Mutual funds’ share in household savings jumps 6x in decade on inclusion, low rates & confidence boost

The Quiet Revolution: How Mutual Funds Are Reshaping Indian Savings For years, the image of the typical Indian saver conjured up visions of gold bangles ...

Mutual funds’ share in household savings jumps 6x in decade on inclusion, low rates & confidence boost

The Rise of Mutual Funds: Are Indian Households Finally Sold? For years, the narrative surrounding Indian household savings revolved around gold, real estate, and maybe, ...

Mutual funds’ share in household savings jumps 6x in decade on inclusion, low rates & confidence boost

The Quiet Revolution: How Mutual Funds Are Reshaping Indian Savings For years, the story of Indian household savings was a familiar one: gold, real estate, ...

Mutual funds’ share in household savings jumps 6x in decade on inclusion, low rates & confidence boost

The Rise of the Mutual Fund: How India is Saving Smarter For years, the narrative around Indian household savings has been dominated by images of ...

Pension push: PFRDA eyes 50 lakh SVANidhi street vendors for APY, cites strong loan repayment record

PFRDA aims to enroll 5 million PM SVANidhi beneficiaries into the Atal Pension Yojana (APY), leveraging the scheme’s success in providing micro-credit to street vendors. ...

Mutual funds caution: Sebi chief warns against fraudulent redemptions; promises incentives for women investors

Sebi chairman Tuhin Kanta Pandey has alerted mutual funds about rising operational risks like fraudulent redemptions, urging vigilance and swift action. Sebi is planning incentives ...

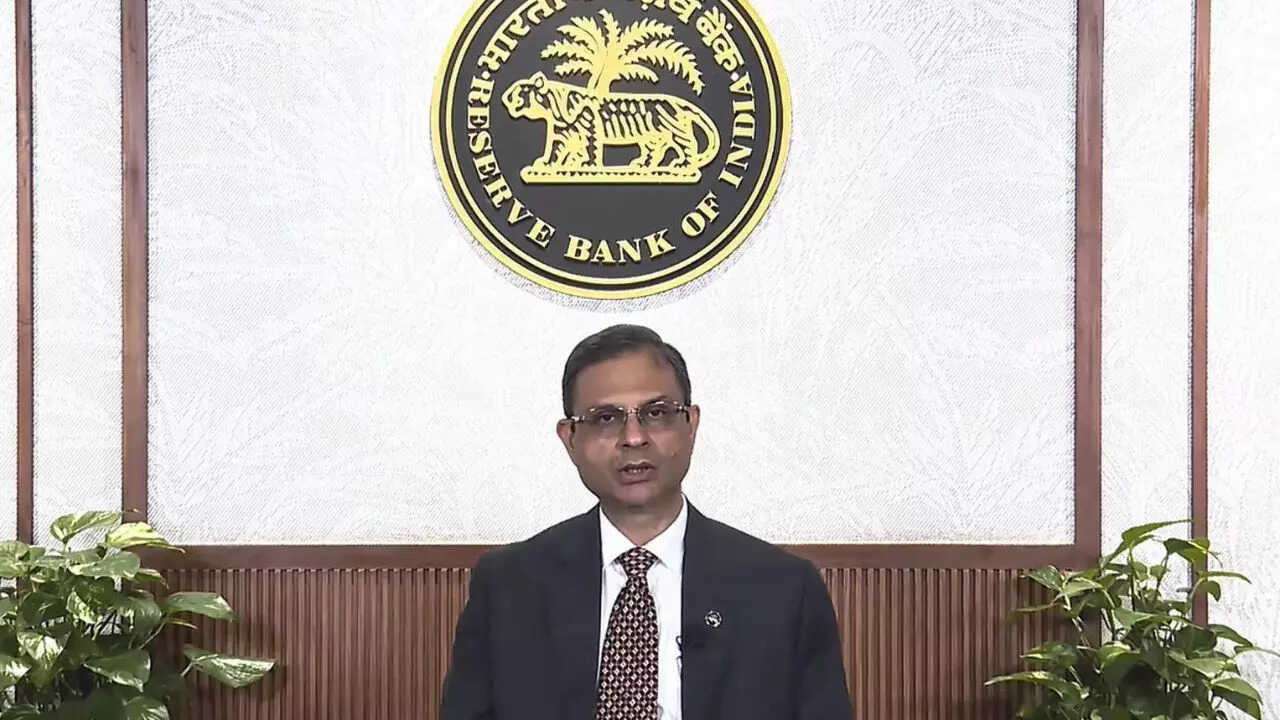

Financial inclusion must focus on literacy, not just access: RBI deputy governor

RBI Deputy Governor Swaminathan Janakiraman emphasized that financial inclusion extends beyond banking access, focusing on empowering individuals through financial literacy for improved lives and economic ...

RBI finalises co-lending framework starting Jan 2026

RBI’s final co-lending rules, effective January 1, 2026, introduce blended lending rates and escrow-based cashflow, potentially impacting originator attractiveness. New norms allow partial credit enhancement ...

‘To make settlement simpler’: RBI to simplify claims process for deceased customers’ nominees; banks launch re-KYC drive for Jan Dhan accounts

RBI Governor announced measures to simplify claim settlements for deceased customers’ accounts and lockers, alongside a re-KYC drive for PMJDY accounts via panchayat-level camps. The ...

Street vendor push: Loan hike, credit cards okayed

Lending a Hand Up: Expanded Credit Access for India’s Street Vendors For millions, the rhythmic clatter of pans, the aroma of spices wafting through the ...