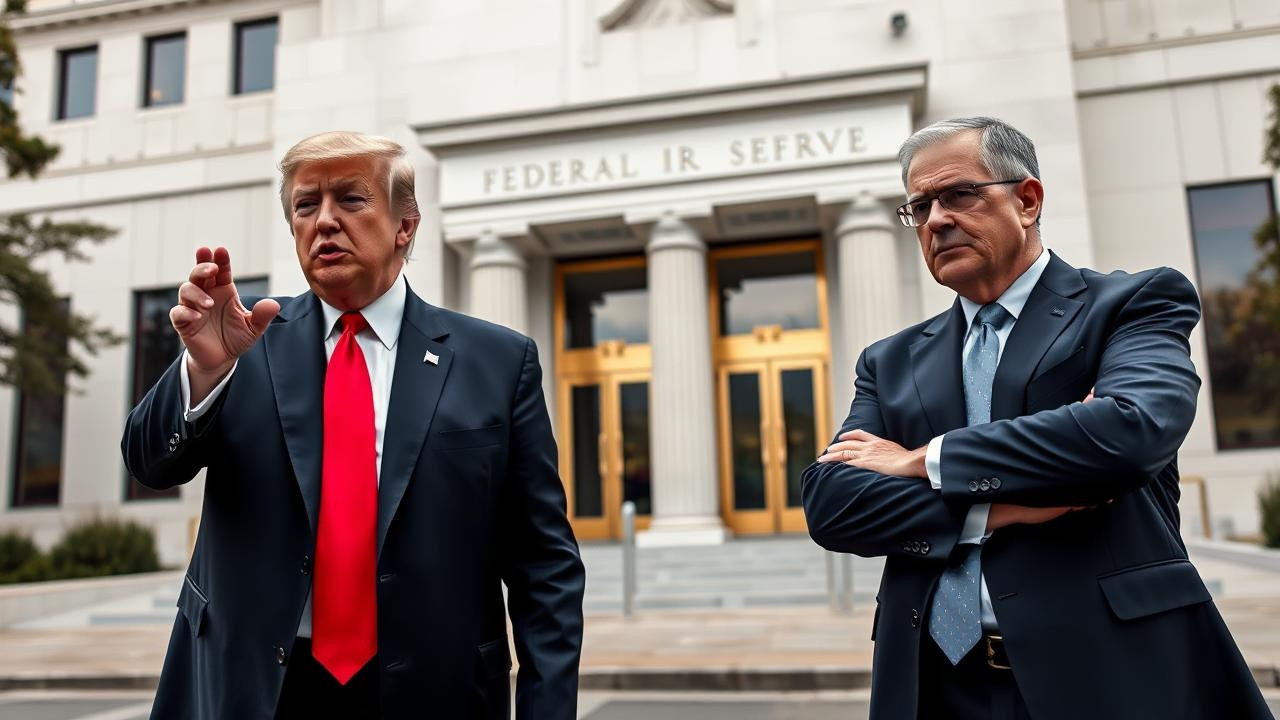

President Trump’s indication of an early Federal Reserve chair nomination, potentially before Jerome Powell’s term concludes in 2026, has stirred market anxieties. Investors fear this move could compromise the Fed’s independence, leading to conflicting monetary policy signals. Experts warn that a politically influenced appointment might destabilize markets, emphasizing the importance of maintaining the Fed’s autonomy.

Powell on the Precipice? Why Trump’s Shadow Looms Large Over the Fed

Okay, let’s be honest, the Federal Reserve isn’t exactly the sexiest topic for a Friday afternoon read. But hear me out. What happens behind those closed doors in the Eccles Building affects everything – from the interest rate on your mortgage to the overall health of the global economy. And right now, a shadow is being cast on the Fed’s future, a shadow in the shape of one Donald J. Trump.

Jerome Powell, the current Fed Chair, is navigating some seriously choppy waters. Inflation, while cooling, is still a stubborn beast. The economy, surprisingly resilient, keeps chugging along, defying predictions of a major recession. And nestled right in the middle of all this is the political game – the one that could decide Powell’s fate come 2026, when his term is up.

The big question swirling around Wall Street (and increasingly, Main Street) is: Will Trump, if he wins the upcoming election, replace Powell? It’s not a given, of course. But the possibility is enough to make markets jittery, and for good reason.

Trump’s relationship with Powell has been… well, let’s just say “complicated.” He initially appointed Powell, but then frequently criticized him for raising interest rates during his presidency. He even publicly mused about firing him – a move that would have been unprecedented and potentially devastating for the Fed’s perceived independence.

That independence is key. The Fed’s ability to make decisions based on economic data, rather than political pressure, is what gives markets confidence. If the Fed is seen as a political tool, that confidence erodes, leading to instability and potentially, a financial crisis. Think of it like a referee in a football game – you want them to call the game fairly, not to favor one team over another.

So, why are markets so wary? It boils down to uncertainty. Trump has, to put it mildly, been unpredictable in the past. He’s publicly stated he wants a Fed Chair who is “lower interest” (translation: someone who will stimulate the economy, perhaps at the expense of fighting inflation). This preference clashes directly with the Fed’s current mandate to keep inflation in check.

This creates a conundrum for investors. If Trump wins and replaces Powell with someone more dovish (meaning someone who favors lower interest rates), inflation could reignite, forcing the Fed to slam on the brakes later, potentially triggering a recession. On the other hand, if Powell remains, there’s the risk that the Fed could overtighten, stifling economic growth unnecessarily.

Furthermore, the fear isn’t just about who gets appointed, but how that person gets appointed. A contentious confirmation process, filled with political drama, would further erode confidence in the Fed.

The consequences of a politicized Fed are significant. We could see:

* Increased Market Volatility: Uncertainty always breeds fear, and fear translates to market swings.

* A Weaker Dollar: If investors lose faith in the Fed’s independence, they might ditch the dollar in favor of other currencies.

* Higher Inflation (or Deflation): Depending on the chosen Chair’s policies, we could see a resurgence of inflation or, conversely, a period of deflation (falling prices), both of which can be harmful to the economy.

* Damage to the Fed’s Credibility: Perhaps the most lasting damage would be to the Fed’s reputation as a credible and independent institution.

Now, let’s be clear: this isn’t necessarily an endorsement of Powell or a condemnation of Trump. It’s simply a reflection of the market’s anxieties about the potential for political interference in monetary policy.

Ultimately, the fate of the Fed, and by extension, a good chunk of the global economy, hinges on the upcoming election. While it’s impossible to predict the future with certainty, one thing is clear: the market is watching closely, and bracing for whatever comes next. So should we all. It’s a story worth following, even if it involves spreadsheets and acronyms. Because at the end of the day, it’s a story about our money, our jobs, and our economic future. And that, my friends, is something we should all care about.