In today’s fast-paced financial world, finding a reliable and efficient way to grow your wealth is paramount. One such method gaining popularity is the SBI Mutual Fund Systematic Investment Plan (SIP), commonly known as SBI MF-SIP. With its blend of convenience, disciplined savings, and potential for long-term growth, this investment tool has become a favorite among both novice and experienced investors.

What is SBI MF-SIP?

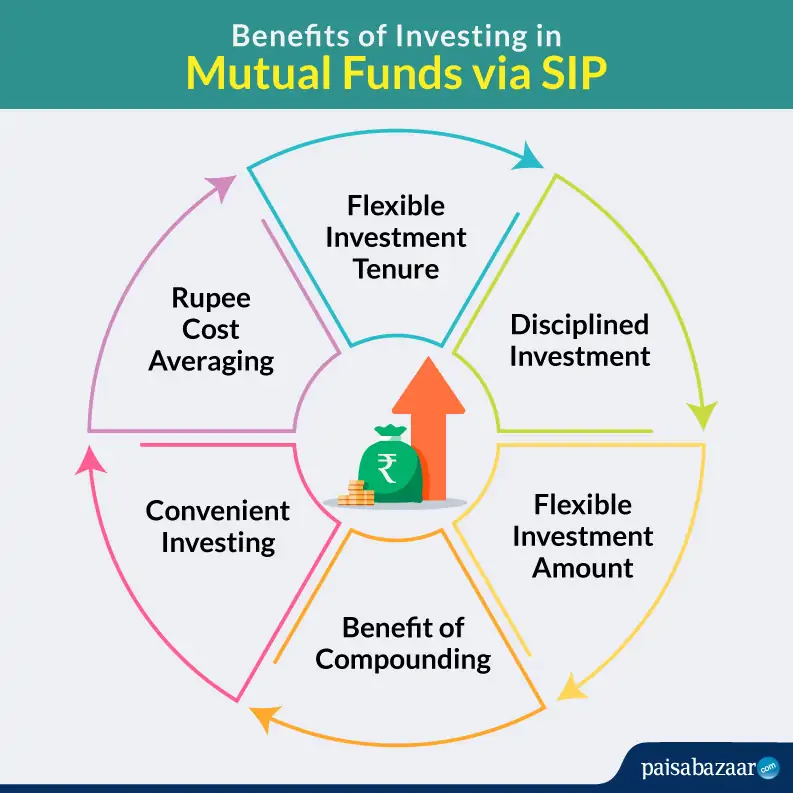

The SBI MF-SIP is a systematic investment plan offered by SBI Mutual Fund. It allows investors to invest a fixed sum of money at regular intervals—typically monthly—into mutual funds. Unlike lump sum investments, a SIP spreads out your investment over time, which helps reduce the risk of market volatility. By purchasing more units when prices are low and fewer units when prices are high, investors can benefit from a strategy known as rupee cost averaging.

This method not only makes investing more accessible but also encourages financial discipline. Many people have found that even modest monthly contributions can accumulate to a substantial corpus over the years.

The Benefits of SBI MF-SIP

1. Disciplined Investment Approach

One of the key advantages of SBI MF-SIP is the discipline it brings to your investment strategy. By committing to regular investments, you’re more likely to stay on track with your financial goals. This regularity can lead to a smoother ride through market fluctuations, providing peace of mind during uncertain times.

2. Affordability for Every Investor

SIP plans are designed to be affordable. With a low minimum investment requirement, SBI MF-SIP is accessible to a wide range of investors. Whether you’re just starting your investment journey or looking to diversify your portfolio, the SIP model allows you to begin with an amount that suits your budget.

3. Potential for Compounded Growth

Time is an investor’s best friend, and SBI MF-SIP leverages the power of compounding. Over a long period, the returns generated on your investments can themselves earn returns, creating a snowball effect. This compounded growth is often the secret ingredient behind successful long-term investment strategies.

4. Flexibility and Convenience

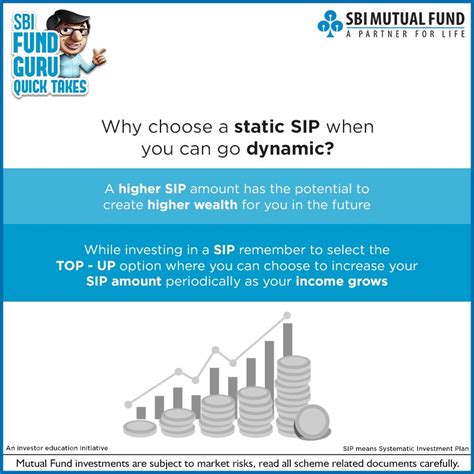

Investors appreciate the flexibility of SBI MF-SIP. You can choose the amount, frequency, and even the duration of your SIP. Moreover, the automated nature of the process—often facilitated by SBI’s online platforms—ensures that your investments are made on time, without the need for manual intervention each month.

Real-Life Example: A Journey Towards Financial Empowerment

Imagine Priya, a young professional starting her career in a bustling metropolitan city. Like many of us, Priya had dreams of financial independence but was unsure where to start. After attending a financial planning seminar, she learned about SBI MF-SIP and decided to take the plunge with a modest monthly investment.

Over the years, as Priya continued her SIP, she witnessed how market dips allowed her to purchase more units, while market highs made her appreciate the benefits of a disciplined approach. Today, Priya’s investments have grown significantly, allowing her not only to plan for a comfortable retirement but also to fund her children’s education. Her story is a testament to how consistent investing through SBI MF-SIP can transform financial futures.

Expert Insights on SBI MF-SIP

Financial experts widely acknowledge the benefits of systematic investment plans. According to seasoned investment analysts, the key to a successful portfolio is consistency and patience. They highlight that SBI MF-SIP is particularly attractive due to its structured nature, which helps mitigate the risks associated with market volatility.

Experts also emphasize the importance of starting early. With the power of compounding, even small amounts invested regularly can yield impressive returns over time. The automated process of SBI MF-SIP further ensures that investors remain committed to their investment strategy, removing the temptation to time the market—a decision that often leads to missed opportunities.

A recent study on mutual fund performance revealed that investors who regularly contributed via SIPs generally achieved better long-term returns compared to those who opted for lump-sum investments. This research-backed data reinforces the idea that consistency, combined with the inherent advantages of rupee cost averaging, can help investors navigate even the most turbulent market conditions.

How to Get Started with SBI MF-SIP

1. Assess Your Financial Goals

Before diving into any investment, it’s crucial to understand your financial goals. Whether you’re saving for retirement, a home, or your children’s education, having a clear goal will help you determine the right amount to invest and the duration of your SIP.

2. Choose the Right SBI Mutual Fund

SBI Mutual Fund offers a variety of funds tailored to different risk appetites and investment horizons. Take some time to research or consult with a financial advisor to choose the fund that aligns best with your goals.

3. Set Up Your SIP Online

The beauty of SBI MF-SIP is its simplicity. With a few clicks on SBI’s user-friendly platform, you can set up your SIP. Automate your investments so that you never miss a payment and continue to build your wealth effortlessly.

4. Monitor and Review Periodically

Even though SIPs are designed for long-term growth, it’s important to periodically review your portfolio. Adjust your investment strategy as needed to ensure that you remain aligned with your financial objectives.

SBI MF-SIP in the Bigger Financial Landscape

Investing is not just about growing wealth—it’s about building a secure future. SBI MF-SIP, with its structured approach, serves as a reliable vehicle in the world of mutual funds. Its blend of disciplined investing, affordability, and the power of compounding makes it an ideal choice for many. Whether you’re a seasoned investor or a newcomer, this systematic investment plan can help you navigate the often unpredictable financial markets with confidence.

The evolving digital landscape also adds to the appeal. With advanced online platforms and mobile applications, managing your investments has never been easier. This ease of access ensures that you can stay informed about your portfolio and make timely decisions, further bolstering your investment strategy.

Conclusion

SBI MF-SIP represents more than just an investment plan—it embodies a strategic approach to wealth creation. With its disciplined structure, affordability, and proven track record of compounded growth, it stands as a beacon for anyone seeking financial stability and long-term prosperity. By making regular contributions and harnessing the power of rupee cost averaging, investors can navigate market fluctuations and steadily build a robust financial future.

For those ready to embark on their investment journey, SBI MF-SIP is a compelling choice. It’s time to take control of your financial destiny, embrace smart investing, and witness your dreams turn into reality—all one monthly investment at a time.

Declaration:

The content in this article is based on my personal experiences, conversations with financial experts, and publicly available data from trusted sources like SBI Mutual Fund, Livemint, and Moneycontrol. This article is for informational purposes only and should not be considered financial advice. Always consult a certified financial advisor before making investment decisions.