President Trump is planning new tariffs on semiconductor chips and steel, potentially shaking global trade. The rates will start low to encourage domestic manufacturing before increasing significantly. Trump hinted at tariffs as high as 100% or even more on semiconductors, with exemptions for companies building in the U.S.

The Next Trade War Front: Will Chips and Steel Face Trump’s Tariff Hammer?

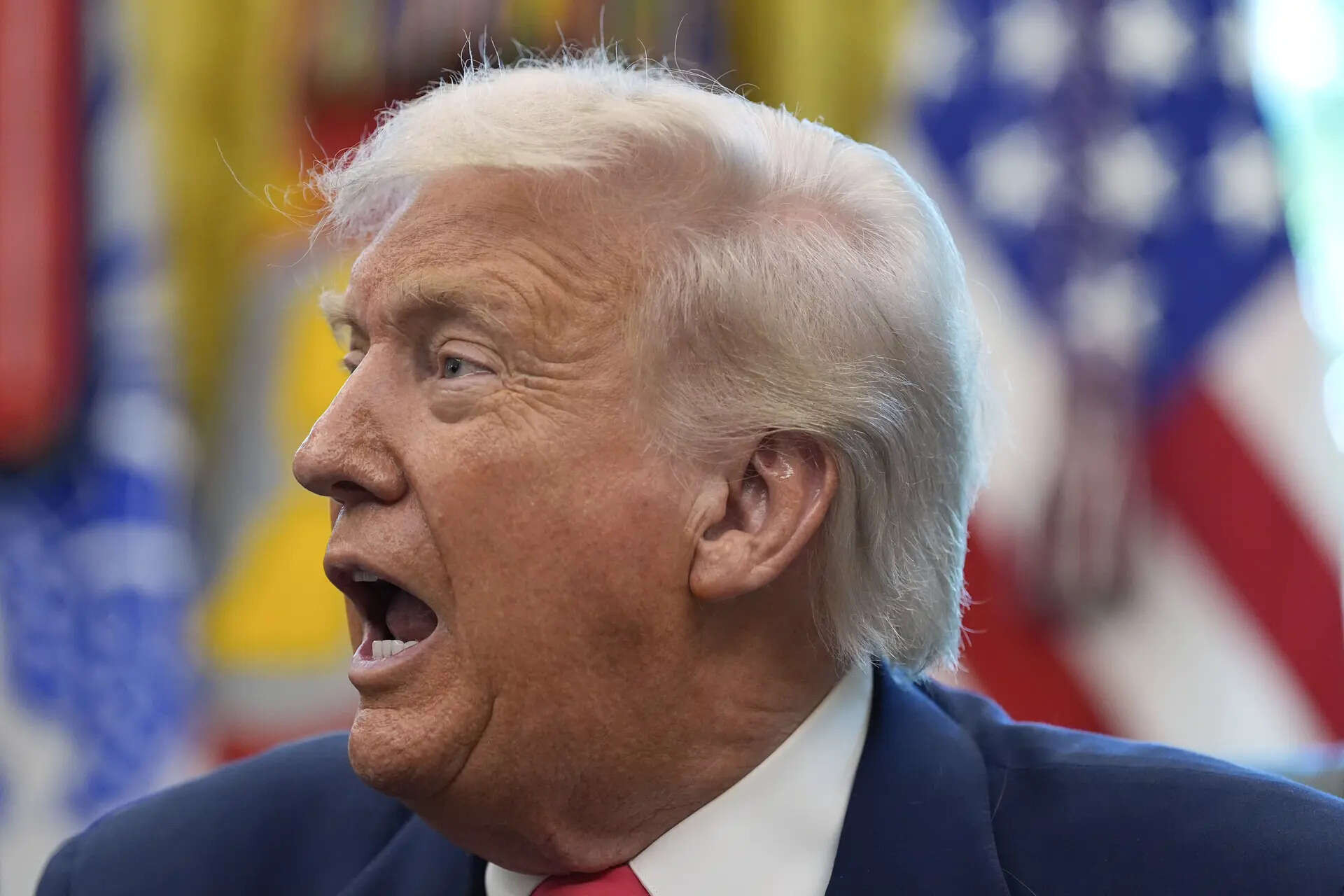

Donald Trump is back in the headlines, and this time, it’s not just political rhetoric. He’s hinting at a potential new wave of tariffs, targeting – you guessed it – more goods. But the items on the chopping block this time are particularly significant: semiconductors and steel. The implications could ripple through global markets and reshape the future of key industries.

It’s no secret that Trump’s previous trade policies, particularly those aimed at China, sent shockwaves through the global economy. Now, whispers of tariffs potentially reaching up to 300% on certain goods have industry insiders holding their breath. What’s driving this renewed focus on tariffs, and what could it mean for businesses and consumers alike?

A Renewed Push for Protectionism?

The rationale behind these potential tariffs seems to echo Trump’s familiar “America First” strategy. The argument centers on protecting domestic industries, bolstering national security, and bringing manufacturing back to the United States. By imposing hefty tariffs, the idea is to make foreign goods more expensive, thereby incentivizing companies to produce goods domestically and consumers to buy American. The strategy is fundamentally about creating a more favorable landscape for American companies.

But is this the best path forward? Many economists argue that tariffs ultimately hurt consumers by raising prices and can lead to retaliatory measures from other countries, sparking trade wars that benefit no one. Previous rounds of tariffs have already caused disruptions to supply chains and increased costs for businesses, contributing to inflationary pressures. Will this new move just pile on more pain?

The Semiconductor Showdown

The prospect of semiconductor tariffs is particularly concerning. Semiconductors, often called “chips,” are the brains behind virtually every electronic device we use, from smartphones and computers to cars and medical equipment. The United States is a major player in the semiconductor industry, but it relies heavily on imports for certain types of chips and components.

Imposing tariffs on semiconductors could significantly increase the cost of electronics for American consumers. It could also harm American companies that rely on these chips in their products. Moreover, it could lead to a shortage of essential components, disrupting industries across the board. Tariffs on chip imports could create a drag on the economy.

The global semiconductor landscape is already complex, with geopolitical tensions and supply chain vulnerabilities adding to the uncertainty. A trade war involving semiconductors could further destabilize the market and hinder innovation. It is critical to consider the long-term consequences before making such drastic changes.

Steel Under Scrutiny Again

Steel tariffs are another familiar battleground. In the past, Trump imposed tariffs on steel imports, citing national security concerns and the need to protect American steelworkers. While these tariffs did provide some short-term relief to the domestic steel industry, they also raised costs for manufacturers who rely on steel, ultimately impacting consumers.

Reintroducing or increasing steel tariffs could have similar effects. It could protect American steel producers but at the expense of other industries and consumers. Moreover, it could invite retaliation from other countries, potentially leading to a broader trade dispute. Many industries rely on affordable steel, making any price increases a potential obstacle to growth.

Navigating the Uncertain Future

As the possibility of new tariffs looms, businesses need to prepare for potential disruptions. Diversifying supply chains, exploring alternative sourcing options, and hedging against currency fluctuations are all strategies that can help mitigate the impact of trade wars.

It’s also crucial to monitor the political landscape and stay informed about any policy changes that could affect your business. Engaging with industry associations and lobbying groups can help amplify your voice and advocate for policies that support a healthy and competitive economy.

Ultimately, the decision to impose new tariffs rests with political leaders. However, it’s important to consider the potential consequences carefully and to weigh the benefits of protectionism against the risks of trade wars. Trade policies have far-reaching implications, and it is essential to pursue strategies that promote global cooperation and economic prosperity. Learn more about navigating the complexities of international trade and supply chain resilience on our other blog posts.

Conclusion:

The potential for new tariffs on semiconductors and steel throws a wrench into the global economy. Whether this is a shrewd negotiating tactic or a firm policy shift remains to be seen, but businesses must prepare for the potential impacts. The future hinges on political decisions, but understanding the implications for semiconductors and other key industries is crucial for making informed decisions and mitigating risk.