip Tariffs Might Work

The proposed tariffs are a blunt instrument, designed to incentivize manufacturers to shift production, or at least sourcing, towards the United States and its allies. By making foreign electronics more expensive, the idea is to create a competitive advantage for domestic producers and those who source their chips from “trusted” locations. This could involve complex calculations based on the origin of the chips within imported electronics, potentially adding a layer of bureaucracy to international trade.

The implications are far-reaching. Think about your smartphone. If the components within are subject to tariffs, the cost of that phone could rise. The same goes for cars, laptops, and a whole host of other electronic devices we rely on daily. While the aim is to bolster domestic chip manufacturing, the immediate impact could be felt by consumers through higher prices.

A Ripple Effect Across Industries

The effects wouldn’t be confined to consumers. Industries that heavily rely on electronics, from automotive to aerospace, could face increased costs and potential disruptions to their supply chains. This could lead to price increases for everything from electric vehicles to advanced medical equipment. Furthermore, the tariffs could spark retaliatory measures from other countries, leading to a broader trade war that could harm the global economy.

The semiconductor industry itself could undergo significant restructuring. Companies might need to re-evaluate their manufacturing strategies, potentially investing in new facilities in the U.S. or shifting production to countries less likely to be affected by the tariffs. This could lead to a period of uncertainty and adjustment as businesses adapt to the new trade environment. This strategic shift could also trigger further investment in research and development related to new chip technologies and manufacturing processes within the United States.

Are There Alternatives?

Tariffs aren’t the only tool in the toolbox. Incentives, such as tax breaks and subsidies, could also encourage domestic chip manufacturing without directly penalizing foreign producers. Investing in education and workforce development programs could ensure that the U.S. has the skilled labor force needed to support a thriving chip industry. A collaborative approach, working with allied nations to diversify supply chains, could also be a more effective long-term strategy than relying solely on tariffs. We have previously discussed the importance of domestic manufacturing for economic security in a previous blog post about [reshoring initiatives](internal-link-to-related-content).

The Road Ahead for Semiconductor Independence

The debate over chip tariffs is a complex one, with potential benefits and drawbacks. While the goal of strengthening national economic security is laudable, the unintended consequences of tariffs could be significant. Striking the right balance between protecting domestic interests and maintaining a healthy global trading system will be crucial in navigating this evolving landscape. Whether tariffs are the answer remains to be seen, but one thing is certain: the future of the semiconductor industry is a key piece of the puzzle in securing America’s technological and economic future. The choices made today will have profound implications for years to come.