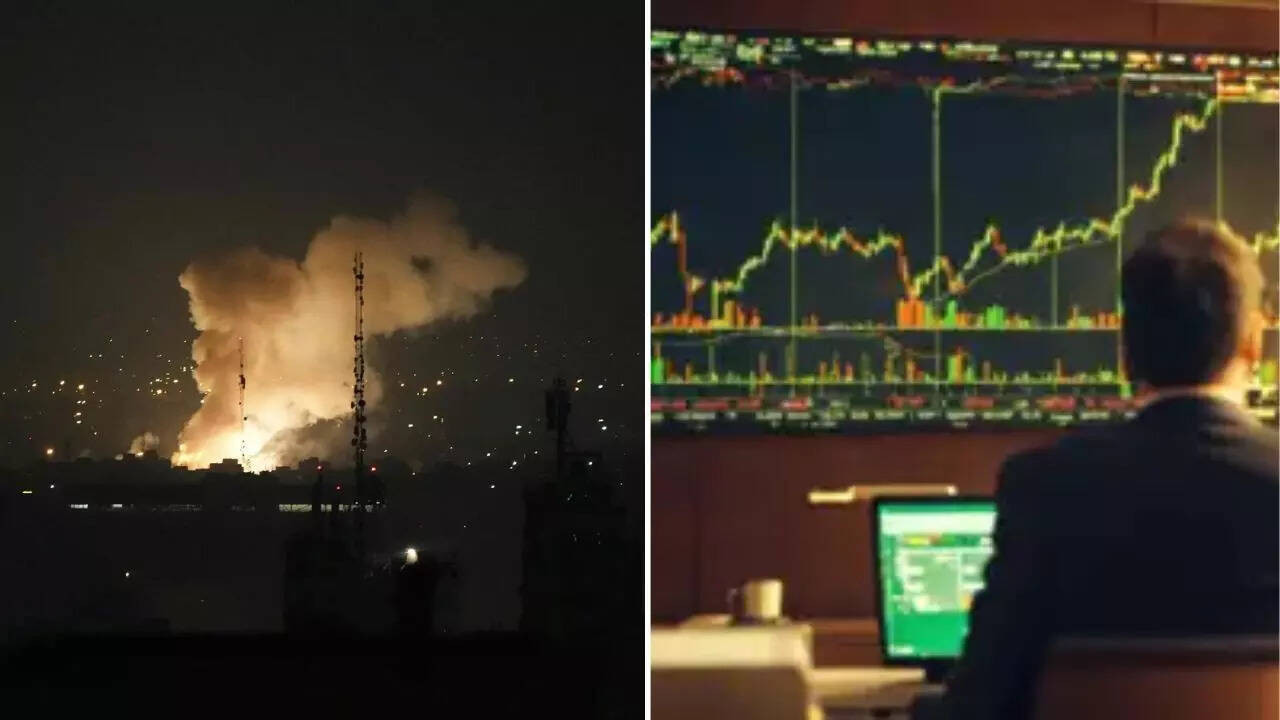

Asian markets plunged following Israel’s military strike on Iran, escalating Middle East tensions. Oil prices surged over 6%, reaching $73.56 a barrel, while gold saw a 1% increase as investors sought safe-haven assets. Japan’s Nikkei and South Korea’s KOSPI experienced declines.

The Earth Just Wobbled: What Israel-Iran Tensions Mean for Your Wallet (and Maybe Your Sanity)

Okay, deep breaths everyone. News cycles can feel like whiplash, can’t they? One minute we’re talking about inflation, the next, headlines are screaming about geopolitical escalations. And right now, those two threads have just become inextricably tangled, thanks to the reported Israeli strike on Iran.

Let’s cut through the noise and get to the heart of what this means for you, beyond the anxiety-inducing news alerts. Because honestly, it’s not just some abstract international affair anymore; it’s potentially impacting everything from the price of gas you pump to the performance of your retirement savings.

Asian markets took a major hit on Friday. Think of it like a collective gulp from investors, a visible wave of uncertainty crashing across trading floors. Shares tumbled, reflecting the immediate reaction to the news – a sharp intake of breath followed by a scramble for safety. We saw investors yanking their money out of riskier assets (like stocks, especially in emerging markets) and pouring it into the perceived “safe havens” – gold, the dollar, even government bonds. It’s the financial equivalent of battening down the hatches.

And gold, oh boy, did gold shine. The precious metal soared, doing exactly what it’s supposed to do in times of crisis: act as a store of value when everything else feels shaky. Think of it as the ultimate security blanket for investors with jittery nerves.

But the real kicker is oil. The price of crude surged. Now, why is this significant beyond just the immediate pinch at the pump? Well, Iran is a major oil producer. Any disruption to the supply chain, real or perceived, sends shivers through the global energy market. Suddenly, the price of everything that relies on oil – from transportation to manufacturing – gets a potential upward nudge. This fuels inflation, making everyday goods and services more expensive. It’s a vicious cycle.

So, why the rush to safe havens? In times of geopolitical uncertainty, people tend to get risk-averse. They want to protect their capital, not gamble with it. The logic is simple: better to lose a little potential upside than risk a major loss in a volatile market. It’s a primal instinct, really – the financial equivalent of seeking shelter from a storm.

This isn’t some isolated event happening “over there.” We live in a hyper-connected global economy. A conflict in the Middle East ripples across continents, impacting trade, investment, and ultimately, the cost of living. This is especially true considering the already fragile state of the global economy after years of pandemic-induced disruptions and persistent inflation. We were already walking on eggshells; now someone just dropped a bowling ball.

The big question now is, what happens next? Will this remain a contained event, or will it escalate? This is where things get tricky, because nobody has a crystal ball. A lot hinges on the reactions of key players – not just Iran and Israel, but also the US, China, and the European Union. Will they push for de-escalation, or will we see a further ratcheting up of tensions?

The coming days will be crucial. Pay attention to the diplomatic efforts, or lack thereof. Watch the oil markets closely. Any further disruption to supply will likely translate into higher prices at the pump and beyond. Keep an eye on those safe haven assets like gold; their performance will offer clues to the overall level of market anxiety.

More importantly, try to avoid knee-jerk reactions with your investments. Panic selling is rarely a smart strategy. Instead, take a deep breath, review your portfolio, and make sure it aligns with your long-term goals and risk tolerance. This might be a good time to consult with a financial advisor to get a professional perspective.

Ultimately, what we’re seeing is a stark reminder of the interconnectedness of our world and the fragility of global stability. These events aren’t just headlines; they are shaping our economic future, and it’s crucial to stay informed and make informed decisions, not emotional ones. The road ahead might be bumpy, but with a little understanding and a level head, we can navigate these uncertain times.

📬 Stay informed — follow us for more insightful updates!