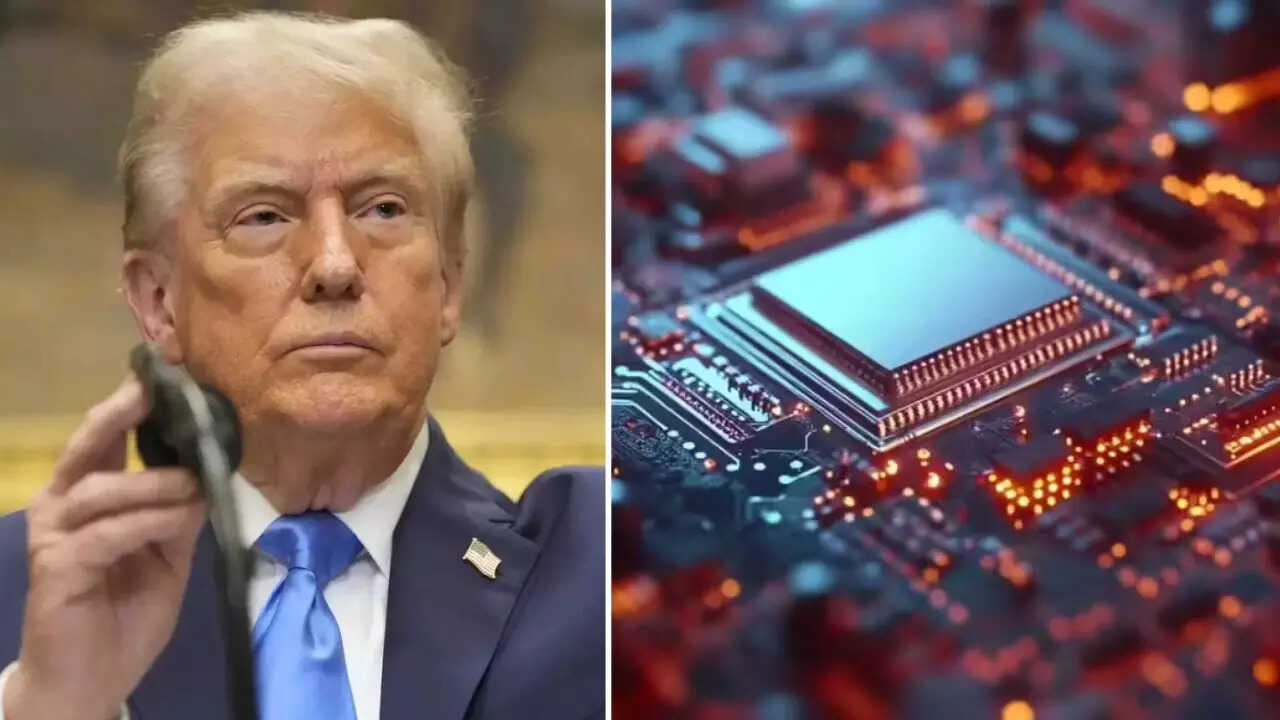

The Trump administration is reportedly planning new tariffs on imported electronics, based on their chip content, to boost US manufacturing. This move could impose a 25% rate on chip value, potentially raising costs for American consumers and worsening inflation. Major chipmakers like TSMC and Samsung might face significant impact, as the policy aims to reshore critical production.

Could Chip Tariffs Be the Next Big Shake-Up for Electronics?

The world of electronics manufacturing could be on the verge of a seismic shift, and its potential impact on consumers and the tech industry is generating considerable buzz. Word on the street – or rather, in Washington – is that the U.S. government is considering slapping tariffs on imported electronics containing foreign-made semiconductor chips. This isn’t just a tweak to existing trade policy; it’s a potentially significant intervention aimed squarely at bolstering national economic security. But what exactly does this entail, and how might it ripple through our digital lives?

The driving force behind this potential move is a desire to reduce reliance on foreign chip manufacturers, particularly those in regions perceived as strategic rivals. Think about it: from your smartphone to your car, from your refrigerator to the servers powering the internet, semiconductor chips are the unsung heroes powering just about everything. A disruption in their supply, be it due to geopolitical tensions or unforeseen disasters, could cripple key sectors of the economy. The logic behind chip tariffs is to incentivize domestic production and encourage companies to diversify their supply chains, reducing vulnerability to external shocks.

But is this a good idea? Well, the ramifications are complex and multifaceted.

The Ripple Effect of Semiconductor Chip Tariffs

The most immediate and obvious consequence would likely be an increase in the cost of electronics. Tariffs are essentially taxes on imports, and businesses rarely absorb these costs entirely. Instead, they are typically passed on to consumers. Prepare for the possibility of pricier smartphones, laptops, and even appliances. The magnitude of the price hikes would depend on the specific tariff rates imposed and the extent to which companies can find alternative, tariff-free sources for their chips.

Beyond the price tag, a focus on domestic chip production could spur innovation within the U.S. Investing in domestic semiconductor manufacturing facilities would create jobs, foster technological advancements, and strengthen the country’s competitive edge in a crucial sector. However, this transition wouldn’t happen overnight. Building new fabs (semiconductor fabrication plants) is a time-consuming and capital-intensive process, requiring significant government support and private investment.

Unintended Consequences: A Global Perspective

While the intention behind chip tariffs might be to bolster national security, it’s crucial to consider the potential for unintended consequences on the global stage. Trade wars are rarely one-sided affairs. Other countries could retaliate with their own tariffs on U.S. goods, leading to a downward spiral of protectionism. This could disrupt global supply chains, hurt businesses, and ultimately stifle economic growth.

Another concern is the potential impact on competition. A tariff-driven shift toward domestic chip production could inadvertently create monopolies or oligopolies, stifling innovation and leading to higher prices in the long run. A healthy and competitive market is crucial for driving efficiency and ensuring that consumers benefit from the latest technological advancements.

Alternatives to Tariffs: A More Collaborative Approach?

Are there alternative solutions to address concerns about semiconductor chip security? Many argue that a more collaborative approach, involving partnerships with trusted allies and strategic investments in research and development, could be more effective than tariffs.

For example, the U.S. could work with countries like South Korea, Japan, and Taiwan to diversify its chip supply chain and reduce its reliance on any single source. Investing in workforce development programs to train the next generation of semiconductor engineers and technicians would also be crucial for ensuring long-term competitiveness.

Furthermore, incentivizing domestic chip production through tax breaks, subsidies, and streamlined regulations could be a more effective way to attract investment and foster innovation without resorting to protectionist measures. A carrot, in this case, might prove more effective than a stick.

The prospect of tariffs on electronics containing foreign-made semiconductor chips raises fundamental questions about trade policy, national security, and the future of the tech industry. While the goal of reducing reliance on foreign sources is understandable, the potential downsides of tariffs – higher prices, retaliatory measures, and stifled innovation – warrant careful consideration. As policymakers grapple with this complex issue, it’s essential to weigh the potential benefits against the risks and explore alternative solutions that promote both national security and global economic prosperity. Perhaps policies like the CHIPS Act, aimed at incentivizing domestic production, offer a more sustainable and less disruptive path forward. More on that can be found here: [Internal Link to CHIPS Act Coverage]. The stakes are high, and the decisions made in the coming months will have a profound impact on the future of the electronics industry and the global economy.