‘Panch-Jyoti’: RBI’s 5-year strategy to boost financial inclusion; key goals and action points explained

The Reserve Bank of India has launched the National Strategy for Financial Inclusion (NSFI) 2025-30, aiming to expand financial access and usage across India. This ...

Gold loan market poised for major expansion; NBFCs plan 3k new branches as demand jumps

India’s gold loan market is poised for significant expansion as non-bank lenders plan to open approximately 3,000 new branches. This surge is driven by increasing ...

Indian spending shifts: Families move beyond basics as survey shows asset-building rising;

Indian households are shifting spending from basic necessities to asset-building purchases like personal goods and appliances, even among lower-income groups. Motor vehicles are the fastest-growing ...

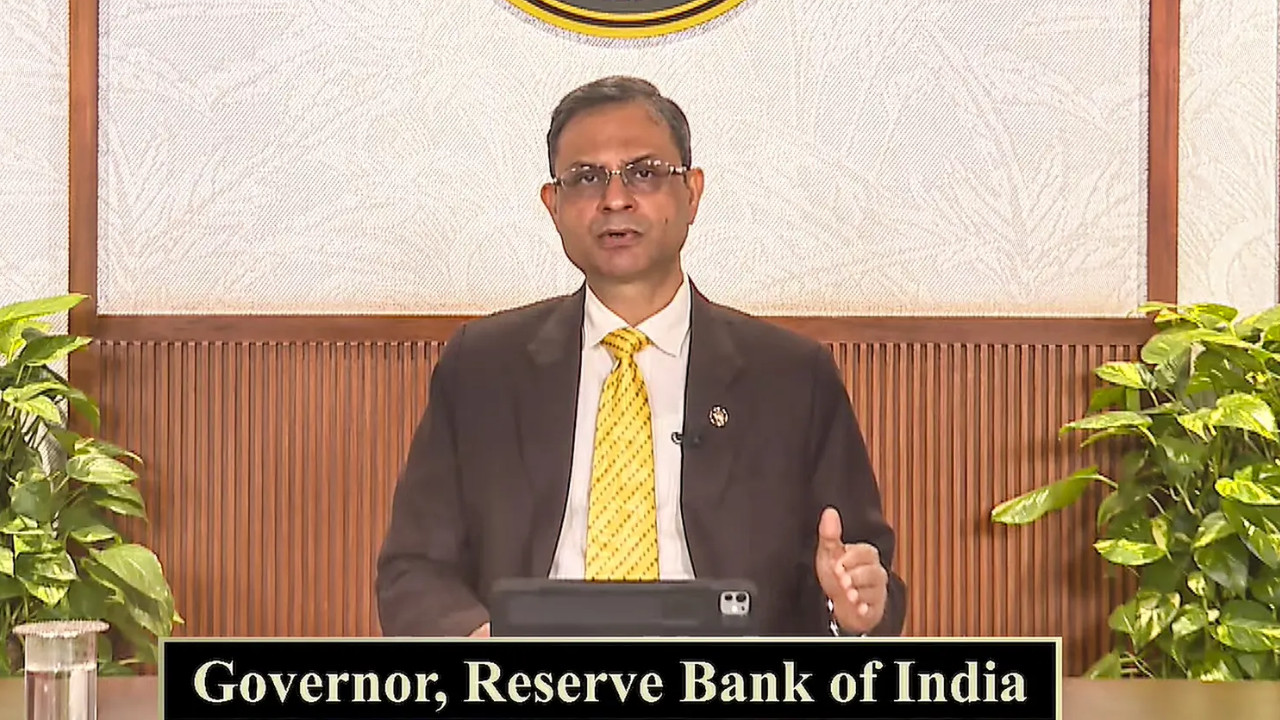

India drives 85% of transactions through UPI; DPPs boost financial inclusion: RBI Governor

India leads in digital public platforms, with UPI processing 85% of digital payments, facilitating financial inclusion and innovation. Reserve Bank Governor Sanjay Malhotra highlighted these ...

Gold loans surge: Organised market set to reach Rs 15 lakh crore by March 2026; says Icra report

The organized gold loan market is projected to reach Rs 15 lakh crore by March 2026, a year ahead of schedule, driven by soaring gold ...

Abu Dhabi fund to buy 41% in NBFC Sammaan for $1 billion

Abu Dhabi’s International Holding Company (IHC) will acquire a 41.2% stake in Sammaan Capital (formerly Indiabulls Housing) for Rs 8,850 crore, marking India’s largest foreign ...

Financial inclusion drive: SBI expands presence in Tamil Nadu; 14 new branches opened

State Bank of India is expanding its reach in Tamil Nadu, inaugurating 14 new branches, two Home Loan centers, and Rural Self Employment Training Institutes. ...

Banking reforms: Cooperative banks get Aadhaar-enabled services under simplified UIDAI framework; boost for rural inclusion

A new Aadhaar-based framework has been introduced for cooperative banks, enabling authentication and eKYC services. This initiative, spearheaded by the Cooperation Ministry and UIDAI, allows ...

India to be third largest economy soon, says RBI Governor; lauded women, Jan Dhan scheme for growth push

RBI Governor Sanjay Malhotra highlighted India’s imminent rise to the world’s third-largest economy, attributing this progress to the Pradhan Mantri Jan Dhan Yojana’s success in ...

Mutual funds’ share in household savings jumps 6x in decade on inclusion, low rates & confidence boost

Riding the Wave: How Mutual Funds Are Capturing India’s Savings Remember the days when gold and fixed deposits reigned supreme in Indian households? While those ...