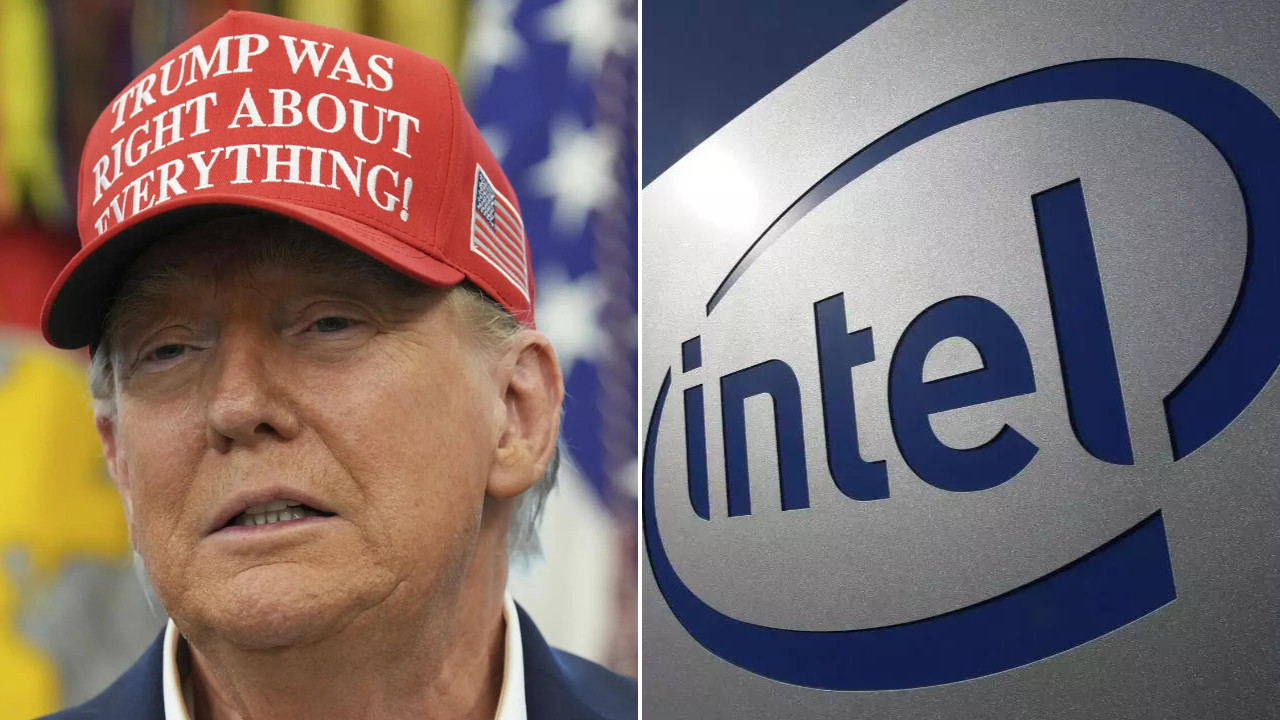

Donald Trump has lauded a landmark $11 billion deal with Intel, predicting it will enrich the US and create jobs. He criticized opponents of the deal, emphasizing that all returns will benefit the country. Intel’s CEO, Lip-Bu Tan, expressed gratitude for the government’s confidence and commitment to US semiconductor production.

Intel’s Big Bet: Can Chip Manufacturing Really Revive American Fortunes?

The scent of silicon and ambition is thick in the air, folks. Not just in Silicon Valley, but seemingly across the entire United States. Recently, Intel and the Biden administration finalized a preliminary agreement that could fundamentally reshape the American semiconductor landscape. The deal, worth a staggering $8.5 billion in direct funding and up to $11 billion in loans, aims to turbocharge Intel’s domestic chip manufacturing capabilities. Former President Trump chimed in, suggesting the deal would make the US “richer” and anticipated more similar deals would follow. But can a single investment, even one of this magnitude, truly bring manufacturing glory back to American shores and solve the global chip shortage?

For decades, chip manufacturing has steadily migrated overseas, particularly to Asia. Factors like lower labor costs, government incentives, and established ecosystems have created a significant advantage for countries like Taiwan and South Korea. This has left the US vulnerable, especially considering the critical role semiconductors play in everything from smartphones and cars to military equipment.

Intel’s investment promises to reverse this trend, or at least put a sizeable dent in it. The funding will support Intel’s ambitious plans to expand its manufacturing footprint in states like Arizona, Ohio, New Mexico, and Oregon. These new fabs (fabrication plants) are envisioned as cutting-edge facilities, producing the most advanced chips using the latest technologies.

The implications extend far beyond Intel’s bottom line. Think about the ripple effect. Thousands of high-paying jobs will be created, not just at Intel, but also at its suppliers and partners. Local economies will get a significant boost. The US will become less reliant on foreign sources for crucial technology, strengthening national security. And who knows? Maybe it will make the US “richer”, as Trump proclaimed.

Beyond the Hype: Challenges and Considerations

While the vision is compelling, the path ahead isn’t without its hurdles. Building and operating advanced chip fabs is incredibly complex and expensive. The technology is constantly evolving, requiring continuous investment and innovation. The talent pool needs to be nurtured, ensuring there are enough skilled engineers and technicians to operate these facilities.

Furthermore, the global semiconductor market is fiercely competitive. Intel will need to navigate complex geopolitical dynamics and compete against established players with significant advantages. Securing a stable supply chain for raw materials and components will also be crucial.

And let’s not forget the environmental impact. Chip manufacturing is energy-intensive and can generate significant waste. Sustainable practices and responsible resource management will be essential to ensure these new fabs operate in an environmentally friendly manner.

What This Means for the Future of American Manufacturing

Despite the challenges, Intel’s investment represents a significant step towards revitalizing American manufacturing. It signals a renewed commitment to domestic production and a recognition of the strategic importance of semiconductors.

If successful, this initiative could pave the way for other companies to invest in US manufacturing, creating a virtuous cycle of growth and innovation. It could also inspire policymakers to enact further measures to support domestic industries and strengthen the American economy. Check out our previous article on boosting local economies through targeted investments for more on that.

Ultimately, the success of Intel’s ambitious plan hinges on execution, collaboration, and a long-term commitment from both the public and private sectors. It’s a high-stakes game, but the potential rewards are immense. The impact of Intel chip manufacturing on the US economy is a wager on the future of American innovation.

Conclusion:

The Intel deal signifies more than just a financial transaction. It’s a calculated move to regain a competitive edge in a critical industry, bolster national security, and create economic opportunities. While challenges remain, the potential for a revitalized American manufacturing sector is palpable. Whether it lives up to the most optimistic predictions remains to be seen, but it’s undoubtedly a bold step in the right direction.