RBI’s Unexpected Move: A Shot in the Arm for Market Confidence

The Indian stock market got a jolt of energy today, and it wasn’t from caffeine. The Reserve Bank of India (RBI) surprised many by holding steady on key interest rates, a move that sent the Sensex soaring 447 points. Instead of the anticipated rate hike to further combat inflation, the RBI signaled a commitment to fostering economic growth, a decision that has investors breathing a collective sigh of relief.

This isn’t just about numbers on a screen; it’s about the undercurrents of confidence that drive investment and shape our economic future. For weeks, the air has been thick with anxiety about rising inflation and the potential for further tightening of monetary policy. Businesses, big and small, have been carefully watching, anticipating the ripple effects on borrowing costs and consumer spending.

Why the RBI Pumped the Brakes on Rate Hikes

The question on everyone’s mind, of course, is why? What prompted this apparent shift in strategy? The official statements suggest a balancing act between taming inflation and supporting the fragile recovery. While inflation remains a concern, the RBI seems to believe that further aggressive rate hikes could stifle economic momentum and potentially push the economy into a slowdown.

Several factors likely contributed to this decision. Global economic headwinds, including the ongoing war in Ukraine and rising energy prices, continue to cast a shadow over the global outlook. Domestically, while some sectors are showing resilience, others are still struggling to recover from the pandemic’s impact. A too-rapid tightening of monetary policy could disproportionately hurt these vulnerable sectors.

Sensex Reacts: A Celebration of Continuity

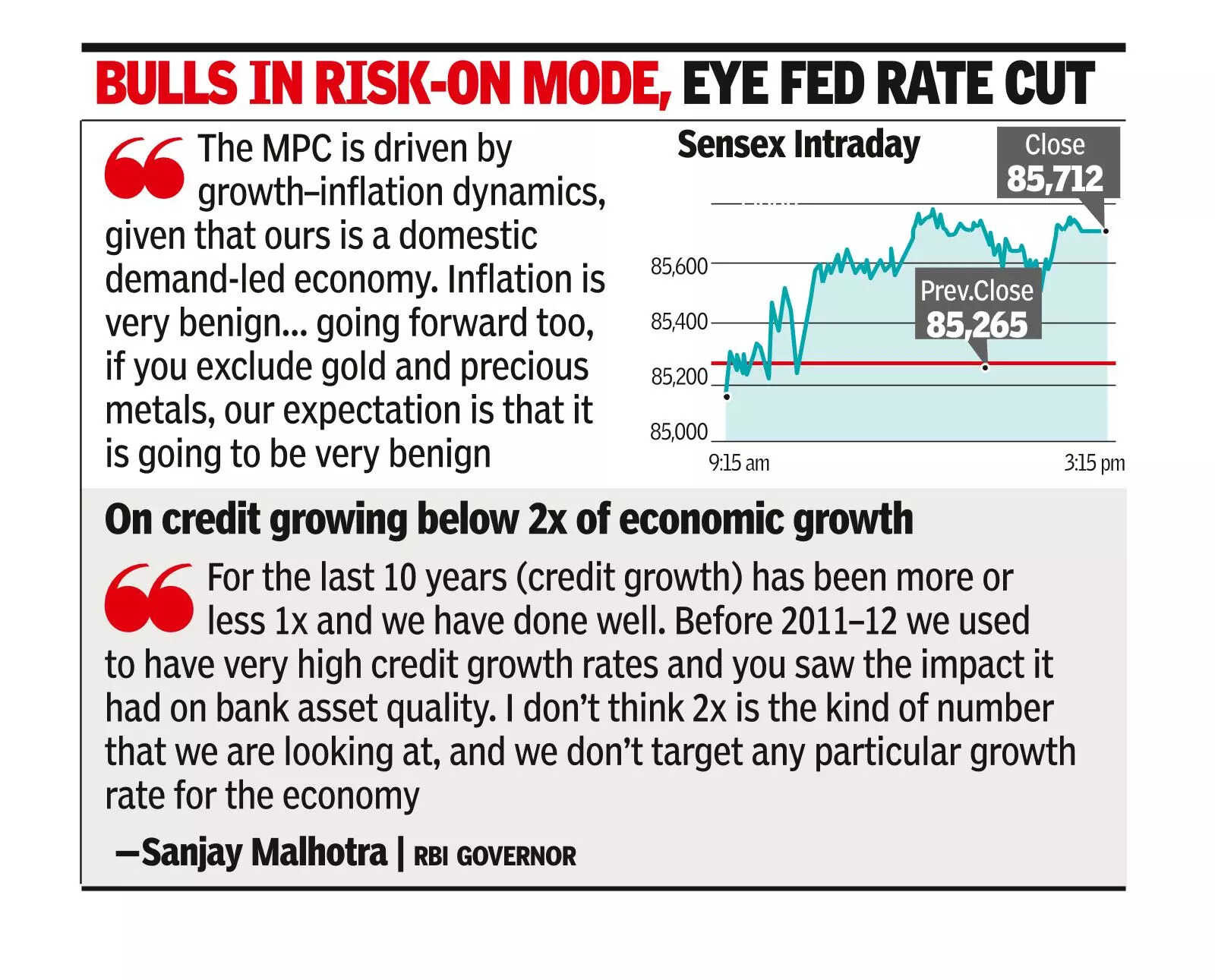

The market’s reaction was immediate and emphatic. The Sensex, a key indicator of investor sentiment, jumped significantly, reflecting a renewed sense of optimism. This isn’t just about the immediate gains; it’s about the signal the RBI’s decision sends. It suggests a more predictable and supportive environment for investment, encouraging businesses to pursue expansion plans and consumers to maintain spending.

Beyond the headline numbers, individual sectors also saw notable gains. Financial stocks, in particular, benefited from the RBI’s decision, as lower interest rates translate to increased borrowing and lending activity. Infrastructure and manufacturing stocks also saw a boost, fueled by expectations of continued government spending and improved demand.

Navigating the Future: A Delicate Balance

The RBI’s decision is undoubtedly a welcome development for the market, but it also raises important questions about the future. The fight against inflation is far from over, and the central bank will need to carefully monitor price pressures in the coming months. A sudden resurgence of inflation could force the RBI to reverse course and implement further rate hikes, potentially triggering renewed market volatility.

The RBI’s current stance places great importance on fiscal policy from the government. Coordinating monetary and fiscal policies is crucial to achieve sustained economic growth without stoking inflation. Government spending on infrastructure and social programs can help stimulate demand, while measures to improve supply chains and reduce production costs can help ease inflationary pressures. If you’re interested in related subjects, check out this article discussing [financial regulation strategies](internal-link).

The Road Ahead for the Indian Economy

The Indian economy stands at a critical juncture. The RBI’s pro-growth stance is a bold move, signaling a willingness to prioritize economic recovery over immediate inflation control. While the path ahead is fraught with challenges, this decision provides a much-needed boost to market confidence and sets the stage for continued growth. Whether this bet pays off will depend on a complex interplay of factors, including global economic conditions, government policies, and the resilience of Indian businesses and consumers. It’s a delicate dance, and the world will be watching.