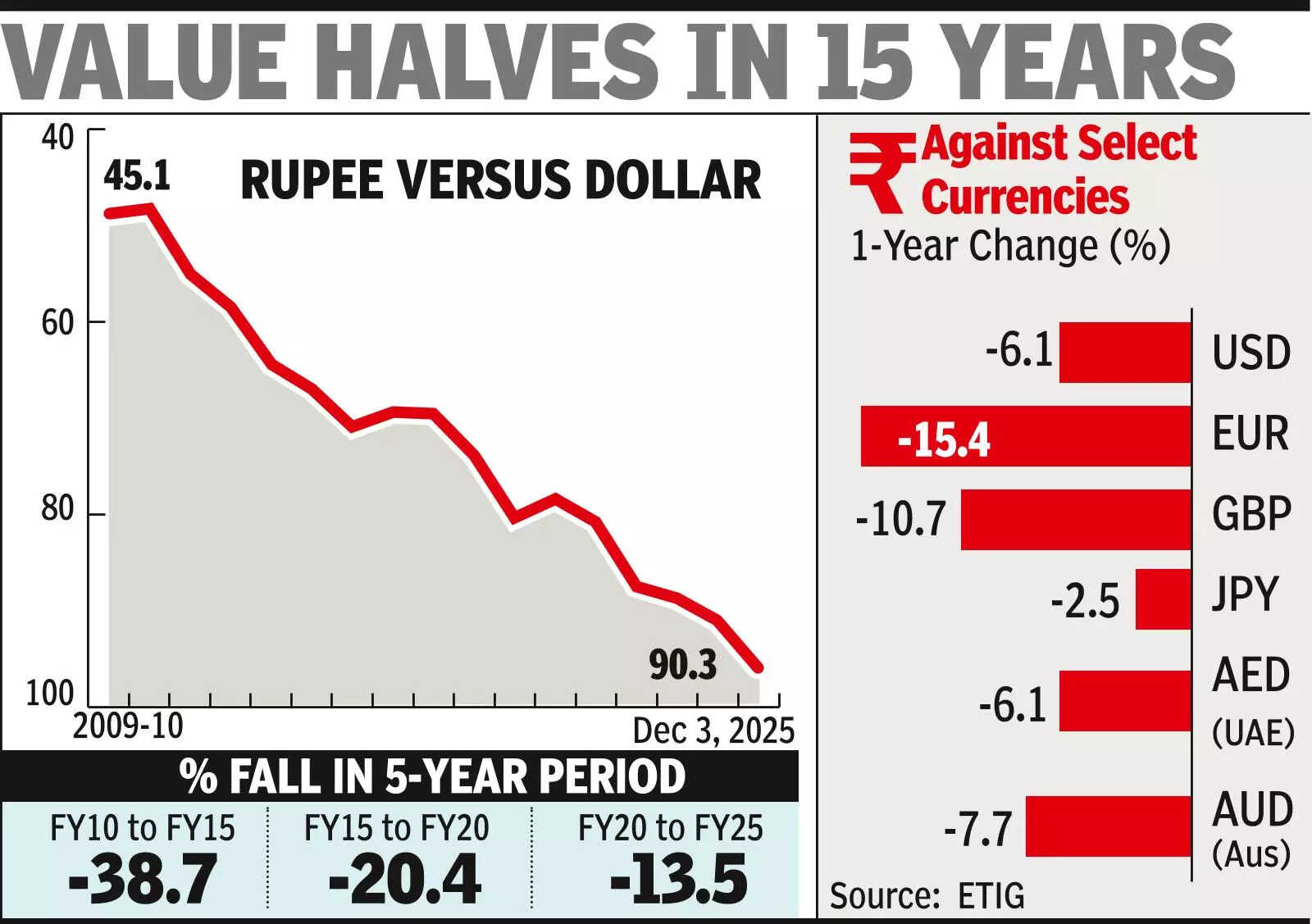

The Indian rupee hit an all-time low of 89.95 against the US dollar, driven by speculators and importers. Experts cite a strong dollar and delayed trade deal as key factors. While some foresee appreciation with a trade deal, others expect continued volatility around the 90-per-dollar mark.

The Rupee’s Descent: What a Record Low Means for You

The Indian rupee recently took a significant tumble, hitting a new all-time low against the US dollar. This isn’t just a number on a screen; it’s a development that ripples through the Indian economy, affecting everything from the price of your next gadget to the viability of overseas education. Let’s break down what’s happening and, more importantly, what it means for you.

For context, the rupee’s slide isn’t happening in isolation. Several global factors are at play, creating a challenging environment for emerging market currencies like ours. The dollar, traditionally seen as a safe haven, has been strengthening due to rising interest rates in the US and ongoing global economic uncertainties. This makes the dollar more attractive to investors, drawing capital away from other markets and putting downward pressure on currencies like the rupee.

But it’s not all about external forces. India’s own economic dynamics contribute to the situation. The demand for dollars in India remains high, driven by factors such as increased imports (especially oil) and investments flowing out of the country. When demand for a currency exceeds its supply, its value naturally decreases. This supply-demand imbalance adds another layer of complexity to the rupee’s trajectory.

The Immediate Impact: Your Wallet Feels the Pinch

So, how does this translate to your everyday life? The most immediate impact is likely to be felt in imported goods. Think about the latest smartphones, laptops, or even certain food items. As the rupee weakens, these imports become more expensive in rupee terms. Importers will eventually pass on these increased costs to consumers, leading to higher prices on store shelves.

Traveling abroad is also set to become pricier. Your travel budget, already strained by rising airfares, will have to stretch even further to accommodate the unfavorable exchange rate. A vacation to the US or Europe will now require a bigger chunk of your savings.

Education abroad is also deeply impacted. For students planning to study overseas, the depreciating rupee adds a significant burden to tuition fees and living expenses, requiring families to shell out more rupees for the same dollar amount. This could potentially alter academic plans or necessitate seeking additional financial support.

Silver Linings? Opportunities Amidst the Downturn

While a falling rupee generally spells trouble, it also presents some potential opportunities. Indian exporters, for example, stand to gain. A weaker rupee makes their goods more competitive in the international market, potentially boosting exports and contributing to economic growth. Sectors like IT, pharmaceuticals, and textiles could see an uptick in demand.

<img src="image_of_rupee.jpg" alt="Rupee value and its impact on the Indian economy.” />

Furthermore, the weakening rupee can attract foreign investment. For foreign investors, Indian assets become relatively cheaper, making it a more attractive time to invest in Indian companies or the Indian stock market. This influx of capital can help offset some of the negative effects of the currency depreciation. If you are an NRI then this is the right time to make a move!

It’s important to In a volatile currency environment, individuals and businesses need to be proactive. For individuals, it’s crucial to budget wisely, prioritize essential expenses, and consider delaying non-essential purchases, especially those involving imported goods. For businesses, hedging currency risk through financial instruments can help mitigate potential losses from currency fluctuations. Diversifying export markets can also reduce reliance on a single currency and lessen the impact of rupee depreciation.

The rupee’s recent slide serves as a stark reminder of the interconnectedness of the global economy and the impact of external factors on our daily lives. While the situation presents challenges, it also offers opportunities. By understanding the underlying dynamics and taking proactive steps, individuals and businesses can navigate the volatility and emerge stronger.