Hardeep Puri, India’s Petroleum Minister, asserts that India’s continued Russian oil imports have stabilized global energy prices. Discontinuing this trade would have caused prices to surge past $120 per barrel. Despite Western restrictions, India increased Russian oil procurement, preventing a significant global supply disruption, he has said.

How India’s Russian Oil Pivot Dodged a Global Price Bullet

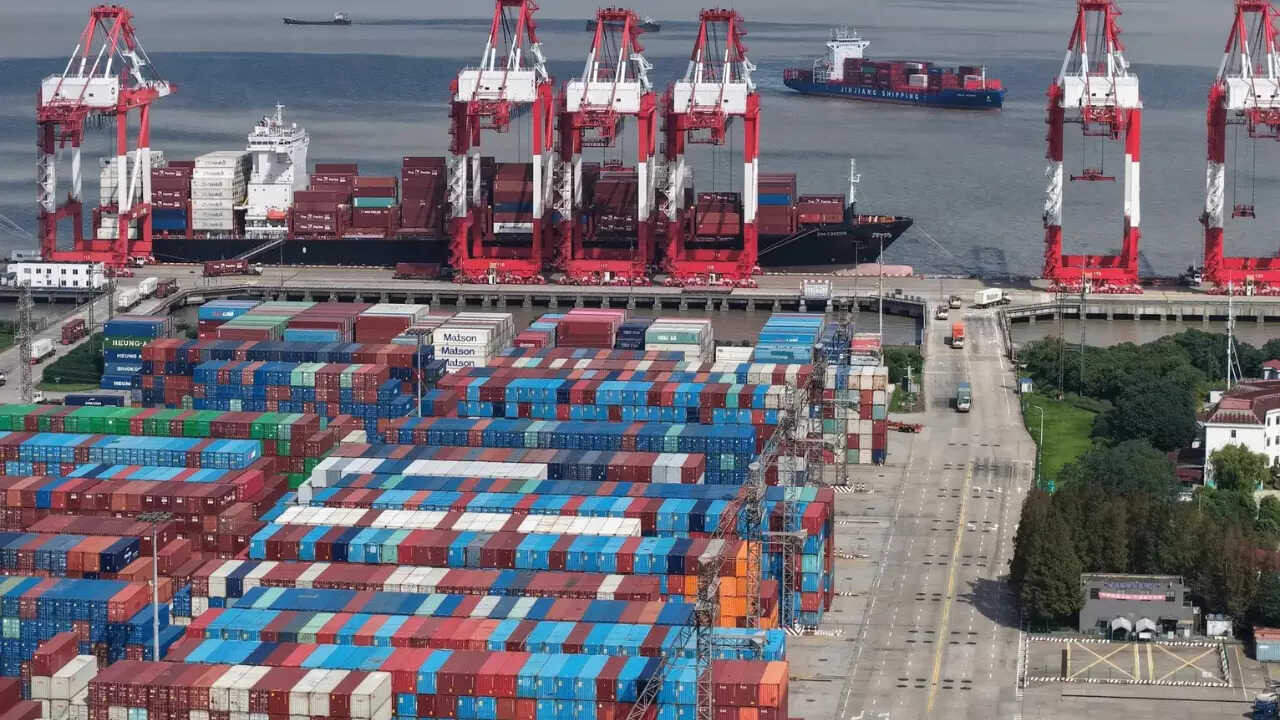

The global energy market has been a rollercoaster in recent years, a dizzying mix of geopolitical tensions, fluctuating demand, and supply chain disruptions. Against this backdrop, India’s decision to significantly increase its oil imports from Russia has been met with scrutiny. But was it a purely self-serving move, or did it play a crucial role in stabilizing the global oil market? A recent statement from India’s Minister of Petroleum and Natural Gas, Hardeep Singh Puri, suggests the latter.

Puri argues that without India’s increased intake of Russian oil, international oil prices could have surged to a staggering $120-$130 per barrel. That’s a price point that would have sent shockwaves through economies worldwide, exacerbating inflationary pressures and potentially triggering recessions. His point is simple: India’s actions, while benefiting its own economy, inadvertently helped prevent a much larger global crisis.

<img src="image-url-here.jpg" alt="An oil tanker against a sunset, symbolizing India's strategic oil imports.” />

This isn’t about taking sides in a geopolitical game; it’s about understanding the intricate dance of supply and demand in the oil market. When traditional suppliers face constraints or disruptions, alternative sources become essential to maintain equilibrium. Russia, despite facing sanctions and international pressure, remained a significant oil producer. India, by tapping into this supply, filled a void that otherwise would have sent prices soaring.

The narrative often paints India as simply chasing the cheapest available oil. While cost is undoubtedly a factor, the sheer scale of India’s energy needs demands a pragmatic approach. The country is a rapidly growing economy with a burgeoning population, and access to affordable energy is vital for its continued development. To suggest that India should have ignored readily available oil while prices elsewhere climbed is to ignore the realities of its energy security concerns. You can read about more on this in our article on [India’s energy independence strategies](internal-link-url-here).

India’s Stance on Russian Oil: More Than Just Savings

Furthermore, Puri highlighted the hypocrisy in some of the criticism leveled against India. He pointed out that many European nations continued to import Russian gas, which is arguably more difficult to replace quickly than oil. The focus on India’s oil imports, while overlooking the continued flow of Russian gas to Europe, suggests a double standard at play.

The minister’s comments aren’t just defensive; they’re a call for a more nuanced understanding of the situation. Global energy markets are complex, and solutions require pragmatism, not just ideological purity. Countries need to balance their geopolitical considerations with the practical realities of meeting their citizens’ energy needs.

The Global Impact of Affordable Energy

The ripple effects of high oil prices are far-reaching. Increased transportation costs drive up the price of goods, impacting consumers directly. Businesses face higher operating expenses, which can lead to job losses and reduced investment. For developing nations, the consequences can be even more severe, potentially hindering economic growth and exacerbating poverty.

India’s oil strategy, therefore, has implications that extend far beyond its own borders. By helping to keep oil prices in check, it contributed to a more stable global economy, benefiting countries around the world. This isn’t to say that India’s actions were entirely altruistic, but it highlights the interconnectedness of the global energy market and the unintended consequences of individual decisions.

Looking Ahead: Diversification and Resilience

The situation also underscores the need for greater diversification in the global energy supply. Reliance on a limited number of suppliers leaves the market vulnerable to price shocks and geopolitical instability. Investing in renewable energy sources, promoting energy efficiency, and diversifying supply chains are all crucial steps towards building a more resilient and sustainable energy future.

In conclusion, India’s increased oil imports from Russia present a complex picture. While driven by its own economic needs, the move appears to have played a significant role in preventing a sharp spike in global oil prices. This demonstrates the delicate balance in the energy market and the need for pragmatic solutions that consider both national interests and the stability of the global economy. As the world transitions to a cleaner energy future, diversification and resilience will be paramount in navigating the challenges ahead.