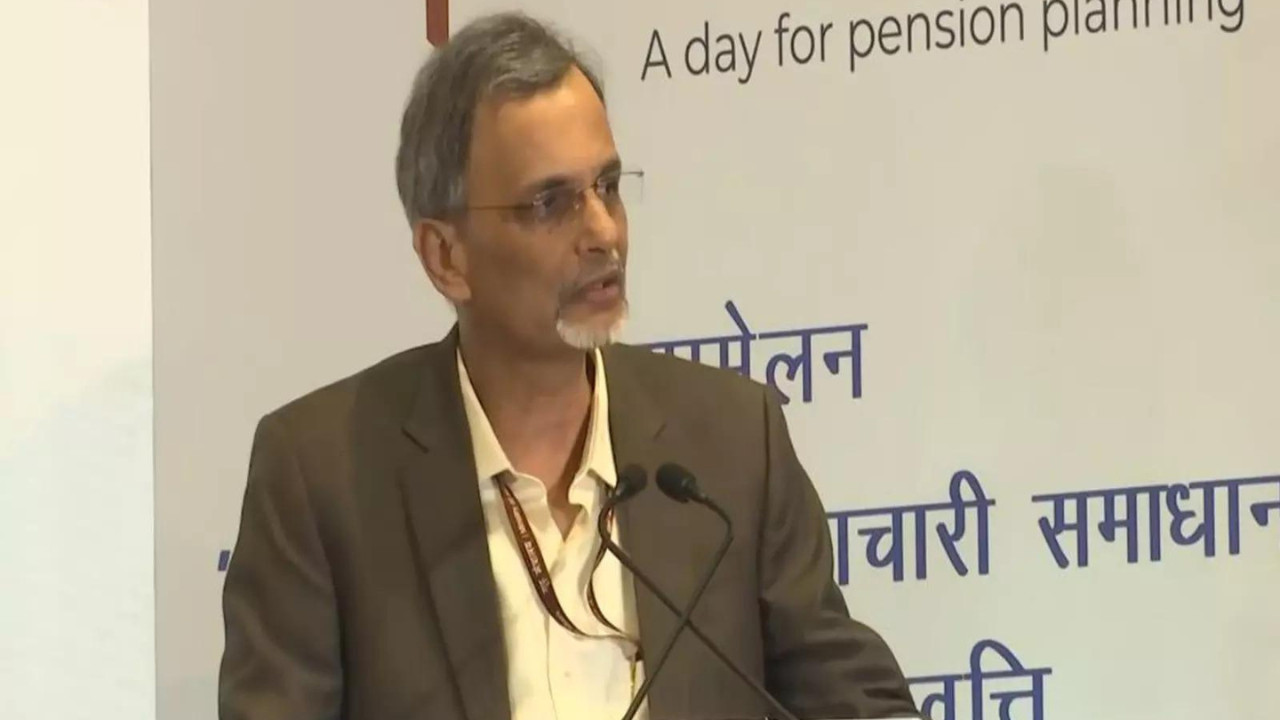

Chief Economic Advisor V Anantha Nageswaran underscored the critical need for long-term savings to ensure financial security, anticipating India’s elderly population will significantly expand by 2050. He stressed a mindset shift towards financial planning due to changing lifestyles, noting government efforts also enhance household saving capacity.

The Silver Tsunami: Are We Ready for India’s Aging Population?

India, a land celebrated for its youthful vibrancy, is facing a demographic curveball. We’re not just getting older; we’re getting older fast. The conversation around retirement planning and long-term financial security just got a whole lot more urgent, and it’s time we paid attention.

The Chief Economic Advisor (CEA), V. Anantha Nageswaran, recently highlighted the looming challenge of an aging population, nudging us to seriously consider how we’ll support our elders – and ourselves – in the decades to come. The implications are far-reaching, impacting everything from government policy to individual investment strategies.

But what exactly is the problem? For years, India has basked in the glory of its “demographic dividend” – a large working-age population driving economic growth. However, birth rates are declining, and life expectancy is increasing. This means a smaller proportion of young workers will need to support a growing number of retirees. Think of it like a seesaw slowly tipping in the wrong direction. The burden on future generations is going to be significant.

Why Long-Term Savings Are No Longer Optional

The old model of relying solely on government pensions or traditional family support networks is becoming increasingly unsustainable. The CEA emphasized the critical need for individuals to take proactive steps towards securing their financial futures through long-term savings and investments. The government can only do so much. The onus is on each of us to build a nest egg that will provide a comfortable retirement.

This isn’t just about accumulating wealth; it’s about ensuring dignity and independence in old age. Imagine being able to pursue your passions, travel, or simply enjoy life without the constant worry of financial constraints. That’s the power of long-term financial planning.

Navigating the Investment Maze: Where to Start?

For many, the world of investments can seem daunting. Stocks, bonds, mutual funds, real estate – the options are endless, and the jargon can be overwhelming. The key is to start small, educate yourself, and seek professional advice when needed. Consider exploring different investment options.

Diversification is also crucial. Don’t put all your eggs in one basket. Spreading your investments across different asset classes can help mitigate risk and potentially enhance returns over the long term. Remember, retirement planning is a marathon, not a sprint. It requires patience, discipline, and a well-thought-out strategy.

Beyond Individual Responsibility: A Call for Collective Action

While individual financial planning is essential, addressing the challenges of an aging population requires a collective effort. The government, financial institutions, and even employers all have a role to play.

We need policies that encourage long-term savings, promote financial literacy, and provide access to affordable healthcare for the elderly. Financial institutions can develop innovative products and services tailored to the needs of retirees. Employers can offer retirement planning resources and matching contributions to employee savings plans.

Moreover, shifting cultural attitudes towards retirement is critical. Retirement should not be viewed as a period of inactivity or dependence, but rather as an opportunity for personal growth, lifelong learning, and continued contribution to society. See how embracing technology can enrich the lives of seniors.

Embracing the Silver Tsunami

India’s aging population presents a complex challenge, but it also presents an opportunity. By taking proactive steps to promote long-term savings, improve healthcare, and foster a culture of respect and inclusion for the elderly, we can transform this demographic shift into a source of strength. The future isn’t written in stone. With foresight, planning, and a shared commitment, we can ensure a secure and dignified future for all. Are we ready to meet the moment?

Conclusion: Secure Your Future Today

India’s demographic landscape is shifting, highlighting the crucial need for long-term financial planning. Individual responsibility, coupled with supportive government policies and innovative financial solutions, is key to ensuring a secure and dignified future for the nation’s aging population. The time to act is now, building a financially resilient future for ourselves and generations to come.