US Treasury Secretary Scott Bessent criticizes China’s rare earth export controls, stating the US and allies are rapidly building independent supply chains. He accuses past US administrations of inaction, emphasizing the current government’s “warp speed” efforts to counter Beijing’s leverage. Bessent believes the global backlash may deter future Chinese restrictions.

Navigating the Rare Earths Maze: A Shifting Geopolitical Landscape

The world hums with the quiet power of rare earth elements (REEs). These seemingly unassuming metals are the unsung heroes powering everything from smartphones and electric vehicles to wind turbines and advanced defense systems. They’re critical, and their supply chain is becoming a major focal point in the ongoing geopolitical dance between the U.S. and China.

For years, China has dominated the rare earths market, controlling a significant portion of both mining and processing. This dominance has given Beijing considerable leverage, a fact not lost on Western nations increasingly concerned about supply chain vulnerabilities. The winds are shifting, though, with new strategies and players emerging on the scene.

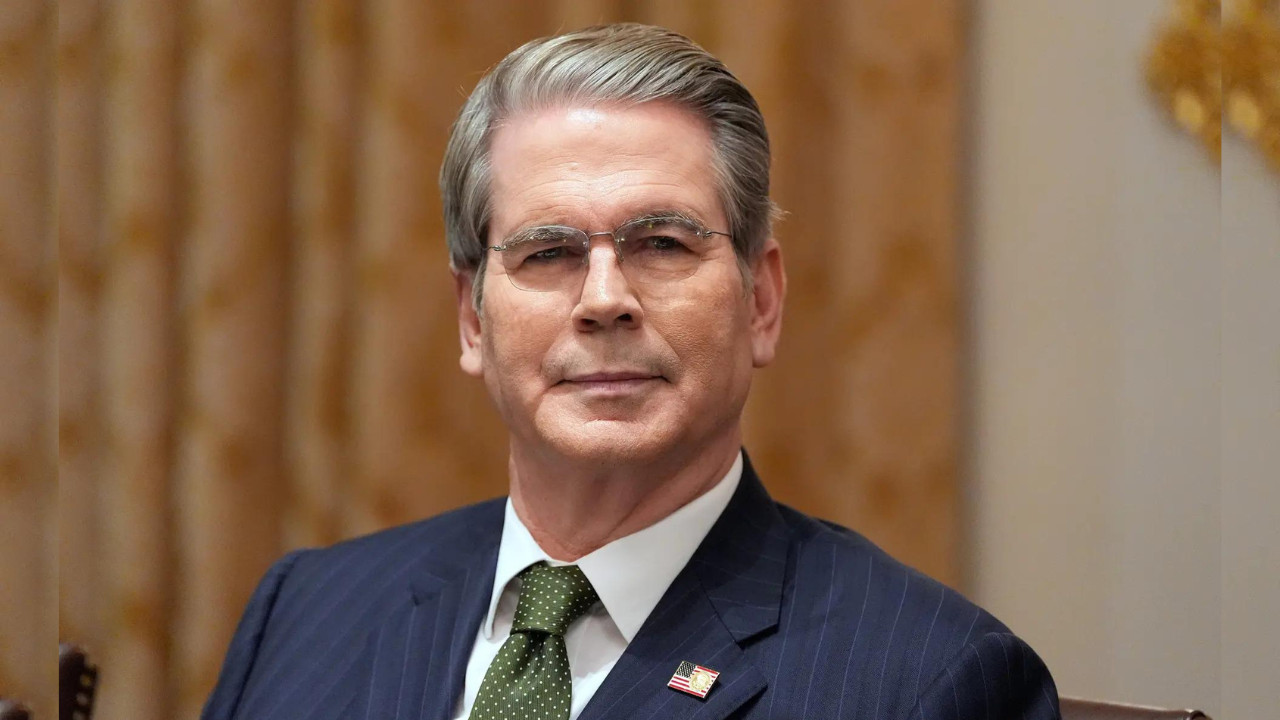

Scott Bessent’s Stark Warning

Scott Bessent, a prominent figure in the investment world, recently voiced sharp criticism of China’s export restrictions on rare earths. He argues that these restrictions are not merely trade policies, but strategic maneuvers designed to exert influence and potentially disrupt industries vital to national security. Bessent isn’t alone in this assessment. There’s a growing chorus of voices urging Western nations to reduce their dependence on China for these critical materials.

Bessent’s perspective highlights a key concern: the potential weaponization of rare earth supplies. Imagine a scenario where access to these elements is curtailed due to political tensions or trade disputes. The consequences for industries reliant on REEs could be devastating, leading to production bottlenecks, price spikes, and ultimately, economic disruption.

Janet Yellen’s Optimistic Outlook: India and Beyond

While Bessent paints a concerning picture, U.S. Treasury Secretary Janet Yellen offers a more optimistic counterpoint. She asserts that India, along with other nations, is moving at “warp speed” to develop its own rare earth resources and processing capabilities. This diversification is seen as a crucial step in reducing reliance on China and bolstering global supply chain resilience.

India, with its significant geological potential and growing industrial base, is indeed poised to play a larger role in the rare earth landscape. The country is actively exploring and developing its own deposits, and investing in the infrastructure needed to process these materials. This is great news for the rare earths market, but it’s not just about India. Other nations, including Australia and the U.S. itself, are also stepping up their efforts to secure and develop their own rare earth resources.

The “warp speed” pace Yellen refers to reflects a growing sense of urgency. Governments and private companies are recognizing the strategic importance of REEs and are accelerating their efforts to diversify the supply chain. This includes investing in domestic mining and processing capabilities, forging partnerships with other nations, and developing innovative technologies to extract and recycle rare earth elements more efficiently.

The Quest for Sustainable and Ethical Sourcing

Beyond geopolitical considerations, there’s also a growing emphasis on sustainable and ethical sourcing of rare earth elements. Traditional mining and processing methods can have significant environmental impacts, including habitat destruction, water pollution, and greenhouse gas emissions. Concerns about labor practices and human rights are also relevant, adding further complexity to the issue.

Consumers are increasingly demanding products that are not only technologically advanced but also ethically and sustainably produced. This demand is driving innovation in the rare earth industry, with companies exploring new mining techniques that minimize environmental impact and implementing stricter labor standards. The development of recycling technologies that can recover REEs from electronic waste is also gaining traction, offering a potentially more sustainable source of these critical materials.

What Does the Future Hold for the Rare Earths Market?

The rare earths market is clearly in a state of flux. China’s dominance is being challenged as other nations ramp up their production and processing capabilities. The focus is shifting towards diversification, sustainability, and ethical sourcing.

The race to secure rare earth supplies is not just about economic competitiveness; it’s about national security and technological leadership. Countries that can secure reliable access to these critical materials will be better positioned to innovate, grow their economies, and maintain their strategic independence.

Ultimately, the future of the rare earths market will depend on a complex interplay of factors, including technological advancements, geopolitical dynamics, and evolving consumer preferences. One thing is certain: the coming years will be a period of intense activity and transformation in this vital industry.

To understand more about securing strategic minerals, read this article on [domestic mining initiatives](internal-link-to-related-content).