China’s curbs on rare earth exports have shaken the global auto industry. Carmakers faced production halts. The restrictions also hurt Chinese magnet producers. Magnet exports saw a sharp decline. A deal between the US and China aims to restart trade. However, recovery is expected to be slow. Domestic magnet firms face challenges.

Rare Earth Realities: China’s Export Limits Hit Home

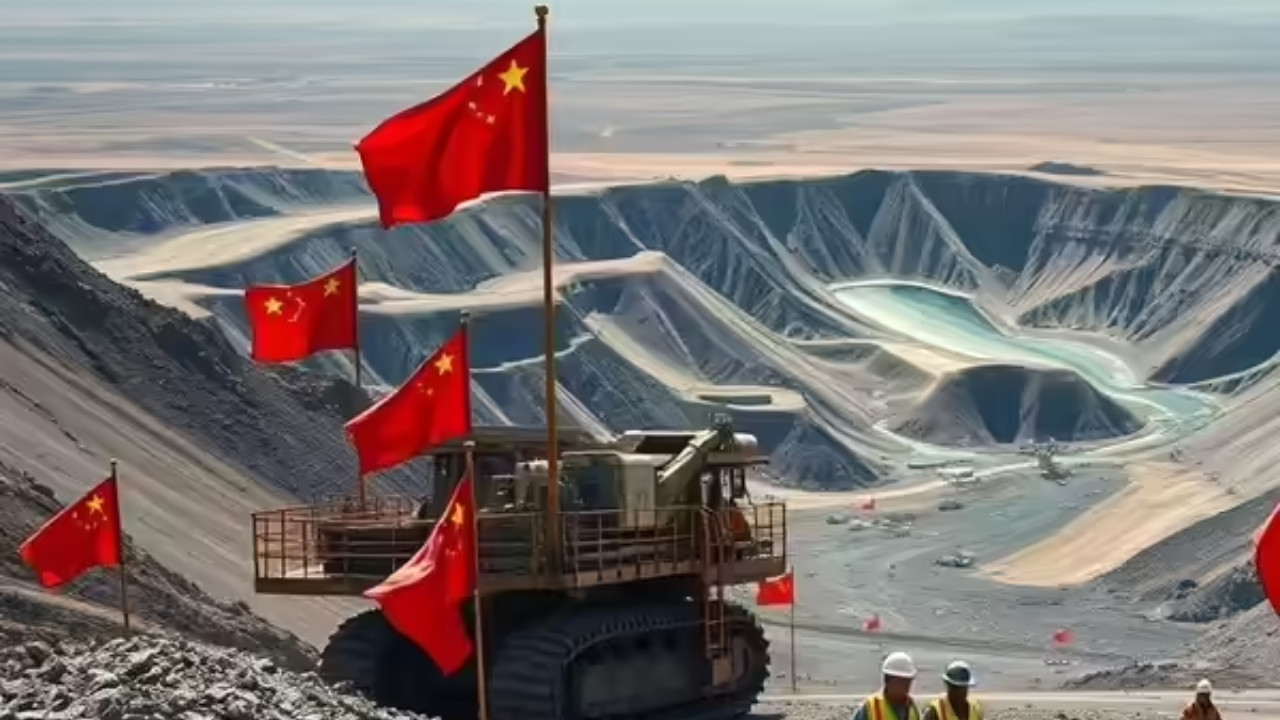

China’s dominance in rare earth elements is a well-known story. Often touted as a strategic advantage, recent export restrictions aimed at bolstering domestic industries and flexing geopolitical muscle seem to be producing an unexpected outcome: a squeeze on Chinese magnet manufacturers. Instead of reaping rewards, these companies, vital consumers of rare earth materials, are facing a challenging landscape of plummeting demand, shrinking revenue, and overflowing warehouses.

The narrative spun around rare earths often involves Western dependence and China’s control. But the reality on the ground is proving far more nuanced. The very policies designed to solidify China’s position in the global supply chain are now impacting its own businesses in unforeseen ways.

What’s Driving the Rare Earth Downturn?

Several factors are converging to create this perfect storm. Firstly, the global economic slowdown has cooled demand for finished goods that incorporate rare earth magnets. From electric vehicles to wind turbines, many sectors reliant on these high-performance components are experiencing slower growth than anticipated. This directly translates into less demand for the magnets themselves.

Secondly, the Chinese real estate sector, a major driver of economic activity, is still facing significant headwinds. This has impacted demand for various manufactured goods that rely on permanent magnets.

Finally, and perhaps most ironically, the export restrictions themselves are playing a crucial role. While intended to prioritize domestic consumption and drive up prices for foreign buyers, these policies have inadvertently created an artificial surplus within China. With less rare earth material flowing out, inventories of both raw materials and finished magnets are piling up.

The Impact on Chinese Magnet Makers

The financial consequences are already being felt. Reports indicate that many Chinese magnet manufacturers are experiencing significant revenue declines. Some are struggling to maintain profitability, while others are being forced to scale back production or even shut down operations entirely. This situation is particularly difficult for smaller and medium-sized enterprises (SMEs), which often lack the resources to weather prolonged periods of economic hardship.

The pressure is mounting from several directions. Raw material prices, while potentially benefiting from reduced exports in the long run, haven’t risen sufficiently to offset the decline in demand for finished magnets. This creates a margin squeeze that puts manufacturers in a difficult position. Many are caught between rising input costs and decreasing sales, making it challenging to remain competitive.

Rare Earth Deals and Unintended Consequences

Recent trade agreements, such as those between the US and other nations aimed at diversifying rare earth supply chains, are also likely contributing to the shift. While the impact is gradual, these deals signal a long-term effort to reduce reliance on China, creating an incentive for companies to explore alternative sources and technologies. This diversification reduces China’s magnet exports and hurts local companies.

This underscores a crucial lesson: economic policies rarely unfold exactly as planned. The complex interplay of global markets, technological innovation, and geopolitical factors can lead to unexpected and sometimes counterproductive outcomes. The current situation facing Chinese magnet makers serves as a stark reminder of the challenges involved in managing complex supply chains and the importance of anticipating unintended consequences.

Looking Ahead: The Future of Rare Earths

The long-term implications of China’s export restrictions are still unfolding. The impact on rare earth element pricing and global supply chains remains to be seen. However, one thing is clear: the current situation is creating significant challenges for Chinese magnet manufacturers. Whether they can adapt and navigate these turbulent waters will depend on a number of factors, including the pace of global economic recovery, the effectiveness of government support measures, and their ability to innovate and differentiate themselves in a competitive market. It will be interesting to see how the situation will shift in the coming months and years.

The Chinese rare earth strategy, while intended to secure its position, has highlighted the complexities of global trade and the importance of a balanced approach. A balanced approach also includes considering what the future of U.S. Rare Earth Magnets looks like and how the global market will adapt to these ever-changing dynamics.