Vedanta Under Scrutiny: A Deep Dive into the Short Seller’s Claims

The Indian stock market held its breath recently as Vedanta Resources, a giant in the metals and mining space, found itself squarely in the crosshairs of a US-based short seller. Shares of Vedanta took a tumble, a stark reminder that even the most established companies aren’t immune to market scrutiny and the potential fallout from accusations leveled by those betting against their success. But what exactly fueled this market reaction, and what does it mean for the future of Vedanta?

The short seller, whose name carries weight in financial circles, released a report alleging that Vedanta has been engaging in questionable financial practices, essentially calling the company a “house of cards.” The core of their argument revolves around the assertion that Vedanta has been manipulating its financials to paint a rosier picture than reality, potentially misleading investors about the true health of the company. They point to complex intercompany transactions and debt structures as evidence of these alleged manipulations, suggesting that the company’s debt is unsustainable and that its valuation is significantly inflated.

Such accusations, naturally, trigger a ripple effect. Investors, often driven by fear of the unknown, tend to react swiftly, leading to a sell-off of shares. This is precisely what happened with Vedanta, showcasing the power a short seller’s report can wield in today’s interconnected financial markets.

Vedanta’s Strong Rebuttal

However, Vedanta hasn’t taken these accusations lying down. The company swiftly issued a strong rebuttal, vehemently denying all allegations. They maintain that their financial practices are transparent and in full compliance with all applicable regulations. Moreover, Vedanta stated their debt levels are manageable and sustainable, supported by the company’s strong operational performance and asset base. The company accuses the short seller of deliberately spreading misinformation to profit from a decline in Vedanta’s share price.

This back-and-forth creates a complex narrative. On one side, you have a firm known for its high-stakes strategies, betting against a company they believe is fundamentally flawed. On the other, you have Vedanta, a multinational corporation with substantial assets and a long track record, defending its integrity and financial soundness. The truth, as is often the case, likely lies somewhere in between.

Understanding the Impact on Investors

So, what does this situation mean for investors? Volatility is almost certainly to be expected in the short term. The market will likely continue to react to new information, rumors, and counter-arguments presented by both sides. Investors holding Vedanta shares are faced with a difficult decision: hold steady, hoping the company’s defense will prevail, or cut their losses and exit the position. This decision will largely depend on individual risk tolerance, investment horizon, and a thorough understanding of the underlying facts and financial statements.

The Bigger Picture: Implications for the Indian Market

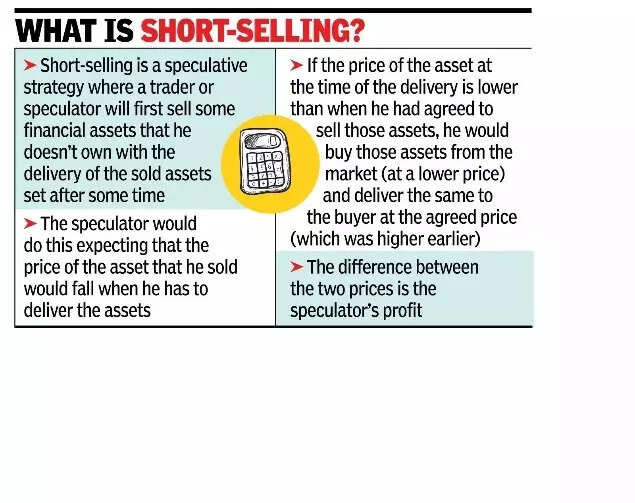

Beyond Vedanta itself, this situation has broader implications for the Indian market. It highlights the increasing scrutiny faced by Indian companies from international investors and the growing influence of short sellers in shaping market sentiment. While short selling can play a valuable role in exposing corporate wrongdoing and preventing market bubbles, it can also be used opportunistically to manipulate stock prices for profit.

Regulators will be watching this situation closely. The Securities and Exchange Board of India (SEBI), the market regulator, is likely to investigate the allegations to ensure that all parties are acting in accordance with the law. This situation could also prompt a broader review of regulations governing short selling and corporate disclosure requirements, aiming to strike a balance between market efficiency and investor protection.

A Fork in the Road for Vedanta

The road ahead for Vedanta is uncertain. The company needs to effectively communicate its financial position to investors and restore confidence in its governance practices. This will require transparency, clear communication, and a proactive approach to addressing investor concerns.

Ultimately, the outcome will depend on the strength of the evidence presented by both sides and the ability of investors to discern the truth amidst the noise. This situation serves as a valuable reminder of the importance of due diligence, critical thinking, and a balanced approach to investing in today’s complex and rapidly evolving financial markets. You can read more about responsible investing strategies [here](internal-link-to-related-content).

The events surrounding Vedanta underscore the critical role of transparency and accountability in maintaining investor confidence. As the dust settles, the lessons learned from this episode will undoubtedly shape the future of corporate governance and market regulation in India.