Rapido Revs Up: Is It Really Leaving Ola in the Dust?

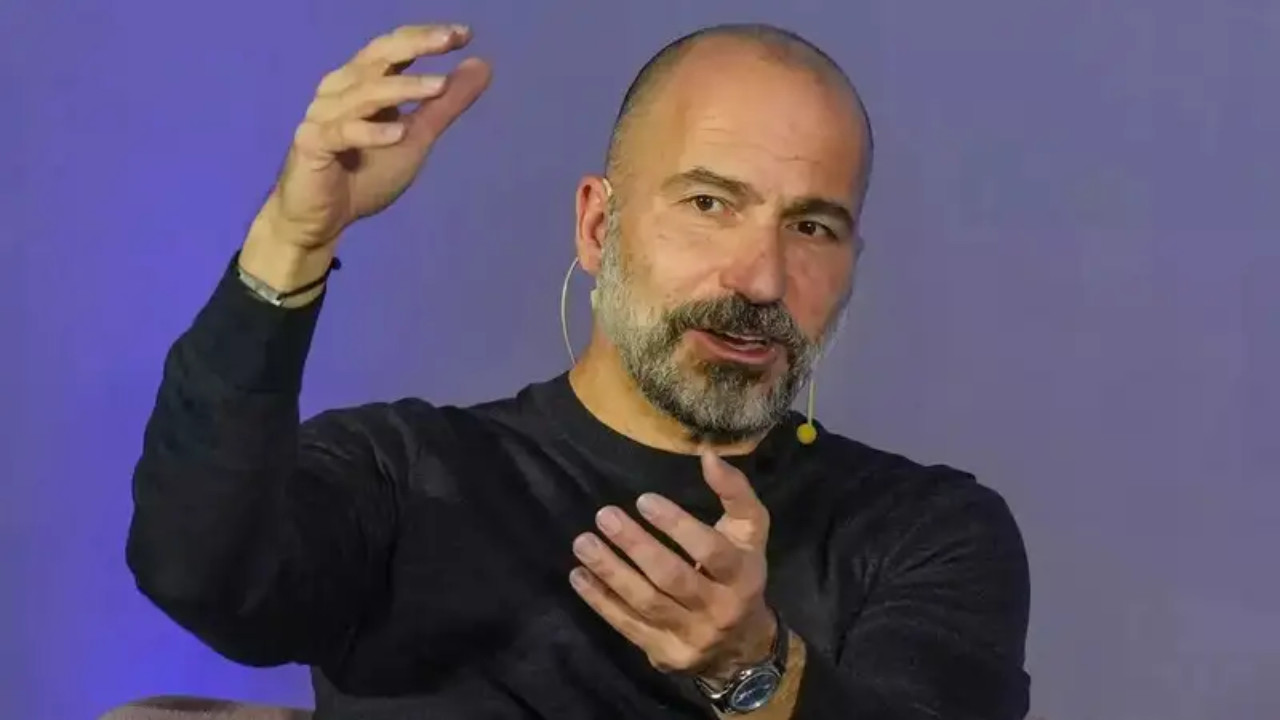

The ride-hailing scene in India just got a whole lot more interesting. Uber’s CEO, Dara Khosrowshahi, recently dropped a bombshell, naming bike-taxi startup Rapido as their primary competitor in the Indian market, effectively sidelining the long-reigning local champion, Ola. It’s a bold statement, and one that has the entire industry buzzing. But is this a genuine shift in power, or is there more to the story than meets the eye?

For years, Ola has been the undisputed king of Indian ride-hailing, battling Uber for market dominance in a landscape defined by intense competition and razor-thin margins. While Uber has focused on a broader global strategy, Ola has doubled down on the Indian market, tailoring its services to local needs and building a recognizable brand. So, how did Rapido, a relatively newer player focusing primarily on two-wheeled transportation, manage to disrupt this established duopoly?

The Rise of the Bike-Taxi: A Game Changer

Rapido’s success story is deeply rooted in understanding the unique challenges of Indian urban mobility. Congestion is rampant, parking is a nightmare, and affordability is a key consideration for most commuters. Bike-taxis offer a compelling solution to these problems. They can weave through traffic with ease, navigate narrow streets, and provide a significantly cheaper alternative to traditional cabs.  This value proposition has resonated strongly with consumers, particularly in smaller cities and towns where Rapido has rapidly expanded its footprint.

This value proposition has resonated strongly with consumers, particularly in smaller cities and towns where Rapido has rapidly expanded its footprint.

The company’s focus on affordability and accessibility has allowed it to capture a significant share of the short-distance commute market. Where Ola and Uber primarily cater to longer trips and higher-paying customers, Rapido has carved out a niche by addressing the everyday transportation needs of a vast segment of the population. This laser focus has allowed them to build a strong brand loyalty among its core users.

Why Uber is Watching Rapido Closely

Khosrowshahi’s acknowledgement of Rapido as a key competitor signals a potential shift in Uber’s strategy in India. It suggests that Uber recognizes the growing importance of the two-wheeler segment and is looking to compete more aggressively in this space.

Several factors could be driving this change. First, the bike-taxi market is experiencing rapid growth, fueled by increasing urbanization and the demand for affordable transportation options. Second, Rapido’s success demonstrates the potential to build a profitable business model catering specifically to this market. Finally, Uber may be looking to diversify its offerings and reduce its reliance on traditional cab services, which are facing increasing competition from local players like Ola.

This shift also reflects the evolving dynamics of the Indian market itself. While Ola and Uber have been locked in a head-to-head battle for market share, Rapido has quietly built a strong presence in the background, focusing on a different segment and offering a unique value proposition. It also reveals Uber’s long term vision of competing on multiple levels and adapting to the nuances of the specific market.

Is This the End for Ola?

While Khosrowshahi’s comments may seem like a slight to Ola, it’s important to remember that Ola still holds a significant share of the overall ride-hailing market in India. They’ve also diversified their offerings, expanding into electric vehicles and financial services. However, the rise of Rapido serves as a wake-up call, highlighting the need for Ola to adapt to the changing needs of Indian commuters.

Ola’s recent struggles, including reports of financial difficulties and employee layoffs, might make Rapido a more viable threat. However, Ola’s brand recognition and established infrastructure cannot be dismissed. The real challenge for Ola is to innovate and find new ways to compete in a market that is becoming increasingly fragmented.

The Road Ahead for Ride-Hailing in India

The Indian ride-hailing market is dynamic and fiercely competitive. The emergence of Rapido as a significant player has disrupted the established order and forced Uber and Ola to re-evaluate their strategies. This competition is ultimately good for consumers, who now have a wider range of transportation options at their fingertips. As companies continue to innovate and adapt to the evolving needs of the market, we can expect to see even more exciting developments in the years to come. For example, the increasing adoption of electric vehicles and the integration of new technologies like AI are likely to play a significant role in shaping the future of ride-hailing in India. Want to learn more about the Indian transportation sector? Check out this article discussing the future of electric vehicles in India.

Ultimately, the future of ride-hailing in India hinges on a few key factors: the ability to offer affordable and convenient transportation options, the capacity to adapt to changing consumer preferences, and the agility to navigate the complex regulatory landscape. While Uber is watching Rapido, Ola cannot afford to be complacent. The race is on, and only time will tell which company will emerge as the true winner.