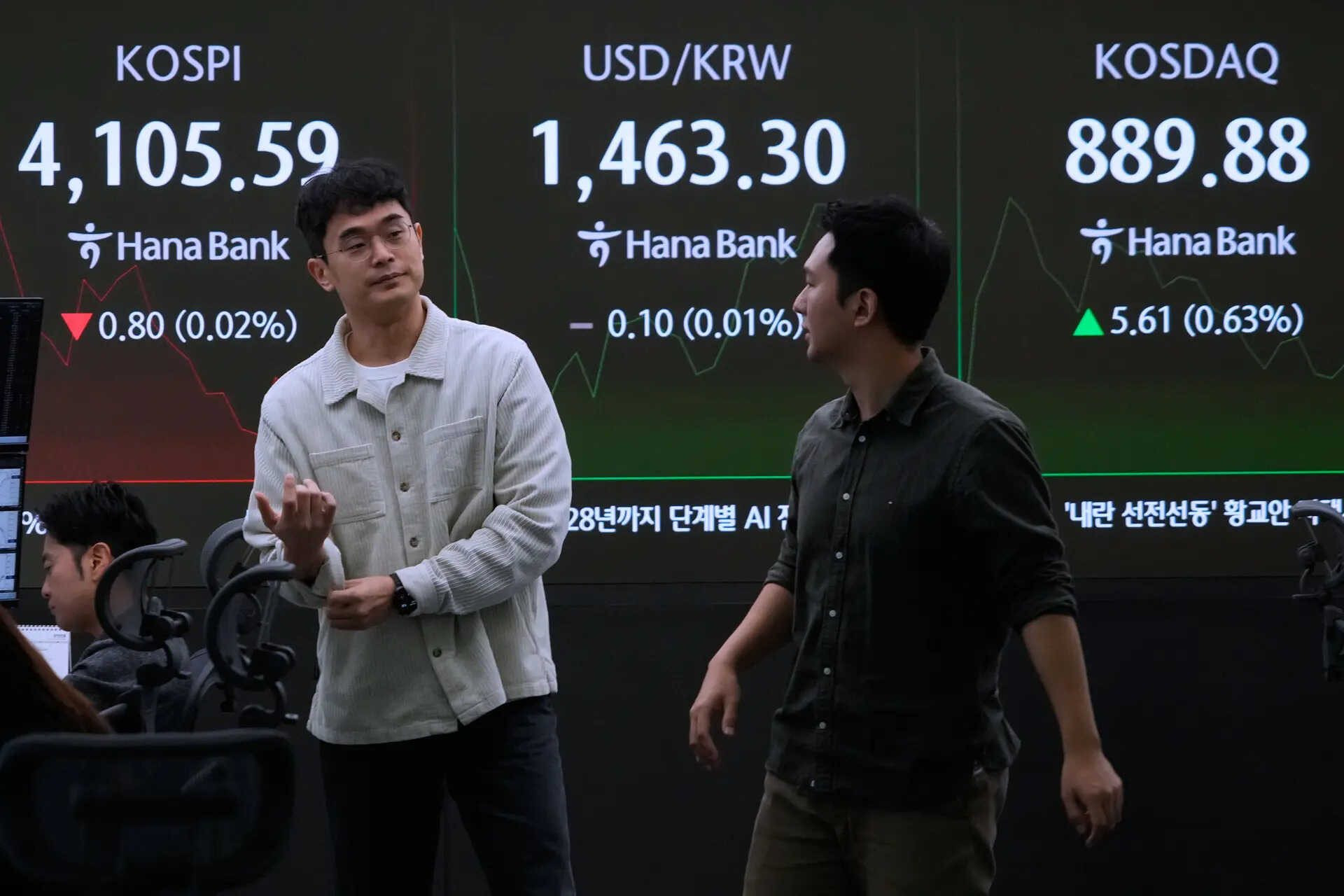

Asian markets traded mostly lower as excitement over the US government shutdown’s end faded, with focus shifting to the Federal Reserve and tech bubble fears. Despite the reopening, investors await economic data, while oil prices fell on surplus forecasts and the Japanese yen weakened, sparking intervention speculation.

Navigating Choppy Waters: Asian Markets React to US Shutdown Resolution

The global financial landscape is a constantly shifting mosaic, and recent events in the US have certainly added a few new, vibrant (and perhaps unsettling) pieces to the puzzle. With the last-minute resolution to avert a US government shutdown, all eyes turned to Asia to gauge the market reaction. The picture? A mixed bag, to say the least.

While the eleventh-hour deal in Washington DC brought a collective sigh of relief, it didn’t translate into uniform optimism across Asian trading floors. Hong Kong’s Hang Seng Index, a key barometer of regional sentiment, experienced a dip, shedding over 150 points. This suggests a lingering unease, perhaps a questioning of the long-term stability implied by such a fleeting resolution. Was this a genuine fix or simply a temporary stay of execution?

However, the story wasn’t entirely one of gloom. Shenzhen, a vibrant hub for technology and innovation, bucked the trend, posting gains. This divergence highlights the complex interplay of factors at play. Shenzhen’s resilience could be attributed to its focus on sectors less directly impacted by US fiscal policy, or perhaps a greater confidence in domestic economic drivers.

Elsewhere in the region, the picture remained equally nuanced. Tokyo’s Nikkei 225, another heavyweight in the Asian markets, showed only marginal movement, suggesting a wait-and-see approach. Investors seemed hesitant to make any bold moves, preferring to assess the fallout and potential future implications of the US situation. Shanghai also remained relatively stable, indicating a similar level of cautious observation.

Why the Mixed Signals?

Several factors could be contributing to this varied response. Firstly, the US shutdown saga has raised concerns about the reliability of American fiscal policy. The constant brinkmanship creates uncertainty, which is anathema to investors. Even with a temporary resolution in place, the underlying issues remain unresolved, leaving the door open for future disruptions.

Secondly, individual Asian economies have their own unique challenges and opportunities. Geopolitical tensions, domestic policy changes, and sector-specific trends all play a role in shaping market sentiment. The impact of the US situation is therefore filtered through these local lenses, resulting in a differentiated response.

Thirdly, the very nature of financial markets encourages a spectrum of reactions. Some investors are quick to react to news headlines, while others prefer a more deliberate, long-term perspective. This inherent diversity ensures that market movements are rarely monolithic. To read about how global trade affects shipping trends, check out this article on [supply chain innovations].

Impact on Technology Stocks

The technology sector, often considered a bellwether for future growth, also exhibited mixed performance. While some tech stocks benefited from Shenzhen’s positive momentum, others faced headwinds, reflecting broader concerns about global economic growth and consumer demand. The tech sector, particularly sensitive to interest rate changes and macroeconomic trends, is often among the first to feel the ripples of global uncertainty. Understanding the performance of Asian stock markets can offer insights into the health of the global tech sector.

Looking Ahead: Navigating the Uncertainty

So, what does this all mean for investors and businesses operating in Asia? In a word: caution. While the US shutdown has been temporarily averted, the underlying issues remain. A degree of volatility is likely to persist as markets grapple with the uncertainty and await further clarity on US fiscal policy.

Now is the time for careful analysis, strategic diversification, and a keen awareness of global economic trends. Opportunities will undoubtedly emerge, but navigating the choppy waters requires a steady hand and a clear understanding of the risks involved. The resilience demonstrated by some Asian markets, like Shenzhen, offers a glimmer of hope, suggesting that innovation and adaptability can provide a buffer against global headwinds. But overall, a measured and informed approach is crucial in these uncertain times.

The short-term resolution of the US government shutdown offered a reprieve, but the underlying economic concerns continue to exert influence on global markets. Investors and businesses alike must stay informed and be prepared to navigate the complexities ahead.