US Treasury Secretary Scott Bessent announced a substantial framework to prevent 100% tariffs on Chinese goods and defer rare earths export controls. High-level talks in Kuala Lumpur preceded this development, aiming for more balanced trade, agricultural purchases, and fentanyl crisis measures. The framework is expected to be finalized by Presidents Trump and Xi.

Navigating the Tightrope: Have US-China Trade Tensions Actually Eased?

For years, the global economy has teetered on the edge, anxiously watching the ongoing dance (or perhaps more accurately, the standoff) between the United States and China. The threat of escalating tariffs, export controls, and outright trade wars has cast a long shadow, impacting businesses and consumers worldwide. Recently, whispers of progress have emerged, suggesting a potential thaw in relations. But are these whispers justified, or merely wishful thinking?

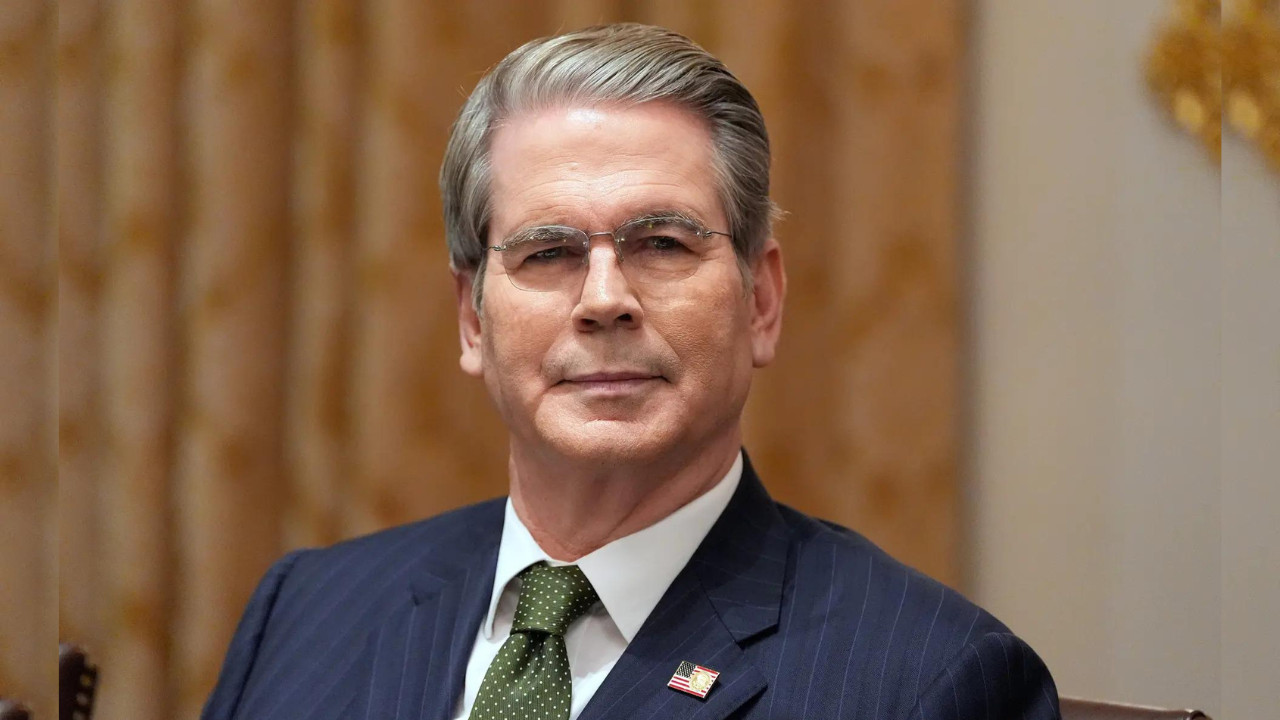

One notable voice adding to the optimism is Scott Bessent, a seasoned investor known for his keen understanding of global markets. Bessent suggests that a “substantial framework” has been reached, hinting at a potential agreement that could de-escalate the situation. This is welcome news, especially considering the high stakes involved.

The Spectre of 100% Tariffs: A Close Call?

Imagine a world where everyday goods crossing the Pacific faced a staggering 100% tariff. This nightmarish scenario, while seemingly far-fetched, was a very real possibility not so long ago. The constant threat of such measures created an environment of uncertainty, forcing businesses to rethink supply chains and investment strategies. If Bessent is correct, and a framework is indeed in place, the near-term danger of these crippling tariffs may have subsided.

Rare Earth Elements: Averting a Critical Clash

Beyond tariffs, another flashpoint in the US-China relationship has been the control of rare earth elements. These vital materials are essential for manufacturing everything from smartphones and electric vehicles to advanced military hardware. China’s dominance in the rare earth market has given it considerable leverage, and the possibility of export restrictions has been a major concern for the US and its allies.

The prospect of China weaponizing its rare earth supply sent shivers down the spines of manufacturers across the globe. Industries reliant on these elements scrambled to diversify their sources, investing heavily in research and development to find alternative materials. Has this particular crisis been averted? If a “substantial framework” exists, it likely addresses this critical vulnerability, perhaps through agreed-upon export quotas or commitments to fair trade practices.

Reading Between the Lines: Cautious Optimism is Key

While Bessent’s comments offer a glimmer of hope, it’s crucial to approach the situation with a healthy dose of skepticism. Trade negotiations are complex and often protracted, with plenty of opportunities for setbacks and misunderstandings. A “substantial framework” could mean many things, and the devil is always in the details.

For instance, are the key areas of intellectual property protection and technology transfer adequately addressed? What about existing tariffs – will they be rolled back, or simply remain in place? These are questions that need clear answers before we can truly declare victory.

Furthermore, political considerations on both sides of the Pacific could easily derail any progress. Domestic pressures and shifting geopolitical landscapes can influence negotiating positions, making a seemingly stable agreement suddenly vulnerable.

Navigating the New Normal in Trade

Regardless of the immediate outcome of these negotiations, one thing is certain: the global trade landscape has been irrevocably altered. The days of unfettered globalization may be behind us, replaced by a more cautious and strategic approach. Businesses need to adapt to this new normal by diversifying supply chains, investing in domestic production, and building resilience into their operations. For more ideas about increasing resilience, check out our article on [supply chain diversification strategies](internal-link-to-related-content).

In conclusion, while the news of a potential US-China trade framework is encouraging, it’s essential to remain realistic. The path to a truly stable and mutually beneficial relationship is likely to be long and winding. Instead of celebrating prematurely, businesses should focus on building resilience and preparing for a future where uncertainty is the only constant. A substantial framework is a positive sign, but vigilance and adaptability are still the best strategies for navigating the complexities of the modern global economy.