Elon Musk bought Tesla shares worth $1 billion. This purchase occurred through a trust. Tesla shares saw a jump before trading began. This follows Tesla’s proposal for Musk’s pay package. Shareholders will vote on this package in November. The package could grant Musk shares based on performance. Tesla has faced challenges this year. The shareholder vote will decide Musk’s compensation.

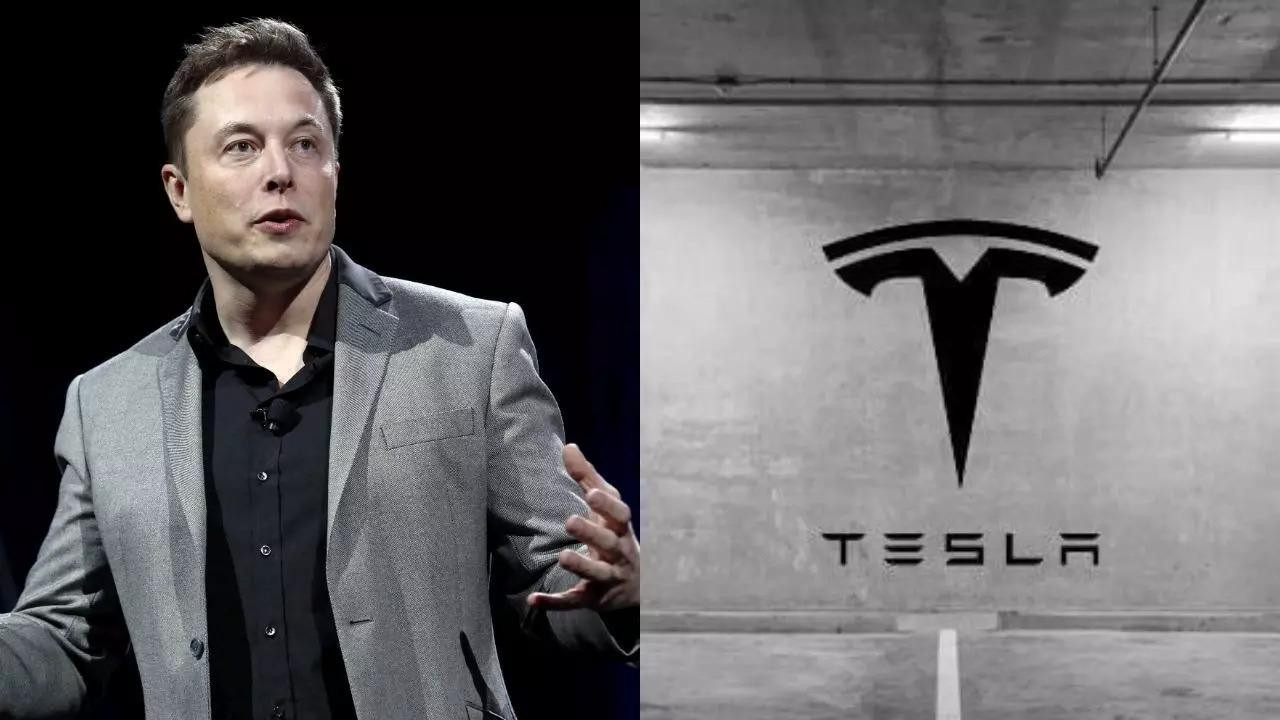

Elon’s Backing: What Does Musk’s Billion-Dollar Tesla Stock Purchase Really Mean?

Elon Musk just put his money where his mouth is, big time. To the tune of a cool $1 billion, he snapped up a hefty chunk of Tesla shares, sending ripples of excitement (and a decent-sized wave of green) through the market. Pre-market trading saw a noticeable surge, and everyone’s asking: What’s the real story here? Is this a vote of confidence, a strategic play, or something else entirely?

Frankly, it’s probably a mix of all three. Musk’s relationship with Tesla is complex, to say the least. He’s the visionary leader, the disruptive innovator, and, let’s face it, the guy who keeps everyone on their toes with his often…unconventional…public pronouncements. So, when he makes a move like this, it’s worth digging deeper than just the headline.

One interpretation is simple: Elon Musk invests because he believes in Tesla. The company, despite the occasional hiccup and the ever-present scrutiny, is still the undisputed king of the electric vehicle hill. They’re expanding production, pushing the boundaries of battery technology, and continuing to explore new avenues like energy storage and AI. It’s a logical conclusion that Musk, intimately familiar with the inner workings of Tesla, sees significant long-term potential.

Another factor at play is undoubtedly the stock’s recent performance. Tesla’s shares, like many tech stocks, have experienced volatility. Buying low, as the saying goes, is a fundamental investment strategy. Musk may be taking advantage of what he perceives as an undervalued position, setting the stage for future gains. After all, he is a businessman.

But let’s not dismiss the signaling aspect. Musk’s purchase sends a powerful message to investors, analysts, and even his own employees. It’s a public declaration of faith, a way of saying, “I’m in this for the long haul.” In a market often driven by sentiment, this kind of visible commitment can be invaluable. It can bolster investor confidence, attract new capital, and reassure those who might be wavering. He’s essentially doubling down, betting on his own vision, and inviting others to do the same.

Beyond the financial and strategic considerations, there’s also the personal element. Tesla is, in many ways, Musk’s legacy project. It’s the embodiment of his ambition to revolutionize transportation and accelerate the world’s transition to sustainable energy. Protecting and nurturing that legacy likely plays a significant role in his decision-making. This purchase could be seen as a personal investment, securing his place at the helm of a company he clearly cares deeply about.

Of course, it’s never just one thing. The market’s reaction to this substantial Elon Musk invests event is a testament to his influence. It shows the weight that his actions carry and the power of his persona in the financial world. Whether it’s purely strategic, fueled by a belief in Tesla’s potential, or a calculated PR move, Musk’s billion-dollar investment will undoubtedly have a lasting impact. This move underscores his commitment and reinforces his position as the driving force behind Tesla’s ongoing journey.

Interested in more insights into the electric vehicle market? Check out our analysis on the future of EV charging infrastructure.

Ultimately, Elon Musk invests and only time will tell the full ramifications of this move. But one thing is clear: it’s a significant statement, one that’s sure to keep the spotlight firmly fixed on Tesla and its ambitious leader. This kind of boldness is what we’ve come to expect from Musk, and it serves as a powerful catalyst for discussion about the future of electric vehicles and the evolving dynamics of the tech industry. It will be fascinating to see how this chapter unfolds.