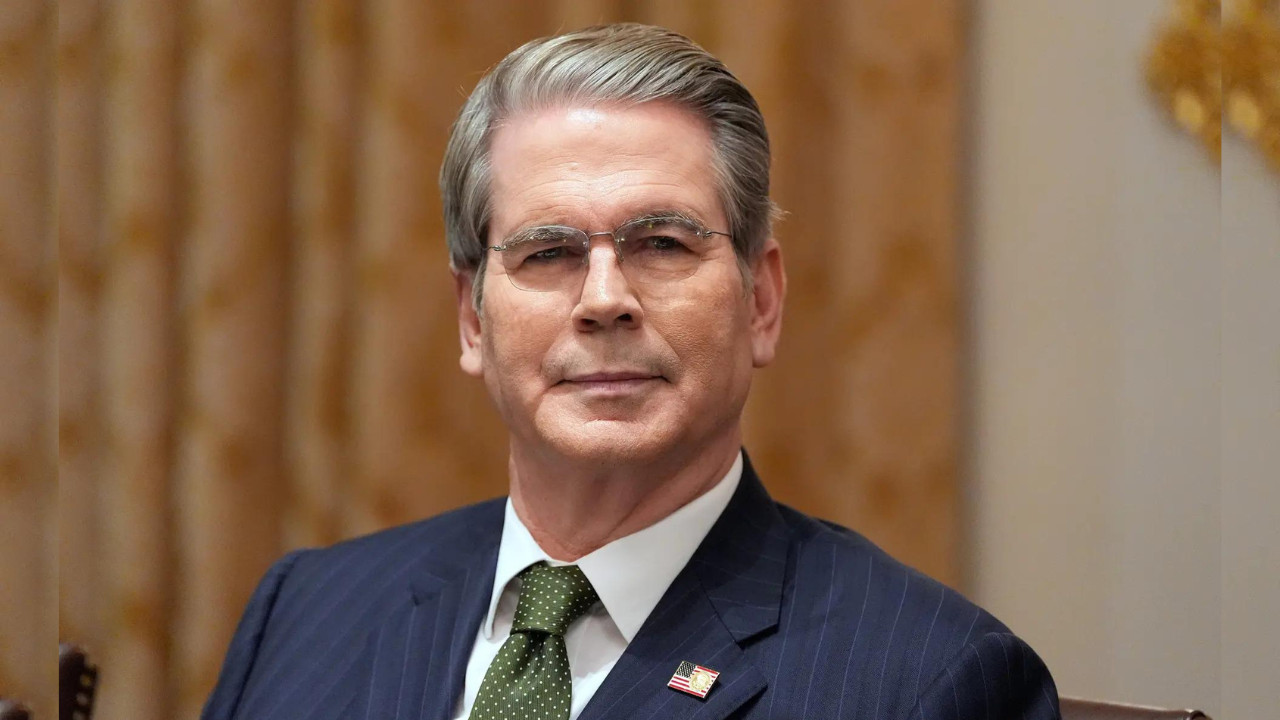

US Treasury Secretary Scott Bessent has urged the European Union to join the US in increasing pressure on Russia, hinting at potential tariffs on nations buying Russian oil. The Trump administration has already imposed significant tariffs on India for its Russian oil trade.

The Russian Economy: On the Brink or Bouncing Back?

The global economic landscape is a complex tapestry, constantly shifting under the weight of geopolitical events. Right now, a significant thread in that tapestry is the Russian economy, and opinions on its future are sharply divided. While some analysts paint a picture of impending collapse, fueled by sanctions and the ongoing war in Ukraine, others suggest a more resilient reality.

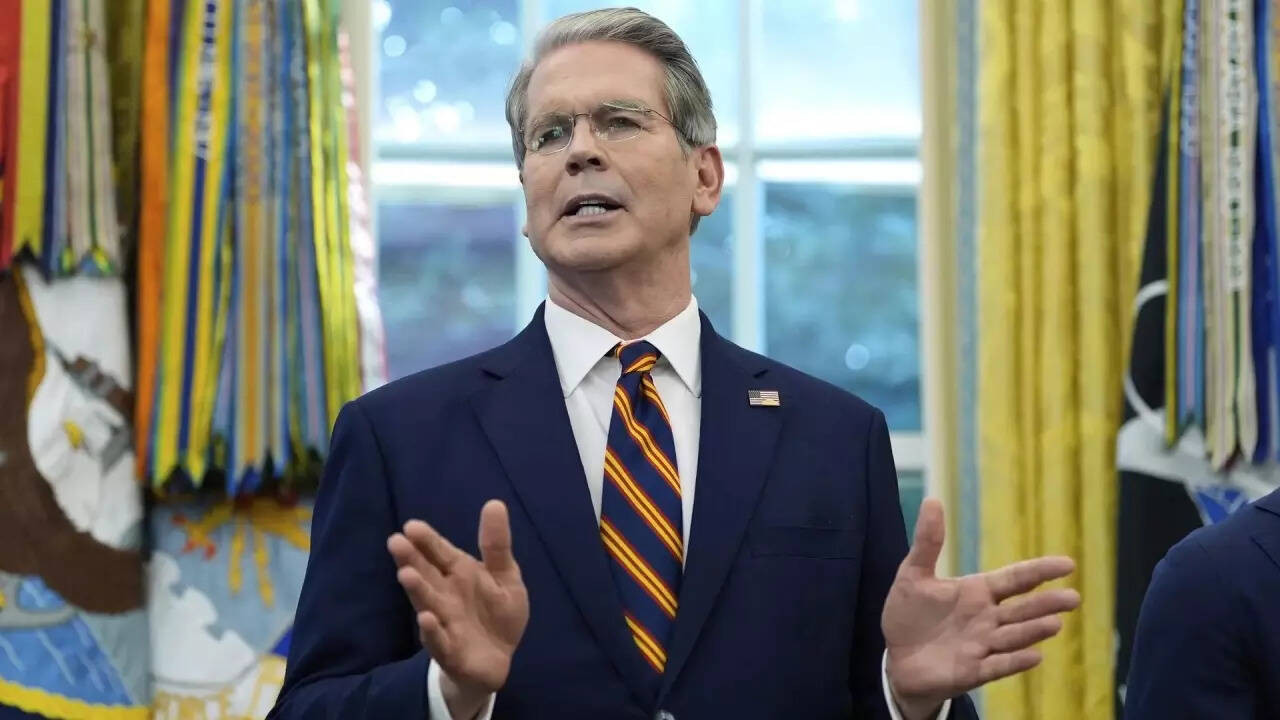

Richard Grenell, a former US intelligence chief and Trump administration official, recently voiced a particularly stark prediction: a “total collapse” of the Russian economy. His proposed solution? Increased tariffs on nations that continue to purchase Russian oil, coupled with intensified pressure from the European Union. Grenell argues that squeezing Russia’s energy revenue stream is the most effective way to cripple its war efforts.

But is such a dramatic outcome truly inevitable, or is there more nuance to the situation?

Sanctions and the Price of War

There’s no denying that the sanctions imposed on Russia following its invasion of Ukraine have had a significant impact. Access to international financial markets has been severely restricted, supply chains have been disrupted, and numerous Western companies have pulled out of the country. The impact on specific industries has been substantial, particularly those reliant on imported technology.

Furthermore, the war itself is a massive drain on resources. Military spending has skyrocketed, diverting funds from other sectors of the economy. The loss of skilled labor, either through emigration or mobilization, further compounds the challenges.

However, painting a picture of utter devastation might be premature.

Shifting Trade and Finding New Markets

One crucial factor tempering the negative effects is Russia’s ability to adapt and find new markets for its exports. While Western nations have reduced their reliance on Russian energy, countries like India and China have stepped in to fill the void. This redirection of trade flows, though not without its logistical hurdles, has helped to sustain Russia’s revenue stream.

This isn’t to say that these new arrangements are without their drawbacks. Russia is often forced to offer significant discounts to these buyers, reducing its overall profit margin. Moreover, relying heavily on a limited number of trading partners increases its vulnerability to future shifts in global demand. Still, the fact remains that Russia hasn’t been completely cut off from the global economy.

The Role of Domestic Production

Another element contributing to the perceived resilience is the focus on boosting domestic production. With access to imported goods restricted, the Russian government is actively promoting import substitution across various sectors. Whether this strategy will be successful in the long term is debatable, particularly when it comes to complex technologies, but it does provide a degree of buffer against external pressures.

Moreover, the Russian government has implemented various measures to stabilize the economy, including capital controls and interest rate hikes. While these measures might stifle growth, they have helped to prevent a complete financial meltdown.

The EU’s Leverage and Future Strategies

The question then becomes: what role can the European Union play in further influencing the situation? As Grenell suggests, increasing pressure on countries buying Russian oil through tariffs and other mechanisms could further tighten the screws. However, such measures also carry significant risks.

The EU itself relies on a delicate balance of energy security and geopolitical considerations. Imposing excessively stringent sanctions could backfire, leading to higher energy prices and potentially triggering a recession within the EU. This delicate balance is a crucial element in how the future of the Russian economy unfolds.

A more targeted and nuanced approach, focusing on specific technologies and sectors critical to Russia’s military capabilities, might be a more effective strategy. Strengthening international cooperation to prevent sanctions evasion is also paramount. For instance, this website also offers insights into [global trade trends](internal-link-to-related-content).

Predicting the Future: A Complex Equation

Ultimately, predicting the future of the Russian economy is a complex endeavor. While the sanctions and the war have undoubtedly created significant challenges, Russia has demonstrated a capacity to adapt and mitigate some of the negative impacts. A “total collapse” remains a possibility, but it’s not a foregone conclusion.

The future hinges on a multitude of factors, including the duration and intensity of the war, the effectiveness of sanctions enforcement, Russia’s ability to diversify its economy, and the willingness of other nations to continue trading with Moscow. It’s a dynamic situation, requiring continuous monitoring and a strategic approach. The interplay of these factors will ultimately determine whether Russia’s economic fate is one of collapse or continued, albeit constrained, operation.