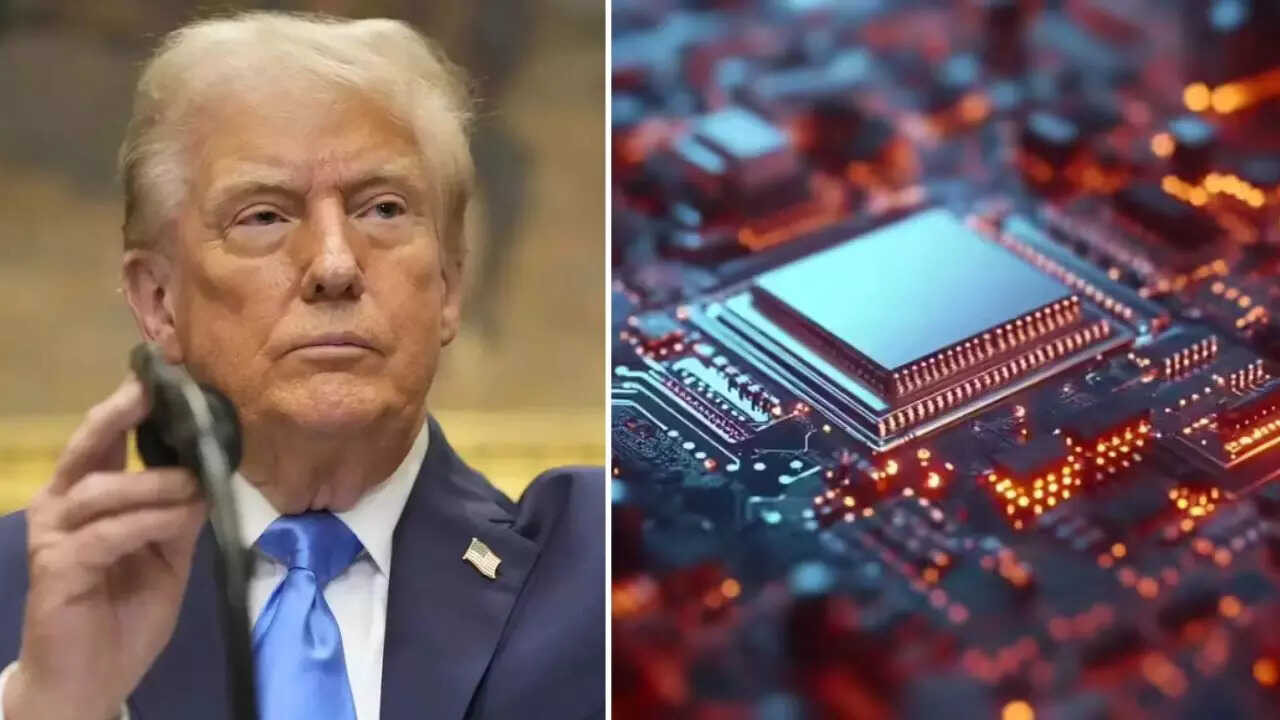

The Trump administration is reportedly planning new tariffs on imported electronics, based on their chip content, to boost US manufacturing. This move could impose a 25% rate on chip value, potentially raising costs for American consumers and worsening inflation. Major chipmakers like TSMC and Samsung might face significant impact, as the policy aims to reshore critical production.

Chips Ahoy! Will New Tariffs Shake Up the Electronics World?

The digital world hums thanks to tiny marvels – semiconductors, or chips as they’re commonly known. They’re the brains behind our smartphones, cars, washing machines, and practically everything else that plugs in or runs on a battery. These unassuming components are so vital that whispers of potential tariffs are sending ripples of anxiety through the global electronics industry.

Imagine a world where the cost of your next phone or laptop suddenly jumped. That’s the potential fallout from reports suggesting the U.S. government is contemplating tariffs specifically targeting imported electronics containing foreign-made chips. This isn’t just about making things a little more expensive; it’s about a potential reshaping of the global supply chain, all in the name of national economic security.

Why all the fuss about semiconductors?

Semiconductors are the foundation of the modern economy. Control over their design and manufacture translates to significant economic and strategic power. The current global chip market is complex, with different countries specializing in different aspects of the process. Some excel at design, others at manufacturing, and still others at supplying raw materials. This intricate web of interdependence has, for decades, kept costs down and innovation high.

However, geopolitical tensions and concerns over supply chain vulnerabilities, particularly in light of recent global events, have prompted a re-evaluation. The idea behind these potential tariffs isn’t necessarily about punishing foreign manufacturers. It’s more about incentivizing domestic chip production and reducing reliance on overseas sources, particularly those perceived as potential adversaries. The core argument is this: a nation that controls its chip supply controls its own technological destiny.

A Tariff on Electronics? The Potential Impact

So, what could be the real-world consequences of such a move? The immediate impact would likely be felt by consumers. Higher tariffs on imported electronics would almost certainly translate into higher prices at the checkout. But the effects wouldn’t stop there.

Manufacturers who rely on foreign-made chips for their products could face significant challenges. They might have to absorb the additional costs, pass them on to consumers, or seek alternative, potentially more expensive, sources of chips. This could lead to decreased competitiveness and, potentially, job losses in industries that depend heavily on imported electronics.

The move could also trigger retaliatory measures from other countries, leading to a full-blown trade war. This would create even more uncertainty and disruption in the global economy, with no clear winners. The potential trade barriers on foreign electronics are a contentious topic.

The Road to U.S. Semiconductor Independence

The desire to bolster domestic chip production isn’t new. The U.S. government has already been investing heavily in initiatives aimed at incentivizing companies to build chip fabrication plants (fabs) on American soil. The hope is that by increasing domestic production capacity, the country can reduce its reliance on foreign sources and ensure a more secure supply of these vital components.

However, building a robust domestic semiconductor industry is a long and complex undertaking. It requires significant investment, a skilled workforce, and a supportive regulatory environment. Tariffs, while potentially providing a short-term boost to domestic manufacturers, might not be the most effective long-term solution.

Navigating a Chip-Driven Future

The debate over chip tariffs highlights the growing importance of semiconductors in the global economy. It’s a complex issue with no easy answers. While the desire to strengthen national economic security is understandable, the potential consequences of tariffs must be carefully considered.

A more balanced approach might involve a combination of strategies, including continued investment in domestic production, collaboration with trusted international partners, and efforts to diversify the global chip supply chain. Finding a solution that promotes both economic security and global stability will be crucial in navigating the chip-driven future. See also: [The Rise of AI and the Future of Work](internal-link). The world watches with bated breath.