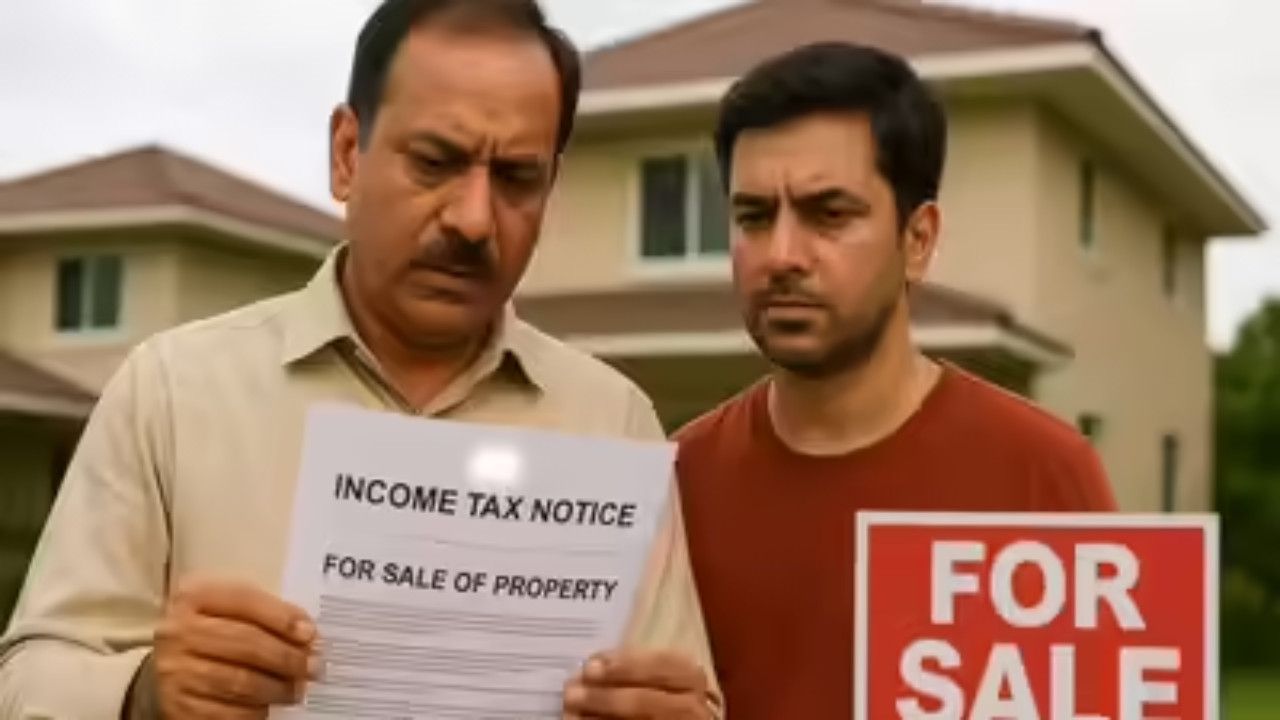

Property buyers are increasingly receiving income tax notices questioning the source of funds for their purchases. Tax authorities are using advanced data analytics to cross-verify declared income against investment levels, especially for transactions over Rs 30 lakh. Prompt and accurate responses with proper documentation are crucial to avoid penalties and reassessment.

Buying Land? The Taxman Might Be Watching

So, you’re thinking of investing in land? Smart move. Real estate remains a solid investment, a tangible asset that can provide long-term security. But before you start dreaming of building your dream home or envisioning a profitable sale down the line, there’s something you need to know: the Income Tax Department is keeping a closer eye than ever on land transactions, especially those exceeding ₹30 lakh.

Why the increased scrutiny? It’s all part of the government’s ongoing efforts to curb tax evasion and bring transparency to the real estate sector. High-value transactions are prime targets for potential money laundering or the concealment of unaccounted wealth. Think of it as a proactive measure to ensure everyone plays by the rules.

What Triggers a Tax Notice When Buying Land?

The rule is simple: If you purchase land (or property) for more than ₹30 lakh, the sub-registrar’s office is obligated to report the transaction to the Income Tax Department. This reporting mechanism falls under Rule 114E of the Income Tax Rules, which mandates the reporting of specified financial transactions. Once the tax authorities have this information, they might just come knocking (figuratively speaking, of course, it’s more likely an email!).

What exactly are they looking for? They’re primarily interested in verifying if the investment aligns with your declared income. Discrepancies between your income tax returns and the value of the land purchased could raise red flags, potentially leading to a notice seeking clarification about the source of funds.

Imagine you’ve declared an annual income of ₹10 lakh in your tax returns, yet you’ve invested ₹50 lakh in a piece of land. The Income Tax Department would naturally want to understand where the extra ₹40 lakh came from. This is where things can get tricky.

Staying on the Right Side of the Law: Avoiding Tax Trouble

The good news is that avoiding complications is entirely possible with proper planning and meticulous record-keeping. Here’s how you can ensure a smooth land-buying experience without attracting unwanted attention from the tax authorities:

* Declare All Income: This is the most fundamental step. Ensure all your income sources, including salary, business profits, rental income, and capital gains, are accurately reported in your income tax returns. Transparency is your best defense.

* Maintain Proper Documentation: Keep detailed records of all financial transactions related to the land purchase. This includes bank statements, loan documents (if applicable), and any other relevant paperwork proving the legitimacy of the funds used.

* Accurately Report the Transaction: When filing your income tax return, make sure to disclose the land purchase accurately. Provide all the necessary details, including the transaction date, property address, and the amount paid.

* Be Prepared to Explain: If you do receive a notice from the Income Tax Department, don’t panic. Respond promptly and provide all the requested information with supporting documents. A clear and transparent explanation of the source of funds is usually sufficient to resolve the matter.

* Consider Professional Advice: If you’re unsure about any aspect of the tax implications of buying land, it’s always wise to consult a qualified tax advisor. They can provide personalized guidance based on your specific financial situation and ensure compliance with all relevant regulations. Learn more about [capital gains tax on property sales](internal-link-to-relevant-article).

The Importance of Understanding TDS on Property

Don’t forget about Tax Deducted at Source (TDS) on property purchases. As a buyer, you are responsible for deducting TDS at the rate of 1% if the property value exceeds ₹50 lakh. This TDS must be deposited with the government using Form 26QB. Failing to deduct and deposit TDS can result in penalties and interest charges. This applies whether you’re buying land or a constructed property.

Staying Informed About Taxation on Land Purchase

The world of taxation can be complex, but it’s not something to be feared. By staying informed about the rules and regulations, maintaining accurate records, and seeking professional advice when needed, you can confidently navigate the process of buying land and avoid any potential tax-related issues. Proactive planning and transparency are your allies in this journey. Don’t let tax worries cloud your vision of that perfect plot of land; instead, embrace a prepared and informed approach.