Asian shares were mixed as investors remained cautious ahead of a potential US government shutdown. Gold continued its rally past $3,850 on rate cut expectations, while oil prices slid further amid supply glut concerns. Zijin Gold International made a strong debut in Hong Kong, raising over $3 billion.

Navigating Choppy Waters: A Look at the Current State of Asian Stock Markets

The hum of global finance never truly sleeps, but lately, it feels like the engine is sputtering a little. Asian stock markets are currently navigating a complex landscape, facing headwinds from potential U.S. government shutdowns and lingering anxieties about global economic growth. It’s a mixed bag out there, with some markets barely budging and others showing small flickers of movement. Let’s dive into the key trends and what might be driving them.

A Sea of Sameness? A Flat Performance Overview

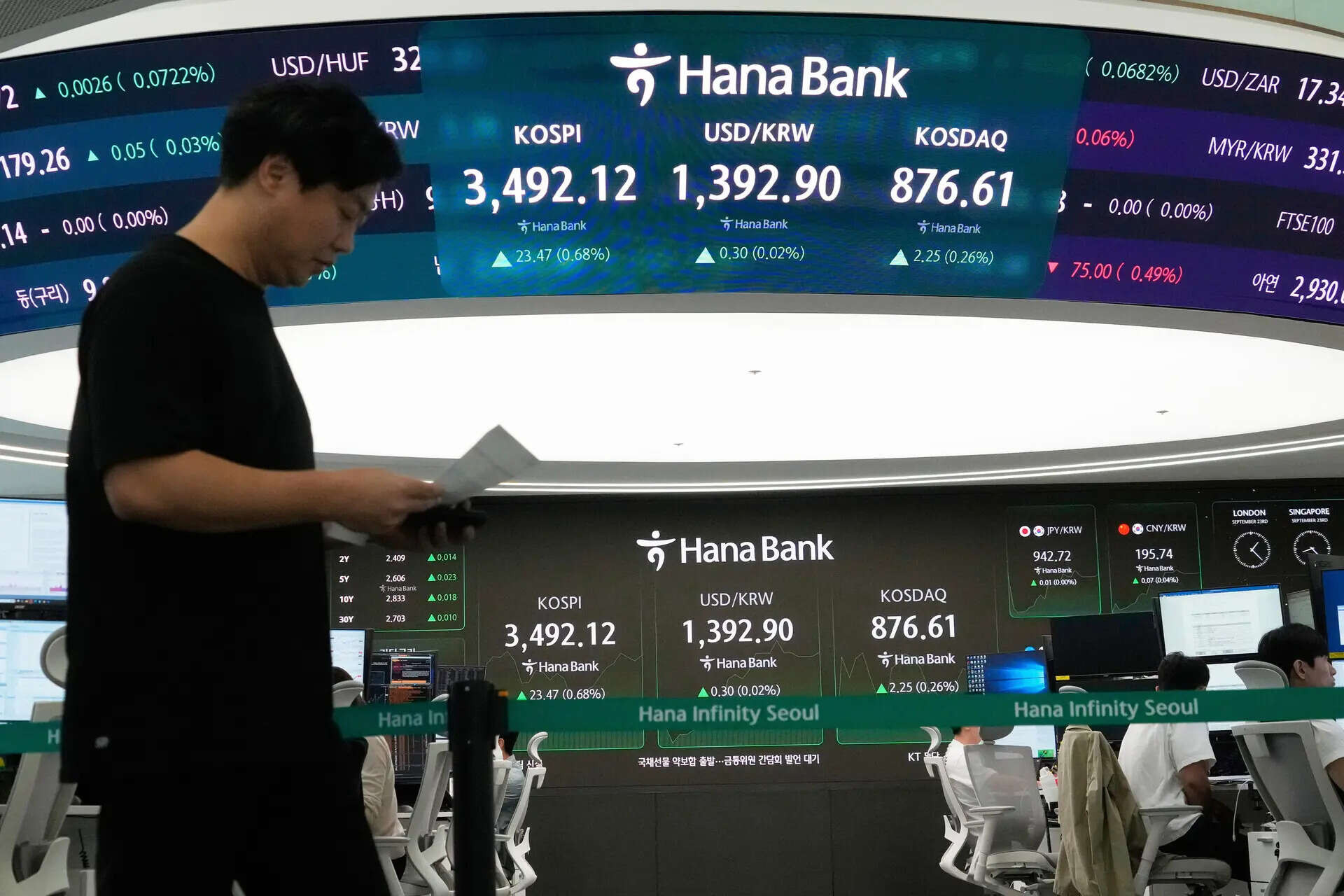

If you glanced at the headlines, you might think the Asian markets are in a holding pattern. And you wouldn’t be entirely wrong. Many indices are showing minimal change, suggesting a cautious approach from investors. The Hang Seng Index in Hong Kong, for example, experienced a slight dip, reflecting ongoing concerns about the Chinese economy. Meanwhile, Japan’s Nikkei 225 eked out a small gain, a testament to the resilience of some Japanese exporters. This general flatness underscores the uncertainty looming large over the global financial stage.

The U.S. Government Shutdown Spectre

One of the biggest factors casting a shadow over market sentiment is the potential for a U.S. government shutdown. The mere threat of a shutdown sends ripples through the global economy. Investor confidence takes a hit as concerns about the stability of the world’s largest economy escalate. A shutdown can disrupt trade, delay economic data releases, and generally create a climate of unpredictability that markets abhor. It’s like driving a car with the check engine light on—you know something might be wrong, even if you don’t know the extent of the issue.

China’s Economic Balancing Act

China’s economic performance continues to be a focal point. While there have been some positive signs recently, the overall picture is still one of moderate growth and ongoing challenges in the property sector. Any news, whether positive or negative, coming out of China has an outsized impact on Asian markets, given the country’s economic weight and influence. The image, Asian stock market reaction to Chinese data, often showcases this volatility.

Interest Rate Watch: A Global Waiting Game

Another key driver of market sentiment is the trajectory of interest rates. Central banks around the world have been aggressively raising rates to combat inflation, but there’s a growing expectation that we’re nearing the end of this tightening cycle. The question now is not if rates will stop rising, but when and by how much will they eventually come down. This uncertainty is keeping investors on edge, as higher rates can dampen economic activity and corporate earnings. We also need to consider how central banks within Asian markets will respond to the US rates. It’s a complex web of interconnected financial decisions.

Navigating the Uncertainty: What’s Next?

So, what does all of this mean for investors? Well, it suggests that a cautious and selective approach is warranted. Focusing on companies with strong fundamentals, solid balance sheets, and proven track records may be wise. Diversification is always a good strategy, especially in times of uncertainty. It is also worth considering that market corrections can present opportunities for long-term investors.

Furthermore, keeping a close eye on economic data releases, policy announcements, and geopolitical developments is crucial. The global economic landscape is constantly evolving, and investors need to stay informed to make sound decisions.

For example, you might find it helpful to review our piece on [long-term investment strategies during times of economic uncertainty] which offers further guidance.

The Path Ahead: A Call for Vigilance

The current state of Asian stock markets reflects a world grappling with economic uncertainty. The potential for a U.S. government shutdown, concerns about China’s economic growth, and the evolving interest rate environment are all contributing to a climate of caution. While it’s impossible to predict the future with certainty, remaining informed, diversified, and prepared to adapt to changing conditions will be crucial for navigating these choppy waters and positioning yourself for long-term success in the market. The key is to remain vigilant and agile.