US Commerce Secretary Howard Lutnick is escalating trade tensions with India, threatening market access unless it buys US corn. Despite India’s self-sufficiency and concerns over genetically-modified crops, Lutnick accuses India of unfair trade practices. This hardline stance, criticized by some as misrepresentative, risks straining relations even where accommodation is possible, as trade disputes continue.

Betting on the Heartland: Why This Wall Street Titan Says “Load Up” on Corn

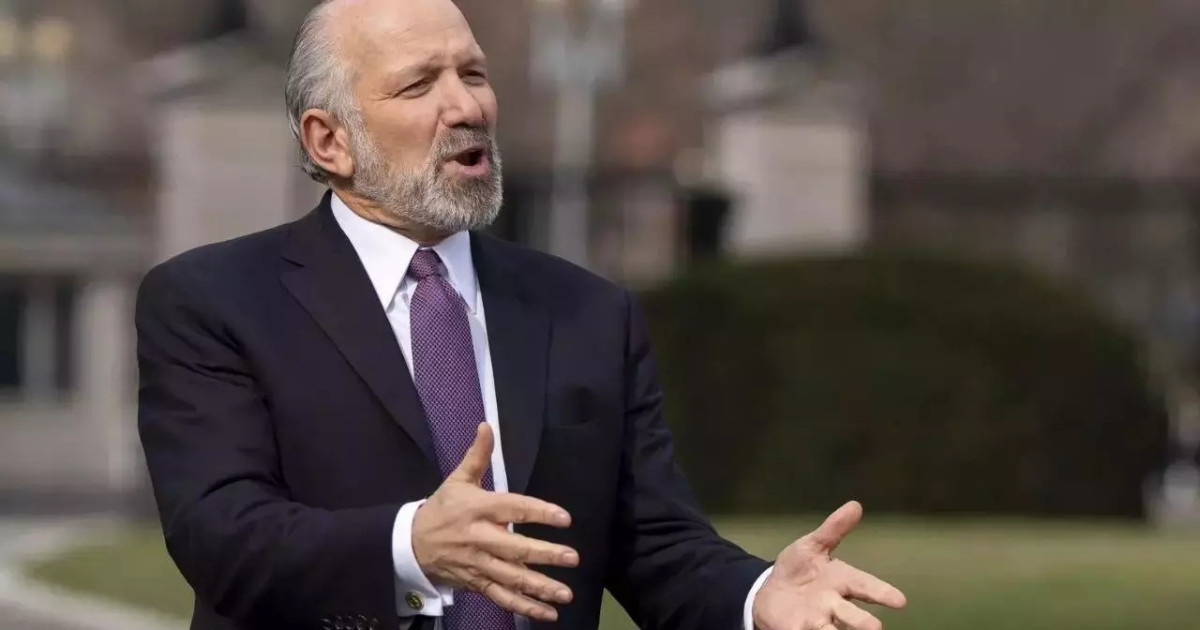

Howard Lutnick, the CEO of Cantor Fitzgerald, isn’t known for mincing words. He’s a Wall Street veteran who’s seen market booms and busts, and when he speaks, people tend to listen. Recently, Lutnick made a bold statement: he’s bullish on corn, and he believes others should be too. But what’s driving this conviction, and should you be stocking up on corn futures alongside him?

Lutnick’s argument centers on a fundamental principle: supply and demand. While predictions can always be wrong, the conditions leading up to his comments definitely suggested upward trends in corn values. A confluence of factors is tightening the corn supply, creating a potentially lucrative opportunity for those who get in early. Let’s delve into the reasons why this seasoned investor thinks corn is ripe for the picking.

The Weather Vane Points to Higher Corn Prices

One of the biggest factors influencing corn prices is, unsurprisingly, the weather. Adverse weather conditions across key growing regions can dramatically impact yields. Consider the impact of drought, excessive rainfall, or even unseasonable frosts, all of which can devastate crops and reduce the overall harvest. Lutnick likely factored in potential weather-related disruptions when making his assessment, understanding the vulnerability of agricultural commodities to unpredictable environmental events.

<img src="image-url-here.jpg" alt="Rolling fields of vibrant green corn under a sunny sky, highlighting the potential for higher corn prices.”/>

Of course, weather is just one piece of the puzzle. Other factors are contributing to the potential shift in the corn market.

Beyond the Farm: Global Demand for Corn

While supply-side constraints are important, the demand side of the equation is equally crucial. Global demand for corn is steadily increasing, fueled by a variety of sources. Firstly, corn is a vital ingredient in animal feed, and as populations grow and diets shift towards more meat consumption, the demand for feed grains like corn naturally increases. Secondly, corn is a key component in the production of ethanol, a biofuel used as an alternative to gasoline. Government mandates and incentives for biofuel production further bolster the demand for corn. Finally, industrial uses of corn, such as in the production of plastics and other materials, contribute to the overall demand picture.

This increasing global appetite for corn, coupled with potential supply challenges, is creating a tight market dynamic. Lutnick’s call to “buy it or else” suggests he believes this imbalance will drive prices higher.

Investing in Corn: Playing the Field

So, how can investors capitalize on this potential opportunity? There are several ways to gain exposure to the corn market. One option is to invest in corn futures contracts, which allow you to speculate on the future price of corn. These contracts are traded on commodity exchanges and can offer significant leverage, but they also come with considerable risk. Another option is to invest in agricultural ETFs (exchange-traded funds) that track the performance of corn and other agricultural commodities. These ETFs provide a more diversified approach and can be less volatile than individual futures contracts. Finally, you could invest in companies involved in the production, processing, or transportation of corn, such as agricultural companies or food processing companies.

Before diving in, it’s crucial to understand the risks involved. Commodity markets can be highly volatile and influenced by a complex web of factors. Thorough research and a solid understanding of the market dynamics are essential for making informed investment decisions.

A Word of Caution: Volatility is Part of the Game

It’s important to ### The Future of Corn: A High-Stakes Gamble?

Ultimately, whether Lutnick’s prediction proves accurate remains to be seen. However, his bullish outlook highlights the potential opportunities in the corn market, driven by a combination of supply constraints and increasing global demand. Investors who are willing to do their homework and accept the risks involved may find that corn offers a compelling investment opportunity. But remember, investing in commodities is not for the faint of heart. It’s a high-stakes game where fortunes can be made and lost quickly. Is this a chance to “load up” on corn, or a gamble that could backfire? Only time will tell.