The Reserve Bank of India lowered its FY26 inflation forecast to 2.6% while raising India’s GDP growth to 6.8%, driven by a good monsoon and GST rationalisation. The central bank maintained the policy repo rate at 5.5% for the second consecutive review, balancing easing inflation with global tariff uncertainties that could impact future growth.

India’s Economic Pulse: RBI Holds Steady, Signals Cautious Optimism

The Reserve Bank of India (RBI) recently unveiled its latest monetary policy decisions, and the message is one of carefully balanced optimism. Bucking the trend of aggressive rate hikes seen globally, the RBI has chosen to maintain the repo rate at a steady 6.5%. This decision, while expected by many, speaks volumes about the central bank’s assessment of the Indian economy’s current trajectory. But what does this hold mean for you and your wallet? Let’s dive into the details.

Repo Rate Unchanged: A Vote of Confidence (for Now)

The decision to keep the repo rate unchanged is, in essence, a bet that the current level is sufficient to manage inflation while still supporting economic growth. For borrowers, this provides a sense of stability. Your existing loans, tied to benchmark rates, are unlikely to become significantly more expensive in the immediate future. For prospective borrowers, the story is similar: you’re not facing a rapidly escalating interest rate environment.

Inflation Projections: Keeping a Close Watch

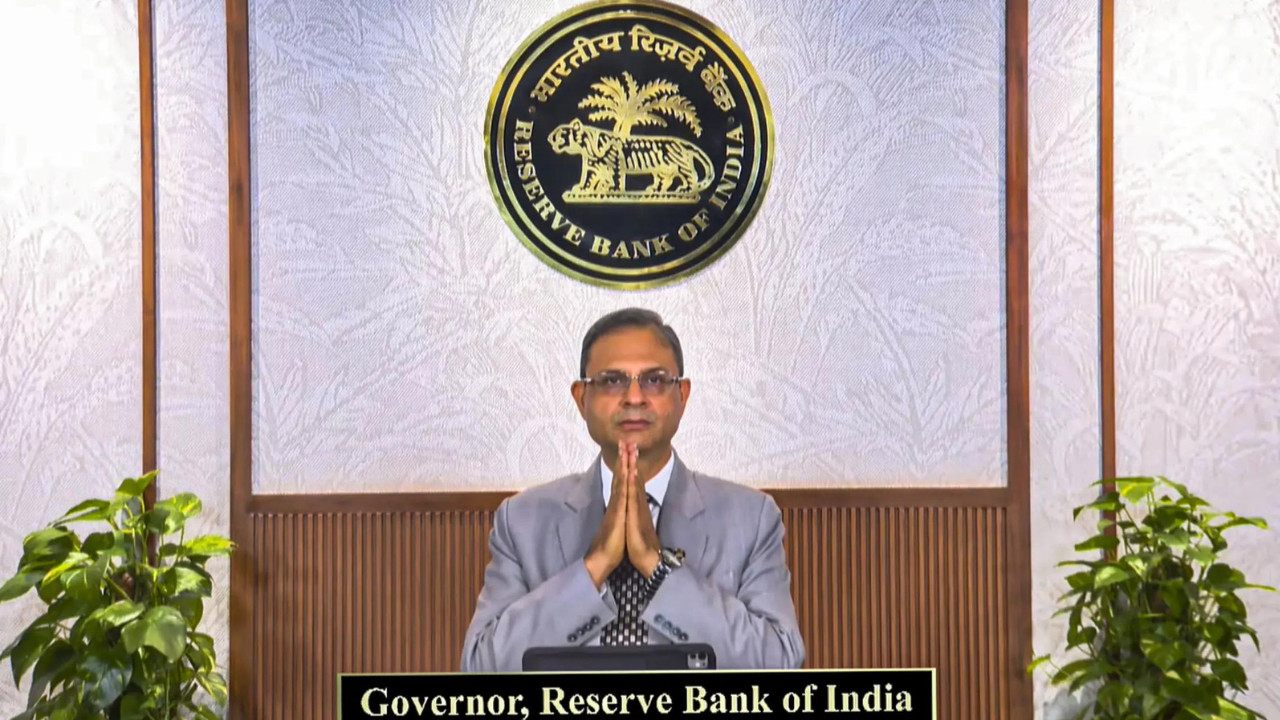

The RBI projects inflation at 2.6% for fiscal year 2026, signaling their commitment to bring inflation within the target range. Achieving this goal is paramount for sustainable economic growth. This projection implies that the central bank believes its current policy stance is adequate to gradually bring inflation under control without choking off economic activity. Any significant deviation from this projected path could prompt a policy response, including potential rate adjustments. The image below showcases the RBI’s commitment to controlling inflation and maintaining economic stability.

GDP Growth Revised Upward: A Silver Lining

In a welcome boost, the RBI has revised its GDP growth projection upward to 6.8% for the current fiscal year. This upward revision reflects growing confidence in the Indian economy’s resilience and its ability to withstand global shocks. Several factors contribute to this optimism. Increased government spending on infrastructure, a recovery in rural demand, and a pick-up in private investment are all playing a role in driving economic expansion.

A strong GDP growth figure is good news for everyone. It translates into more job opportunities, higher incomes, and a greater sense of economic well-being. Businesses are more likely to invest and expand when they see a favorable economic outlook, creating a virtuous cycle of growth and prosperity. The upward revision suggests that India is on a relatively strong growth trajectory compared to many other major economies.

The Global Context: Navigating Uncertain Waters

The RBI’s policy decisions are not made in a vacuum. The central bank must constantly assess the impact of global economic developments on the Indian economy. Geopolitical tensions, volatile commodity prices, and the monetary policy actions of other major central banks all have the potential to influence India’s growth and inflation outlook. For example, continued increases in interest rates by the US Federal Reserve could put pressure on the rupee and lead to imported inflation. The RBI’s monetary policy will likely adjust in response to these external pressures.

What it Means for You: A Measured Approach

So, what does all this mean for the average person? The RBI’s stance suggests a period of relative stability in interest rates. While significant rate cuts are unlikely in the near future, borrowers can breathe a sigh of relief knowing that their loan EMIs are unlikely to rise sharply. Savers, on the other hand, may not see a substantial increase in deposit rates.

However, it’s important to remain vigilant. The economic landscape is constantly evolving, and unexpected events could always disrupt the RBI’s plans. Keep a close watch on inflation data, global economic trends, and the RBI’s future policy announcements.

Ultimately, the RBI’s monetary policy is a balancing act. It aims to control inflation, promote economic growth, and maintain financial stability. For more information about financial stability, read more here about [the importance of diversification in your investment portfolio](internal-link-to-diversification). The latest decisions reflect a cautious optimism about the Indian economy’s prospects, but the central bank remains prepared to act decisively if necessary. By keeping a close eye on key economic indicators, you can make informed financial decisions and navigate the evolving economic landscape with confidence.