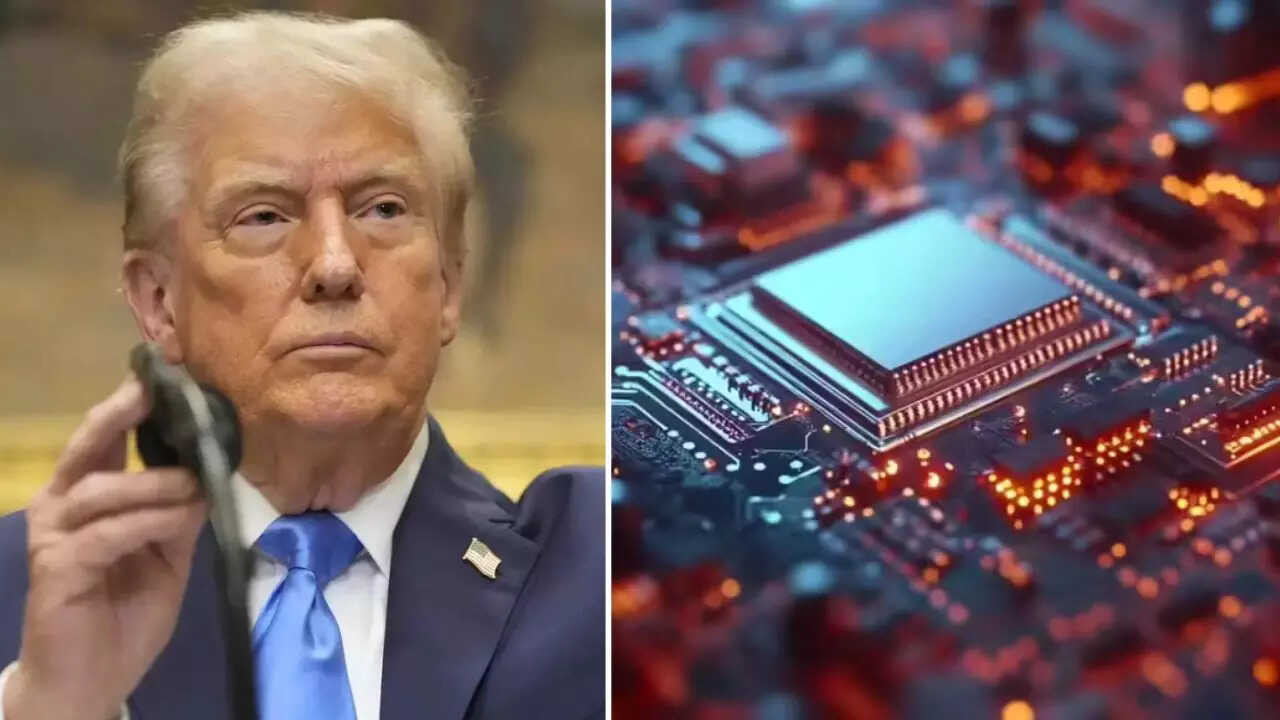

The Trump administration is reportedly planning new tariffs on imported electronics, based on their chip content, to boost US manufacturing. This move could impose a 25% rate on chip value, potentially raising costs for American consumers and worsening inflation. Major chipmakers like TSMC and Samsung might face significant impact, as the policy aims to reshore critical production.

Chips Ahoy! Could Tariffs on Electronics Be on the Horizon?

The world of tech is never quiet, and the latest buzz swirling around involves something deeply embedded in, well, everything: semiconductors. The former Trump administration reportedly considered a rather bold move – slapping tariffs on imported electronics based on the origin of the chips inside. This isn’t just about phones and laptops; this delves into the very core of modern national economic security. What could such a move mean for consumers, businesses, and the global tech landscape? Let’s unpack this potential shakeup.

Why the Fuss About Chips?

Think of semiconductors as the brains of modern electronics. They power everything from your smartphone and car to sophisticated medical equipment and military hardware. Control over semiconductor design and manufacturing is a geopolitical hot potato. Whoever leads in this area wields significant economic and strategic power. Dependence on foreign chipmakers, particularly in nations viewed as potential adversaries, raises concerns about supply chain vulnerabilities and even national security risks. Imagine a scenario where access to crucial chips is cut off – the impact could be devastating. This is where discussions about domestic chip production and secure supply chains enter the picture.

The Tariff Tango: A Potential Impact

The idea behind chip-based tariffs is simple in principle: incentivize companies to source chips from domestic manufacturers or “friendly” nations, thereby reducing reliance on potentially unreliable sources. However, the execution is anything but simple. Implementing such tariffs could send ripples throughout the global electronics market.

* Higher Prices for Consumers: Tariffs are essentially taxes paid by importers, which are often passed down to consumers. Expect to see price hikes on electronics if these tariffs become a reality. Your next smartphone, laptop, or even your smart fridge could cost significantly more.

* Supply Chain Chaos: The global electronics supply chain is incredibly complex, with components often crossing borders multiple times during the manufacturing process. Introducing tariffs based on chip origin could disrupt this finely tuned system, leading to delays, shortages, and increased costs for manufacturers.

* Retaliatory Measures: Trade wars are rarely one-sided. Other countries could retaliate with their own tariffs on US goods, hurting American businesses and potentially escalating into a broader trade conflict.

* Innovation Stifled?: Some argue that tariffs can stifle innovation by raising costs and limiting access to the best components, regardless of origin. Companies might be forced to use less efficient or outdated chips simply to avoid tariffs.

The Road Ahead: Navigating a Complex Landscape

While the specifics of the former administration’s plans remain somewhat murky, the underlying concerns about semiconductor security are very real and continue to resonate today. The current administration has also emphasized the importance of bolstering domestic chip manufacturing and securing supply chains, evident in initiatives like the CHIPS Act. How these policies will ultimately be implemented, and whether they will involve tariffs or other measures, remains to be seen.

What’s certain is that the global semiconductor landscape is undergoing a major shift. Companies are reevaluating their supply chains, governments are investing heavily in domestic chip production, and the race for technological supremacy is heating up. It’s a complex situation with no easy answers. A deeper understanding of supply chain risk management is paramount for success in today’s dynamic environment.

Securing the Future: A Strategic Imperative

The debate around chip-based tariffs highlights a fundamental truth: semiconductors are not just components; they are strategic assets. Securing access to these critical technologies is essential for economic competitiveness, national security, and technological leadership. As we navigate this evolving landscape, it’s crucial to consider all options, from tariffs to strategic investments, to ensure a resilient and secure semiconductor supply chain for the future. This is a puzzle with many pieces, and getting it right will determine who thrives in the coming decades.

[Internal Link to a related post about the CHIPS Act].