A new digital lending platform for small businesses, PSB Xchange, will launch in January 2026, aiming to disburse ₹3 lakh crore by 2030. This initiative by 12 public sector banks and Veefin Solutions will connect fintechs and other entities with MSMEs, facilitating access to formal financing at competitive rates.

Small Businesses Get a Digital Lending Lifeline: PSB Loans in 59 Minutes

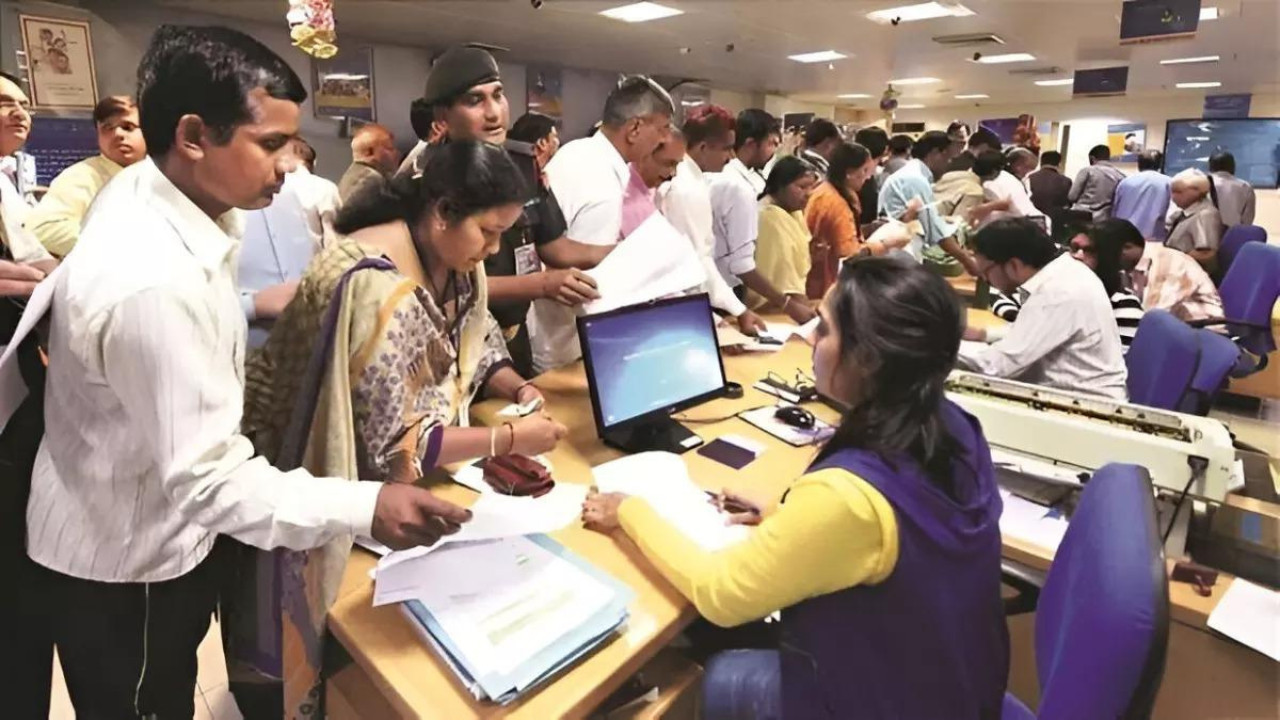

For years, small business owners have faced a familiar hurdle: accessing the capital they need to grow. The traditional loan application process can be a labyrinth of paperwork, drawn-out approvals, and ultimately, disappointing denials. But what if securing a business loan was as quick and easy as ordering your morning coffee online? That’s the promise behind the rapidly evolving PSB Loans in 59 Minutes platform.

This innovative initiative is transforming the lending landscape for Micro, Small, and Medium Enterprises (MSMEs) across India, injecting much-needed efficiency and transparency into the process. Forget weeks of waiting – the platform aims to provide in-principle loan approvals in under an hour. Sounds ambitious, right? Let’s delve into how it actually works.

How Does PSB Loans in 59 Minutes Speed Up the Process?

The magic lies in automation and data integration. PSB Loans in 59 Minutes leverages sophisticated algorithms and connects to various databases – including credit bureaus, income tax portals, and banking records – to assess an applicant’s creditworthiness in real-time. By automating much of the initial evaluation, the platform drastically reduces the time it takes to determine eligibility. The platform uses complex algorithms to analyze a range of data points, going beyond simple credit scores to gain a more holistic picture of the business’s financial health. This includes looking at cash flow patterns, sales history, and even online reviews to assess risk and potential.

Imagine the relief of knowing where you stand within minutes, instead of days or weeks. This speed isn’t just convenient; it’s crucial for businesses that need to act quickly on opportunities, whether it’s purchasing new equipment, expanding their operations, or managing unexpected expenses.

Beyond Speed: The Benefits of Digital Lending for MSMEs

The advantages of PSB Loans in 59 Minutes extend far beyond just speed. The platform also promotes greater transparency in the lending process. Applicants can clearly see the factors influencing their loan eligibility and understand the terms and conditions upfront. This transparency builds trust and empowers borrowers to make informed decisions.

Furthermore, the platform offers a level playing field for smaller businesses that may have previously struggled to compete with larger, more established companies. By standardizing the application process and reducing the reliance on personal relationships, PSB Loans in 59 Minutes opens up access to capital for a wider range of entrepreneurs.

The government’s backing of this platform provides credibility and encourages participation from both lenders and borrowers. This support signals a commitment to fostering a more vibrant and inclusive MSME sector.

More Banks Onboard for Wider Reach

The platform is continually evolving, with more Public Sector Banks (PSBs) joining the initiative. This expansion increases the availability of loans and provides MSMEs with a wider range of financing options to choose from. The increased competition among lenders can also lead to more favorable terms and interest rates for borrowers.

This growing network creates a more robust and sustainable digital lending ecosystem, benefiting not only the MSMEs but also the overall economy. As more banks embrace the platform, its reach and impact will only continue to grow. For related reading, check out our post on [government initiatives supporting small businesses](internal-link-to-related-article).

Challenges and the Road Ahead for PSB Loans in 59 Minutes

While PSB Loans in 59 Minutes holds immense promise, some challenges remain. Ensuring data security and privacy is paramount, given the sensitive financial information involved. Robust cybersecurity measures and strict adherence to data protection regulations are essential to maintain user trust.

Furthermore, the platform needs to address the digital divide and ensure that all MSMEs, regardless of their location or technological capabilities, can access its services. This may involve providing training and support to help businesses navigate the platform and understand the application process. Ongoing refinements and improvements, based on user feedback and evolving market needs, are crucial to maximizing the platform’s effectiveness and impact.

The increasing focus on providing accessible and quick PSB loans in 59 minutes signifies a positive shift towards empowering small businesses and fueling economic growth.

The Future of Small Business Lending is Digital

The PSB Loans in 59 Minutes platform is more than just a convenient tool; it’s a symbol of the changing landscape of small business lending. By embracing technology and streamlining the loan application process, it’s paving the way for a more inclusive and efficient financial system. As the platform continues to evolve and expand, it has the potential to unlock the immense potential of MSMEs and drive economic growth across India. The future of small business lending is undeniably digital, and PSB Loans in 59 Minutes is leading the charge.