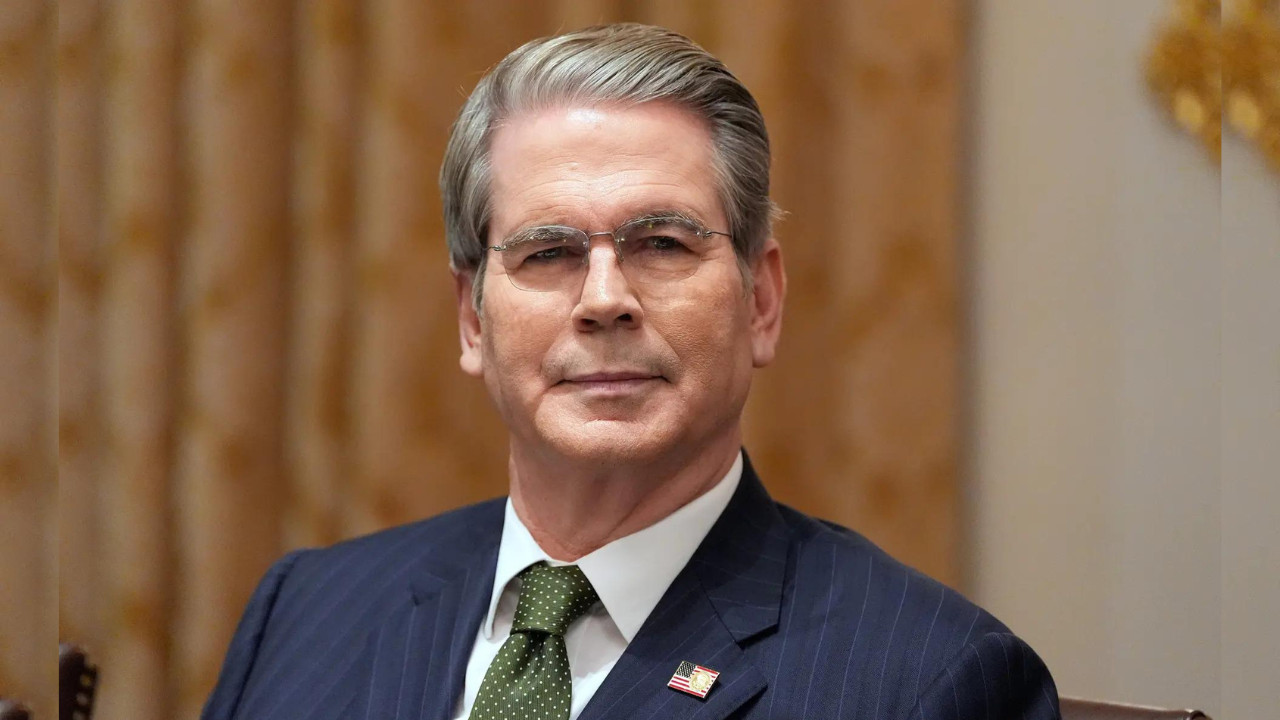

Reserve Bank of India Governor Sanjay Malhotra indicated that a policy space exists for a future interest rate cut, but stressed the need for the right timing to maximize impact. While inflation outlook is benign, global uncertainties necessitate waiting for existing measures to take effect before further action. The central bank maintained the benchmark lending rate at 5.50%.

The RBI’s Balancing Act: Navigating Growth and Inflation

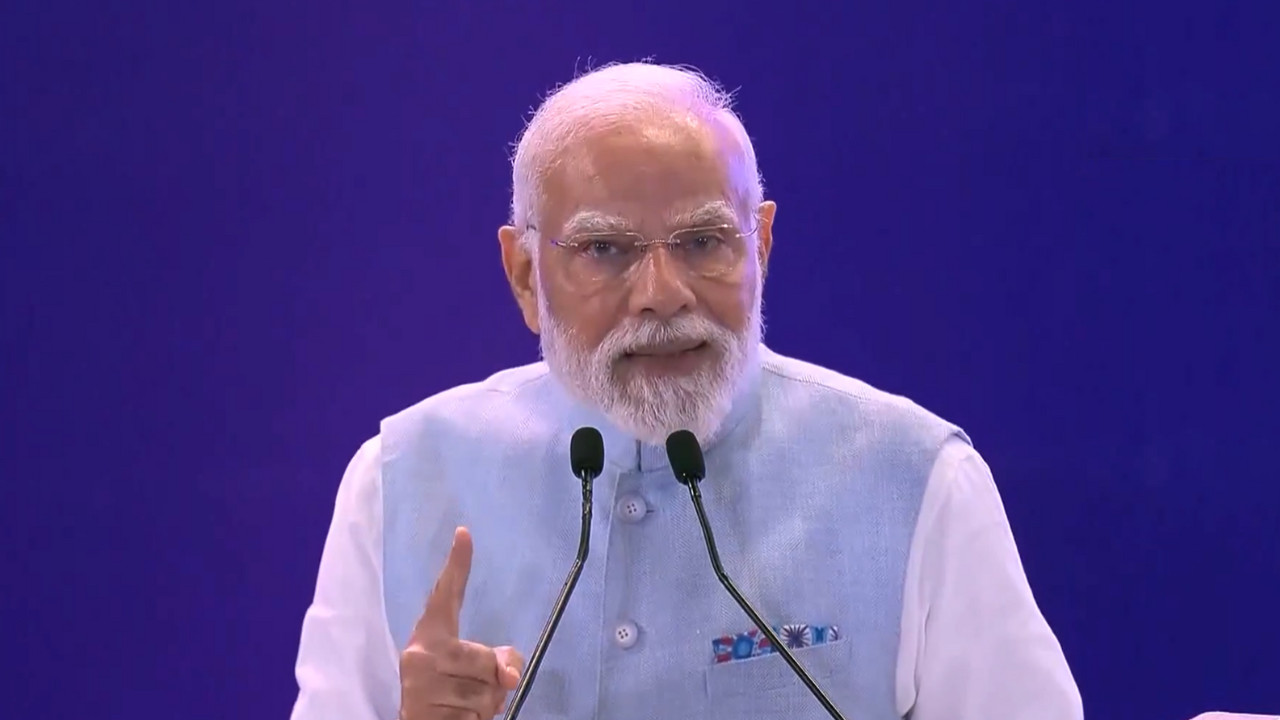

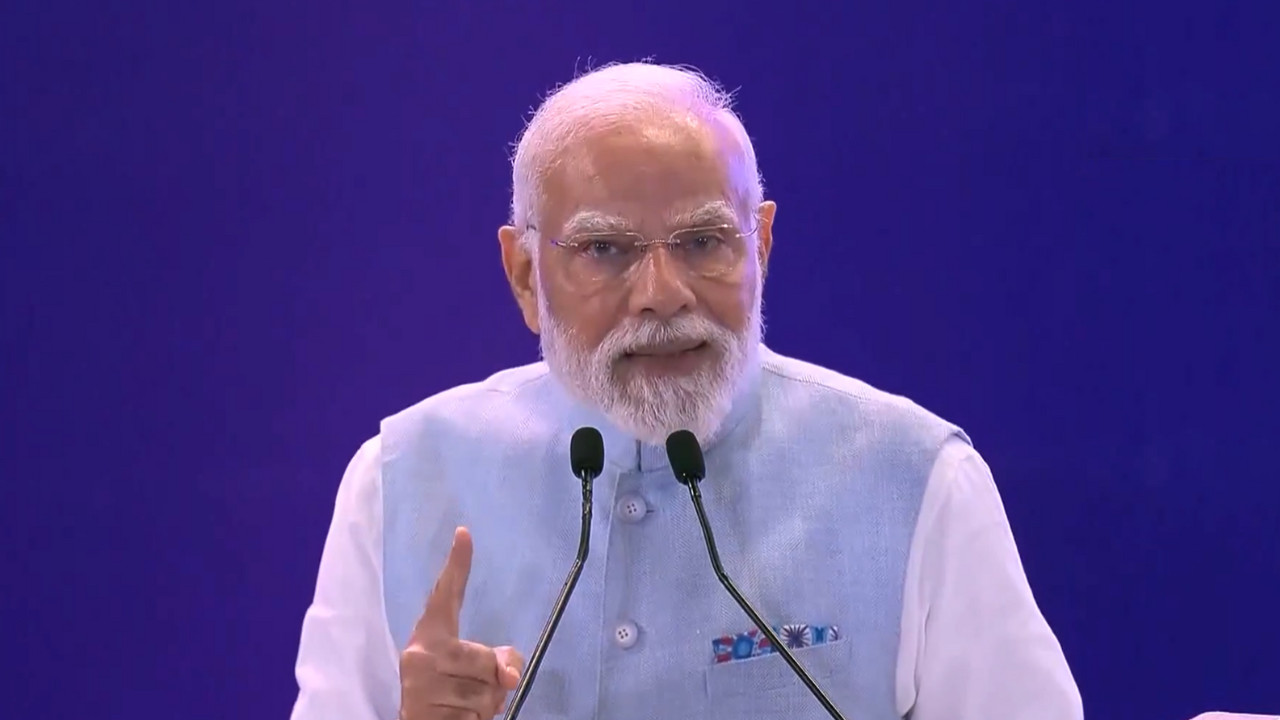

The latest Monetary Policy Committee (MPC) minutes have dropped, and they offer a fascinating peek behind the curtain of India’s economic decision-making. It’s a world of nuanced debate, carefully weighed risks, and a constant tightrope walk between fostering growth and keeping inflation at bay. Reading through the discussions, one thing becomes clear: the Reserve Bank of India (RBI) is playing a long game.

The central theme echoing through the minutes is that while the MPC acknowledges the policy space for potential rate cuts, now isn’t the moment to pull the trigger. Why the hesitation? It boils down to a delicate balancing act. The Indian economy, while showing resilience, isn’t firing on all cylinders just yet. Global uncertainties continue to cast a shadow, and lingering inflationary pressures demand a cautious approach.

Growth Signals: Encouraging, but Not Decisive

Several factors are painting an optimistic picture of economic expansion. Consumer confidence seems to be gradually improving, and investment activity is showing signs of picking up. Government spending on infrastructure projects is also providing a much-needed boost. However, this nascent recovery remains vulnerable to external shocks.

The MPC members underscored the importance of monitoring global economic trends closely. Geopolitical tensions, fluctuating commodity prices, and the potential for renewed supply chain disruptions all pose significant threats to India’s growth trajectory. A premature rate cut could jeopardize the progress made and potentially lead to a resurgence of inflationary pressures.

Inflation: The Unseen Guest at the Table

While inflation has moderated from its peak, it’s far from being completely tamed. Food prices, in particular, remain a major concern, influenced by unpredictable monsoon patterns and global supply dynamics. The MPC emphasizes the need to remain vigilant against any potential flare-ups in inflation, as this could erode consumer purchasing power and undermine economic stability.

The Path Ahead: A Data-Driven Approach to Monetary Policy

So, what’s next? The MPC has made it clear that future decisions will be data-driven. They will closely monitor key economic indicators, including inflation, growth, and global developments, before making any further adjustments to the policy rate. This suggests a flexible and pragmatic approach, ready to adapt to changing circumstances.

The minutes reveal a consensus within the MPC that maintaining a cautious stance is the most prudent course of action at present. They are prioritizing stability and long-term sustainable growth over short-term gains. This patient approach, while perhaps frustrating for those eager for immediate stimulus, ultimately aims to create a more resilient and stable economic environment for India. It’s a calculated gamble, betting that a steady hand on the monetary levers will deliver more lasting benefits in the long run. Perhaps related, you may want to read this post about [understanding repo rates](https://example.com/understanding-repo-rates).

Navigating Uncertainty: A Test of Economic Acumen

The current economic landscape presents a complex challenge for policymakers worldwide. The RBI, through its careful deliberations and data-driven approach, is striving to navigate these uncertainties and steer the Indian economy toward a path of sustainable and inclusive growth. Only time will tell if their strategy proves successful, but one thing is certain: the RBI’s balancing act is a testament to the complexities of modern monetary policy. This monetary policy balancing act will be critical to India’s economic future.