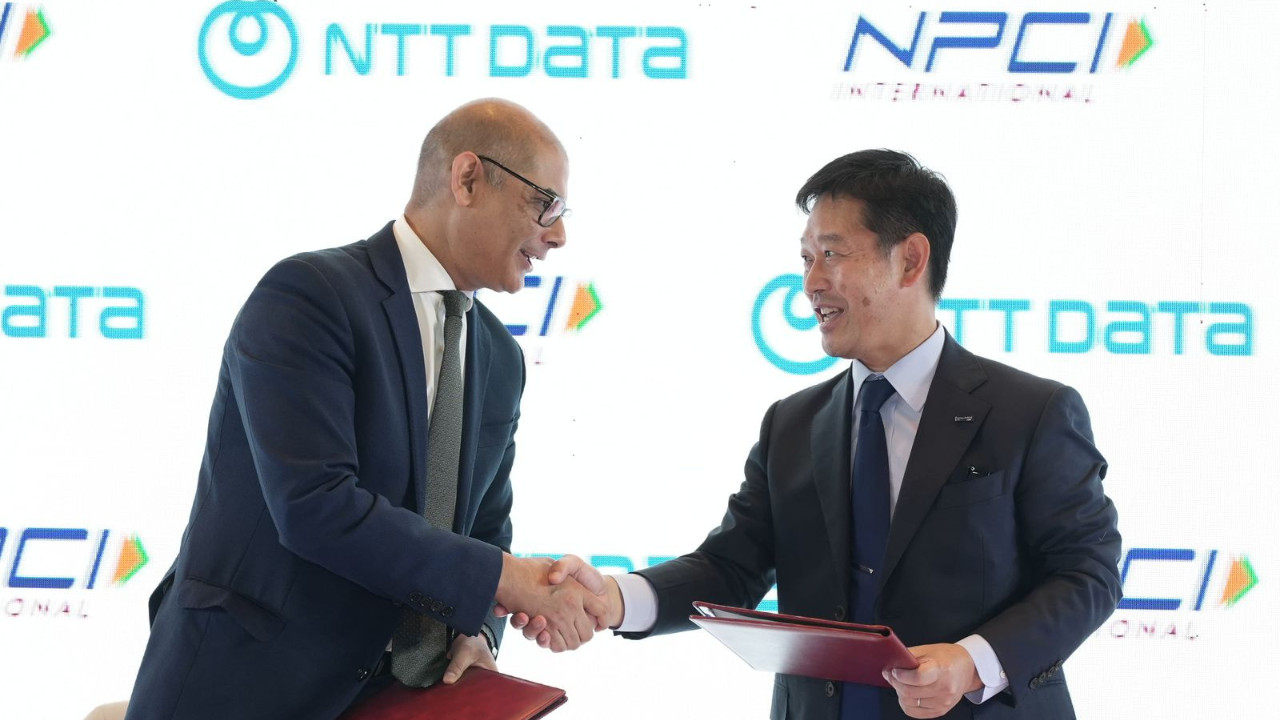

Indian tourists visiting Japan will soon be able to use UPI for payments following a deal between NPCI International and NTT DATA. This partnership will allow travelers to scan QR codes with their UPI apps at merchant locations managed by NTT DATA, offering a familiar and seamless digital payment experience.

Japan Gears Up for UPI: A New Chapter for Digital Payments

Imagine strolling through the vibrant streets of Tokyo, effortlessly paying for your ramen or that must-have anime figurine with a quick scan of your phone. That vision is inching closer to reality, thanks to a recent collaboration between NPCI International Payments Limited (NIPL) and NTT Data Corporation. This partnership aims to bring India’s Unified Payments Interface (UPI) to Japan, potentially revolutionizing how transactions are conducted in one of the world’s leading economies.

UPI has already transformed the Indian financial landscape, offering a seamless and user-friendly way to send and receive money. Its simplicity and efficiency have made it a runaway success, and now, its footprint is expanding globally. But why Japan? And what does this mean for the future of digital payments?

The Appeal of UPI: Simplicity and Security

UPI’s appeal lies in its ability to bypass traditional banking hurdles. Instead of complex card details or account numbers, users can transact using a virtual payment address (VPA) or by scanning a QR code. This streamlined process not only makes payments faster but also enhances security, reducing the risk of fraud.

For Japan, which has been gradually embracing digital payment methods, UPI offers a compelling alternative to cash and credit cards. While Japan is known for its technological prowess, cash still reigns supreme in many daily transactions. Introducing UPI could encourage a greater shift towards digital payments, boosting efficiency and convenience for both consumers and businesses.

Beyond Japan: The Global Rise of UPI

Japan isn’t the only country recognizing the potential of UPI. NIPL has been actively forging partnerships worldwide to extend the reach of this innovative payment system. Currently, UPI is accepted in several countries, including:

* Nepal: A natural extension, given the close ties between India and Nepal.

* Bhutan: Further solidifying UPI’s presence in the Himalayan region.

* Singapore: A major financial hub, where UPI offers a convenient option for Indian expats and tourists.

* UAE: Another popular destination for Indian travelers and businesses.

* Mauritius: Expanding UPI’s presence in the Indian Ocean region.

* Sri Lanka: Strengthening economic ties through simplified payments.

* France: A significant milestone, marking UPI’s entry into the European market.

These partnerships demonstrate the growing recognition of UPI as a reliable and efficient payment solution. The ambition is clear: to establish UPI as a globally recognized standard for digital transactions. Think of traveling abroad and using the same familiar app to pay for everything, just like you do back home. That’s the vision driving UPI’s international expansion. You might also consider signing up for a related service, like our guide to international money transfers, to better prepare for this global financial shift.

Navigating the Challenges: A Path Forward for UPI

Of course, expanding UPI globally isn’t without its challenges. Adapting to different regulatory environments, integrating with existing payment infrastructure, and ensuring cybersecurity across diverse networks are all crucial considerations. The collaboration between NIPL and NTT Data signifies a commitment to addressing these challenges head-on, leveraging NTT Data’s expertise in the Japanese market.

For example, the level of digital literacy varies from country to country, so user education is key. In some regions, there’s concern about data privacy. Overcoming these obstacles requires collaboration, innovation, and a deep understanding of local nuances.

A Glimpse into the Future of Payments

The potential launch of UPI in Japan is more than just a business deal; it’s a glimpse into the future of payments. A future where borders become less relevant, and financial transactions are seamless, secure, and accessible to everyone. As UPI continues to expand its global footprint, it has the potential to empower individuals, businesses, and economies alike. The implications for tourism, international trade, and remittance flows are significant. This ongoing journey will reshape how we think about money and how we interact with the global financial system.