Canadian Prime Minister Mark Carney highlighted progress in building Asia-Pacific partnerships, including with India, as a strategy to reduce reliance on the United States amid escalating tariff tensions. He apologized to President Trump for a provincial anti-tariff ad, emphasizing federal control over trade policy. Carney expressed optimism for future US trade talks once conditions stabilize.

The Pacific Pivot: Why Global Finance is Flocking to Asia

For years, the financial world has danced to a distinctly Western tune. But the music’s changing. A palpable shift is underway, a re-orchestration of global finance that sees the Asia-Pacific region stepping into the spotlight. Forget whispers of future potential; the region is actively writing its own economic symphony, attracting attention and investment on an unprecedented scale.

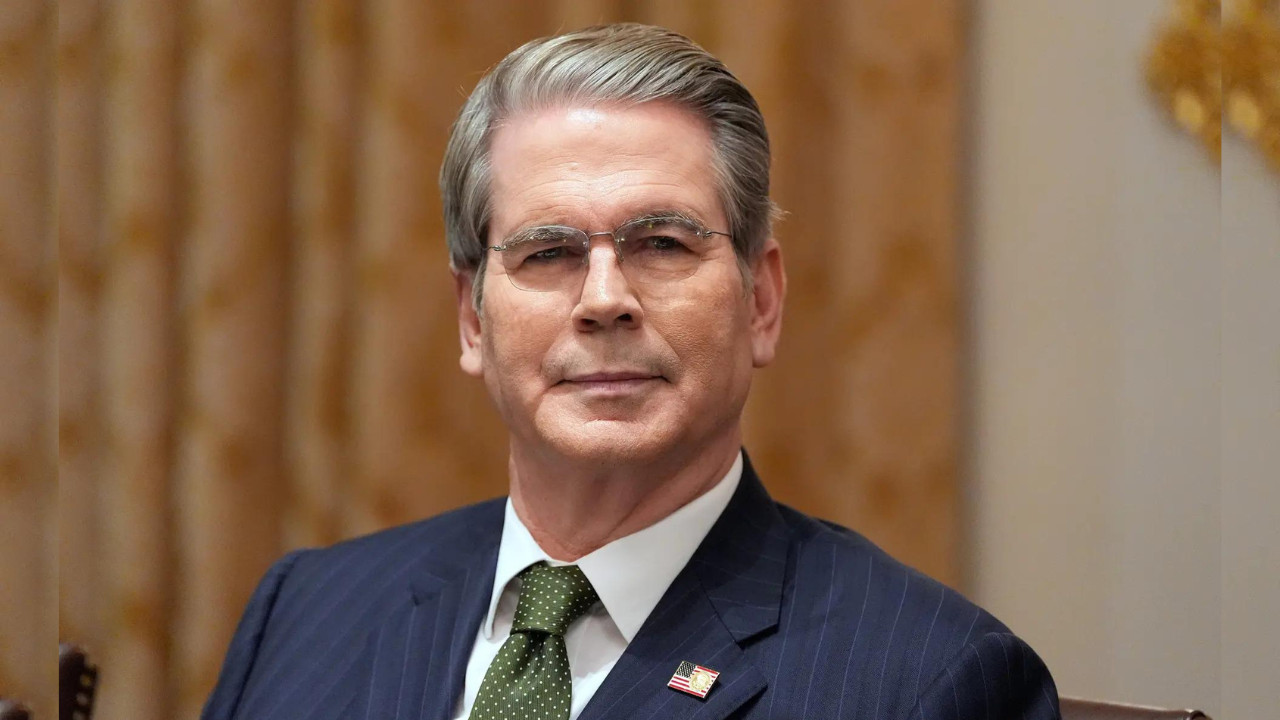

This isn’t just about chasing cheaper labor or tapping into emerging markets anymore. This is about recognizing true innovation, burgeoning consumer power, and a proactive approach to shaping the future of finance. Consider the recent pronouncements from Mark Carney, former Governor of the Bank of England, who, while addressing the Asia Pacific Financial Forum, emphasized the unique opportunities for building “new partnerships” in India and across the Asia-Pacific. His words weren’t mere diplomatic pleasantries; they underscored a fundamental reality. The region presents a powerful alternative to over-reliance on the US economy.

India’s Untapped Potential and Asia’s Growth Engine

Carney’s focus on India is particularly noteworthy. The nation’s sheer demographic weight, coupled with its rapidly developing technological infrastructure, positions it as a key player in the unfolding narrative. We’re talking about a country poised to leapfrog traditional development stages, embracing digital finance and sustainable technologies with remarkable agility. This dynamism is attractive, and seasoned investors are taking note.

But India isn’t alone. The entire Asia-Pacific region is a hive of activity. From the tech hubs of Singapore and South Korea to the manufacturing prowess of Vietnam and Thailand, the diverse economies of the region offer a compelling mosaic of opportunities. This diversification acts as a buffer against global economic shocks, making the region an appealing destination for those seeking stability and growth potential.

Cutting the Cord: Diversifying Beyond US Dependence

The impetus for this Pacific pivot isn’t solely about attraction; it’s also about strategic diversification. The global financial landscape has become increasingly volatile, and an over-reliance on any single economic power, particularly the United States, exposes economies to unnecessary risk. The Asia-Pacific region presents a viable, and increasingly attractive, alternative. It’s a chance to hedge bets, explore new avenues for growth, and forge partnerships based on mutual benefit rather than dependency.

This diversification manifests in several ways. We’re seeing increased intra-regional trade, the development of robust local capital markets, and a growing emphasis on Asian-led initiatives. Consider the Regional Comprehensive Economic Partnership (RCEP), a massive free trade agreement involving 15 Asia-Pacific nations, which signals a commitment to regional integration and a desire to shape their own economic destiny. We discussed other key trade agreements in a previous blog post on [global supply chain resilience](https://example.com/supply-chain-resilience).

Building Bridges, Not Walls: The Future of Global Finance

The shift towards the Asia-Pacific isn’t about replacing one dominant power with another. It’s about fostering a more balanced and multi-polar global financial system. It’s about recognizing the unique strengths and contributions of different regions and building a network of interconnected economies that are more resilient and adaptable.

Carney’s comments highlighted the importance of building “bridges,” not walls, between the East and the West. This necessitates a shift in mindset, a willingness to engage in meaningful dialogue, and a commitment to fostering mutual understanding. The future of global finance hinges on our ability to embrace this collaborative approach. The Asia-Pacific region isn’t just an emerging market; it’s a vital partner in shaping a more prosperous and equitable future for all.

A Final Word

The winds of change are undeniably blowing across the financial world. The rise of the Asia-Pacific region presents both opportunities and challenges. But one thing is clear: those who recognize and embrace this shift will be best positioned to thrive in the new global landscape. It’s no longer a question of if the center of gravity will shift, but how we will adapt to and participate in this exciting new era of global finance. The financial partnerships formed now will define success in the years to come.