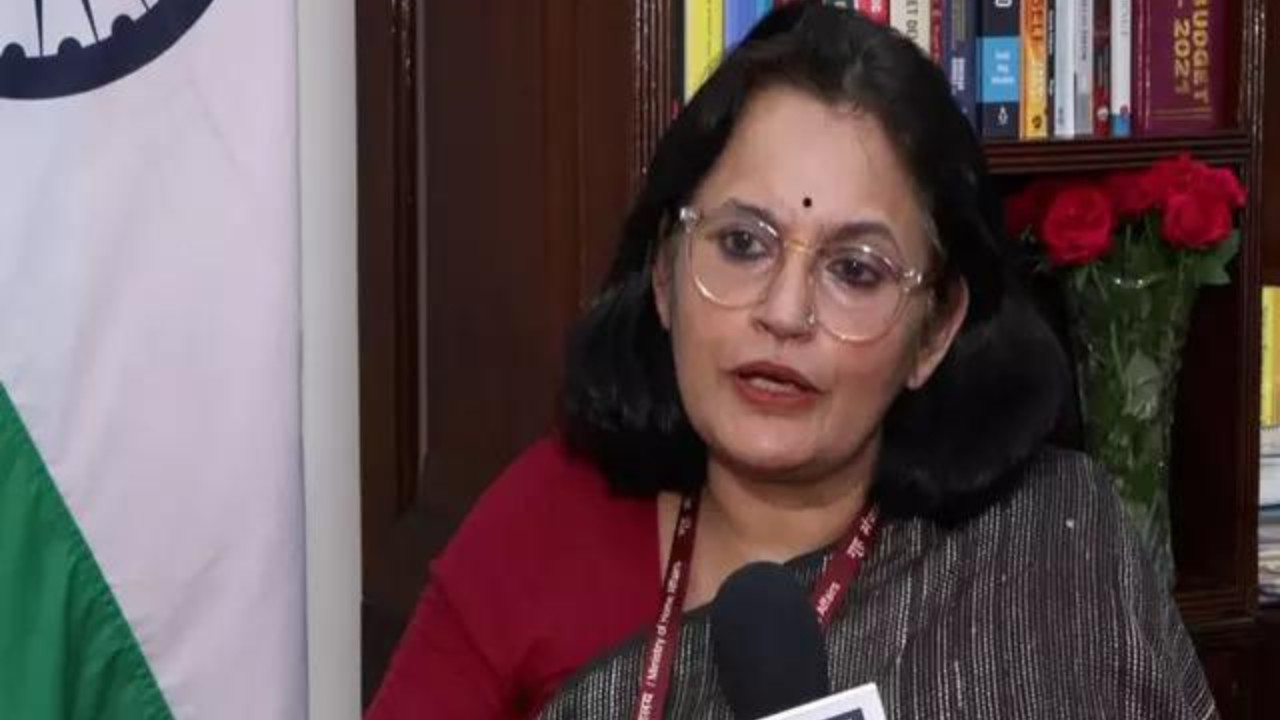

Economic Affairs Secretary Anuradha Thakur affirmed India’s commitment to achieving its fiscal deficit target of 4.4% of GDP by 2025-26, despite recent concerns. She highlighted the economy’s strong fundamentals, noting positive private consumption and robust public and private capital expenditure. India’s impressive 7.

India’s Fiscal Tightrope Walk: Navigating Growth and Deficit Reduction

The air in Delhi is thick with more than just monsoon humidity. It’s charged with anticipation regarding India’s economic trajectory. The nation’s finance mandarins are walking a tightrope, balancing the imperative of sustained high growth with the equally crucial need to rein in the fiscal deficit. And recently, there’s been a wave of cautious optimism emanating from the corridors of power.

The buzz centers around the government’s commitment to achieving a fiscal deficit of 4.4% of GDP by fiscal year 2026. This isn’t just an arbitrary target; it’s a carefully calibrated goalpost designed to signal fiscal responsibility to both domestic and international investors, while still providing the necessary fuel for India’s ambitious growth engine.

The Secretary of the Department of Economic Affairs (DEA) recently articulated a confident stance, pointing to the strong growth momentum as a key enabler for achieving this deficit target. But how realistic is this aspiration? What are the factors underpinning this confidence, and what are the potential pitfalls that could derail the plan?

Riding the Growth Wave Towards Fiscal Consolidation

The core premise is that robust economic expansion will naturally lead to higher tax revenues. Think of it like this: a rising tide lifts all boats. As businesses thrive and incomes rise, the government’s coffers swell with increased tax collections, allowing it to reduce borrowing and, consequently, the fiscal deficit. The DEA Secretary emphasized that this isn’t wishful thinking; it’s a projection rooted in observed trends and anticipated future growth. This positive outlook assumes India maintains its position as one of the fastest-growing major economies in the world.

However, relying solely on growth isn’t a foolproof strategy. Global headwinds, such as geopolitical instability or a sharp slowdown in major trading partners, could dampen India’s economic prospects. Furthermore, unexpected domestic shocks, like an erratic monsoon impacting agricultural output, could also throw a wrench in the works. Managing these uncertainties requires a proactive and adaptable fiscal policy.

Beyond Growth: Prudent Spending and Strategic Investments

While high growth is undoubtedly crucial, the government also needs to exercise fiscal discipline. This means carefully prioritizing spending, eliminating wasteful expenditures, and ensuring that every rupee spent delivers maximum value. The focus is shifting towards strategic investments in infrastructure, education, and healthcare – sectors that not only boost economic growth but also improve the overall well-being of citizens.

Furthermore, the government is actively pursuing measures to improve tax compliance and broaden the tax base. This includes leveraging technology to detect and prevent tax evasion, as well as simplifying tax procedures to encourage more businesses and individuals to comply.

A key component in this strategy is to boost domestic manufacturing through initiatives like “Make in India” and production-linked incentive (PLI) schemes. These initiatives aim to attract foreign investment, create jobs, and reduce India’s reliance on imports, ultimately strengthening the country’s economic resilience. To learn more about how India is attracting global investments, check out our article on India’s changing FDI landscape.

Navigating the Challenges on the Road to Fiscal Deficit Goals

Despite the optimistic outlook, several challenges remain. One major concern is the rising global interest rates, which could increase the cost of borrowing for the government. This, in turn, could put pressure on the fiscal deficit. Additionally, the government needs to carefully manage inflationary pressures, which could erode the purchasing power of consumers and businesses.

Another challenge is to ensure that economic growth is inclusive and benefits all sections of society. Addressing income inequality and creating opportunities for marginalized communities are crucial for sustaining long-term growth and stability. This necessitates targeted social programs and policies that promote education, skill development, and access to finance for all.

Striking the Right Balance: India’s Fiscal Future

Ultimately, achieving the 4.4% fiscal deficit target by FY26 will require a delicate balancing act. The government needs to maintain a pro-growth stance while simultaneously exercising fiscal prudence. This means carefully managing spending, boosting tax revenues, and addressing the underlying structural challenges that could hinder India’s economic progress. The path ahead may not be easy, but with a clear vision, sound policies, and a bit of luck, India can successfully navigate the fiscal tightrope and emerge stronger and more prosperous.