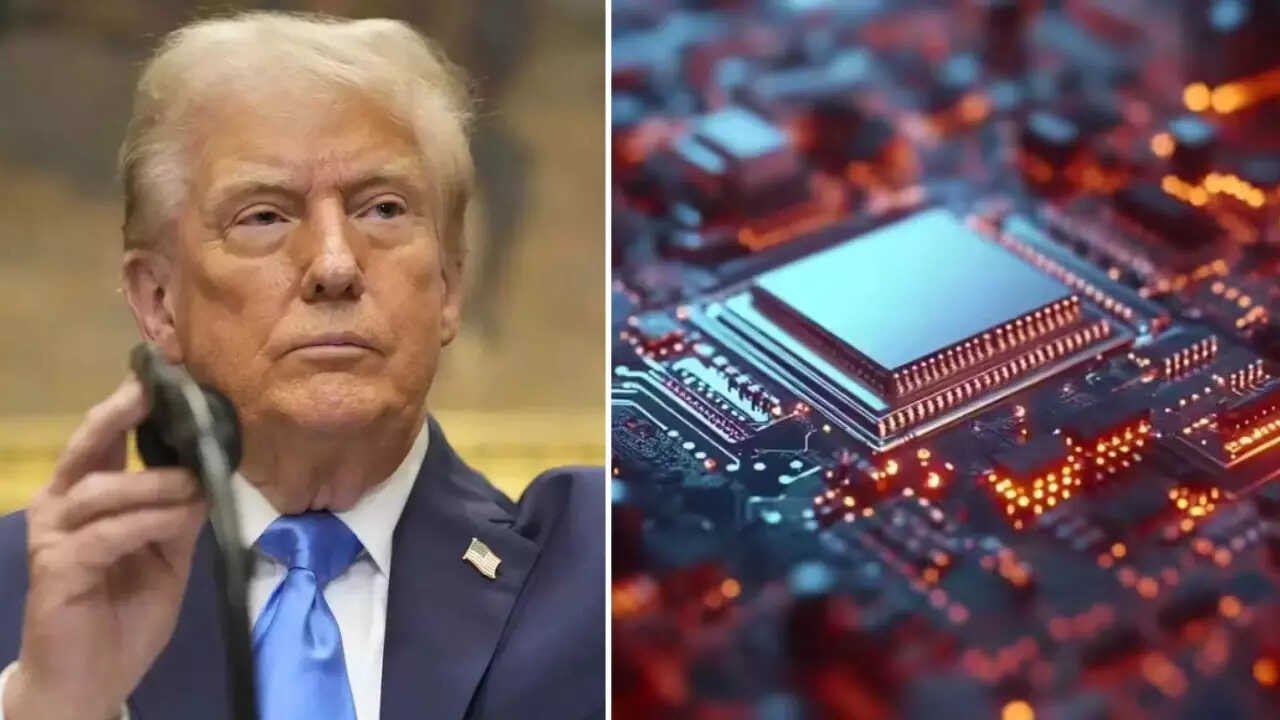

The Trump administration is reportedly planning new tariffs on imported electronics, based on their chip content, to boost US manufacturing. This move could impose a 25% rate on chip value, potentially raising costs for American consumers and worsening inflation. Major chipmakers like TSMC and Samsung might face significant impact, as the policy aims to reshore critical production.

Chip Tariffs: A Bold Move for National Economic Security?

The winds of change are blowing through the global electronics industry, and they might just bring with them a surge of tariffs. News is circulating that the former Trump administration considered a rather audacious plan: slapping tariffs on imported electronic devices containing foreign-made semiconductors. The rationale? Bolstering national economic security. But what does this really mean, and what implications could it have for businesses and consumers alike?

The motivation behind these potential chip tariffs is pretty straightforward, at least on the surface. The idea is to incentivize companies to bring semiconductor manufacturing back to the United States, or at least closer to home. Dependence on foreign sources, particularly in regions with geopolitical instability, is seen as a vulnerability. Imagine a scenario where access to critical chips is cut off due to international conflict or trade disputes. That’s a risk no major economy wants to run.

This isn’t just about national pride or bringing jobs back to America, although those are certainly factors. It’s about ensuring a reliable supply chain for essential technologies. From smartphones and laptops to cars and medical devices, semiconductors are the brains of countless products we rely on every day. Controlling the production of these chips gives a nation significant leverage.

The idea was to create a kind of financial incentive for companies to “reshore” or “nearshore” their manufacturing operations. By making imported electronics more expensive, domestic production becomes comparatively more attractive. Think of it like this: If a foreign-made phone suddenly costs $200 more due to tariffs, a phone made in the US, even if slightly more expensive initially, starts looking like a pretty good deal.

But tariffs are rarely simple, and the potential consequences are far-reaching.

For starters, tariffs are almost always passed on, at least in part, to consumers. That means higher prices for everything from laptops to washing machines. It also could stifle innovation if companies have less money to invest in R&D due to increased import costs.

Another challenge lies in the intricate global supply chains that define the electronics industry. Components often crisscross borders multiple times before a final product is assembled. Implementing chip tariffs would require meticulous tracking and enforcement to determine the origin of every single semiconductor. This adds complexity and administrative burden for businesses.

Furthermore, tariffs invite retaliation. If the US imposes tariffs on foreign-made chips, other countries could respond with tariffs of their own, targeting American exports. This could spark a trade war, with potentially damaging consequences for the global economy.

While the Trump administration may have laid the groundwork, the Biden administration has also expressed interest in strengthening domestic semiconductor manufacturing. The CHIPS Act, signed into law in 2022, provides billions of dollars in subsidies and tax credits to encourage companies to build chip factories in the United States. The long-term effects of this act, combined with potential tariff policies, could reshape the global semiconductor landscape.

The path forward is uncertain, but one thing is clear: the future of semiconductor manufacturing is a strategic imperative. The push to secure domestic supply chains is gaining momentum, and we can expect to see continued efforts to incentivize companies to invest in US-based production. Whether tariffs ultimately become a key tool in this strategy remains to be seen, but the debate surrounding their potential impact is far from over.

Learn more about the impact of global trade on domestic markets on our [dedicated trade and economics page](internal_link_url_here).

Ultimately, any policy regarding chip tariffs must strike a careful balance between protecting national interests and fostering a healthy, competitive global market. The coming years will be crucial in determining how this balance is achieved, and the implications for businesses and consumers worldwide will be significant.