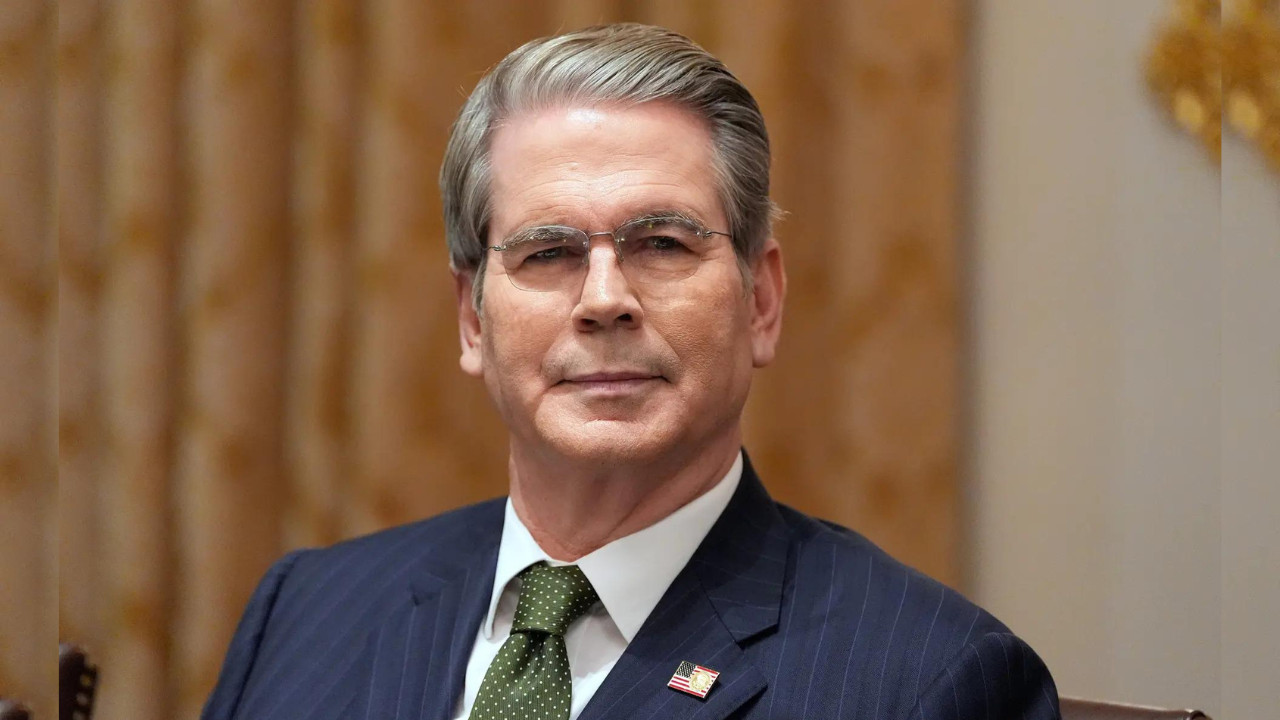

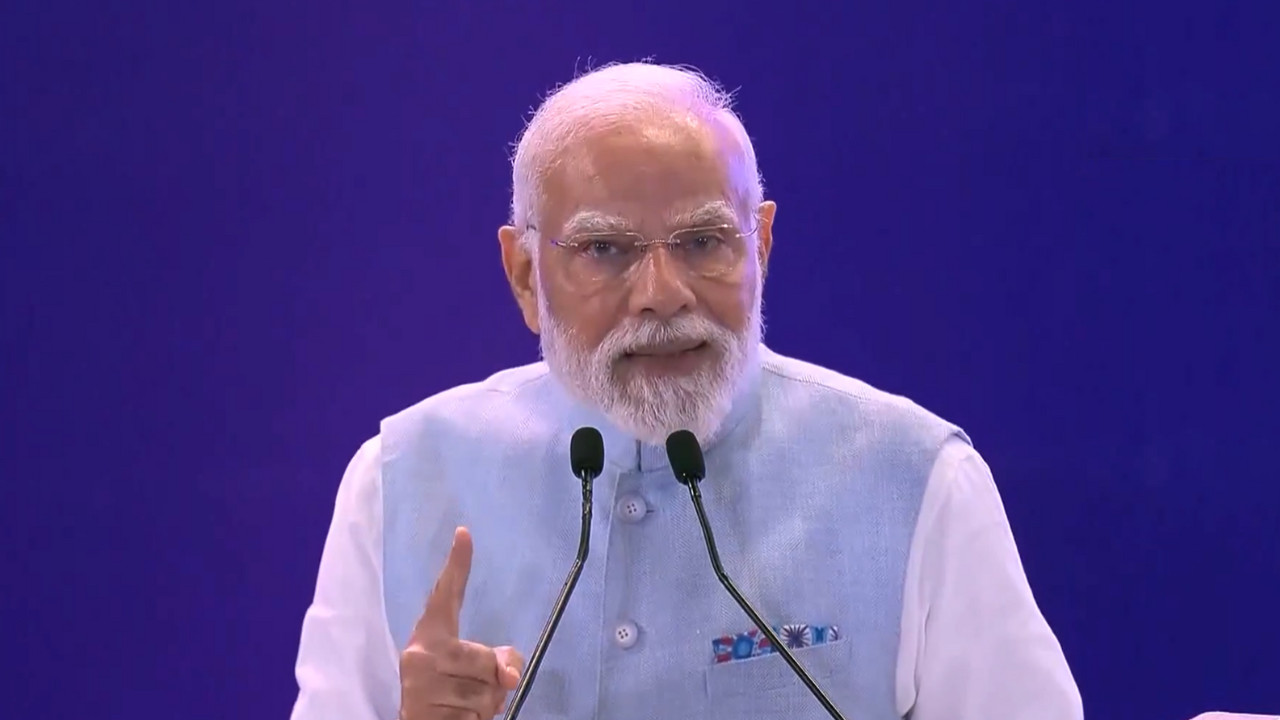

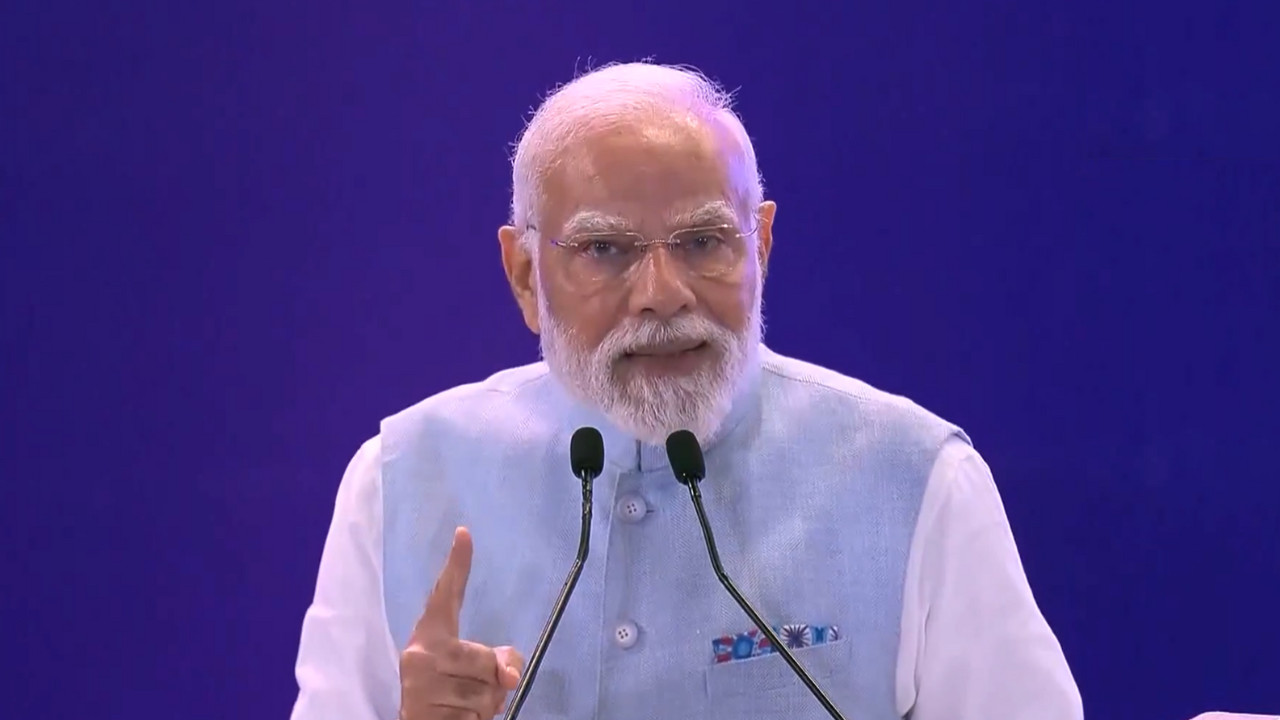

Asian markets showed mixed performance as investors digested President Trump’s positive remarks on his meeting with Xi Jinping, which included tariff reductions and China’s commitment to resuming soybean purchases. Central banks in Japan and Hong Kong maintained steady or adjusted policies, while cautious signals from the Federal Reserve regarding future rate cuts influenced global sentiment.

The Post-Summit Wobble: Why Asian Markets are Feeling the Pressure

The ink’s barely dry on the handshakes, and already the global markets are parsing the implications of the recent meeting between Donald Trump and Xi Jinping. While many hoped for a clear path forward on trade, the reality appears to be…murkier. Across Asia, stock markets are reflecting this uncertainty, with a general downturn rippling through trading floors.

What exactly is causing this post-summit wobble, and what does it mean for investors in the region and beyond?

A Glimmer of Hope, Quickly Dimmed?

Initially, news of the meeting brought a sigh of relief. The prospect of a continued trade war between the world’s two largest economies had been hanging over markets like a sword of Damocles. The meeting, however, seems to have offered more of a temporary reprieve than a lasting solution. The Shanghai Composite, a key barometer of Chinese market sentiment, slipped 0.3% suggesting that optimism regarding improved trade relations remains tentative at best.

Digging Deeper: What the Numbers are Telling Us

Beyond the headline figures, a closer look at individual markets reveals a nuanced picture. While some indices experienced modest gains, the overall trend pointed downwards. Several factors are contributing to this hesitancy. Firstly, there’s a general fatigue with the ongoing trade disputes. Investors are weary of the constant volatility and the unpredictable nature of geopolitical events.

Secondly, the lack of concrete details following the summit has left many feeling underwhelmed. Without clear commitments on key issues like tariffs and intellectual property protection, the meeting feels more like a continuation of the status quo than a genuine breakthrough. The initial optimism has been replaced by a sense of cautious waiting – a wait that is, in itself, contributing to market instability.

Beyond Trade: Other Factors at Play

It’s also important to remember that trade isn’t the only factor influencing Asian markets. Broader global economic concerns, including inflation rates, interest rate hikes, and the lingering effects of the pandemic, all play a significant role. A strong US dollar is also impacting emerging markets and increasing financial pressure. Concerns over domestic policy within individual Asian nations add another layer of complexity.

Navigating the Uncertainty: What Now for Investors?

So, what should investors do in the face of this uncertainty? The temptation to panic sell can be strong, but history has shown that knee-jerk reactions often lead to poor decisions. Instead, a more considered approach is needed. This might involve:

* Diversifying your portfolio: Spreading investments across different asset classes and geographical regions can help mitigate risk.

* Focusing on long-term fundamentals: Rather than getting caught up in short-term market fluctuations, focus on companies with solid financials and strong growth potential.

* Seeking professional advice: A financial advisor can provide personalized guidance based on your individual circumstances and risk tolerance. You may also want to learn more about investing in volatile markets.

The Road Ahead: Watching and Waiting

Ultimately, the future direction of Asian markets hinges on a number of factors, including the ongoing trade negotiations between the US and China, the global economic outlook, and the policy decisions of individual Asian governments. The next few weeks and months will be crucial in determining whether the post-summit wobble turns into a full-blown correction or simply a temporary pause before the next leg up. For now, vigilance and a well-thought-out investment strategy are key to navigating the uncertainty.

slug: asian-stock-markets