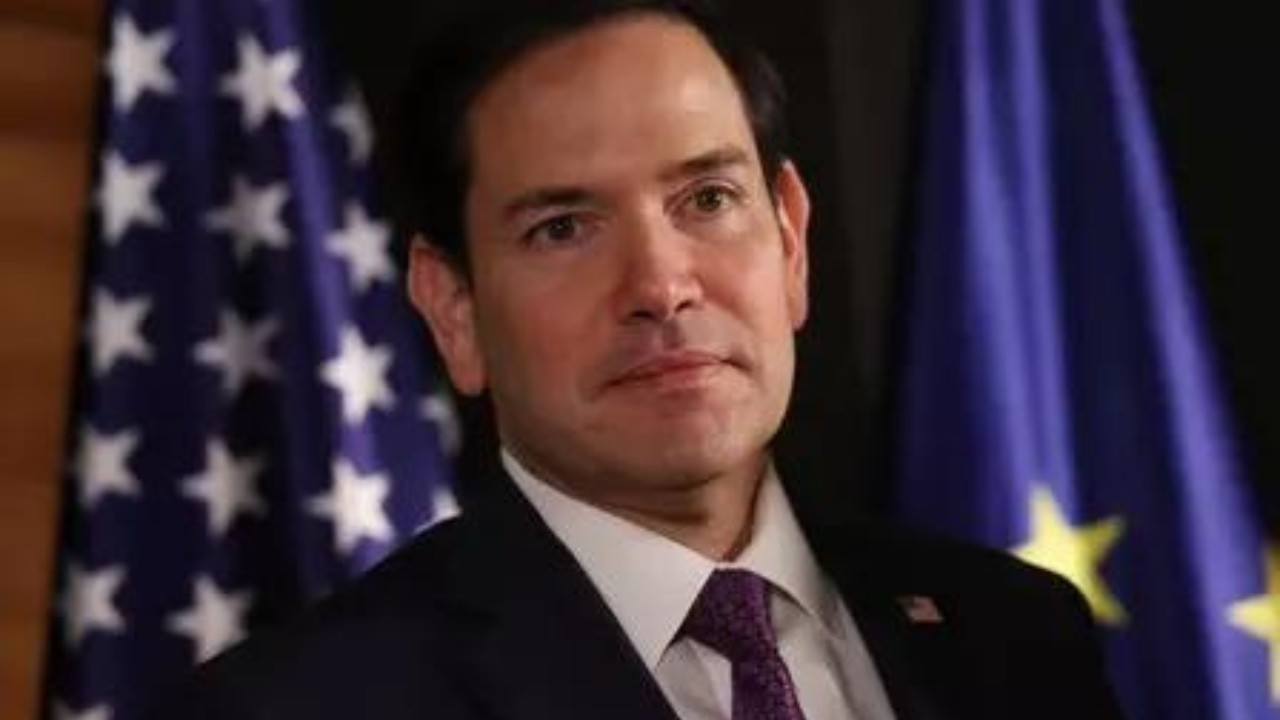

US State Secretary Marco Rubio has warned of potential energy price hikes if the US imposes secondary sanctions on China for processing Russian oil. This comes amid concerns over the US’s approach, with tariffs on India for similar purchases. Rubio highlighted that China refines Russian oil and sells it globally, impacting prices.

Navigating the Tightrope: Why the US Isn’t Slapping Tariffs on Russian Oil Buyers

The global energy market is a tangled web, a delicate dance between supply, demand, and political maneuvering. Lately, the music’s been particularly frantic, and everyone’s watching the US to see what steps it will take next. So, why aren’t we seeing a wave of tariffs slapped on countries still buying Russian oil, particularly China and some European nations? The answer, as US Secretary Marco Rubio recently articulated, is far more nuanced than a simple yes or no.

The initial reaction might be to reach for the tariff hammer. Russia’s war in Ukraine has created an undeniable moral imperative to cripple its ability to finance the conflict. Cutting off oil revenue is a clear path to that goal. Yet, simply throwing tariffs at every nation importing Russian crude could trigger a series of unintended consequences, potentially doing more harm than good.

One major concern is the potential for a dramatic surge in global oil prices. Imagine a scenario where already strained supply chains are further constricted by widespread tariffs. The resulting spike could send shockwaves through the world economy, hitting consumers hard at the pump and fueling inflation. This isn’t about turning a blind eye; it’s about strategically choosing the right tools for the job.

Rubio points to the potential for sanctions as a more effective, targeted weapon. Sanctions can be tailored to specific entities and activities, allowing for a more precise approach to limiting Russia’s financial gains without disrupting the entire global market. It’s a scalpel, not a sledgehammer.

The China Factor and Energy Security

China’s role in this equation is critical. As a major consumer of energy, China’s purchasing decisions have a significant impact on global oil markets. While the US has imposed its own ban on Russian oil imports, persuading China to do the same (or significantly reduce its intake) is a monumental task. Simply imposing tariffs might not be enough to deter China, and could even backfire, leading to retaliatory measures that further destabilize the global economy.

Furthermore, China’s long-term energy strategy plays a crucial role. China is working hard to diversify its energy sources and ensure energy security. Imposing tariffs could incentivize China to deepen its relationship with Russia, solidifying Russia’s position as a key energy supplier and potentially undermining long-term efforts to isolate Russia.

Europe’s Delicate Position

The situation in Europe is equally complex. Several European countries are heavily reliant on Russian energy, a legacy of decades-old infrastructure and supply agreements. While many are actively working to wean themselves off Russian oil and gas, the transition takes time and significant investment. Hitting these nations with immediate tariffs could cripple their economies and create significant social unrest.

The US is also likely considering the transatlantic alliance and the importance of maintaining a united front against Russian aggression. Punitive measures against European allies could strain these relationships and weaken the overall response to the crisis. This is especially relevant given the ongoing discussions around energy independence and the green transition in Europe – topics we cover extensively in our section on [global energy policy](internal-link-to-energy-policy-content).

The Path Forward: Targeted Action and Diplomacy

So, what’s the alternative to widespread tariffs? The focus seems to be on a combination of targeted sanctions, diplomatic pressure, and collaboration with allies to reduce their reliance on Russian energy. The goal is to squeeze Russia’s financial lifeline without causing a global economic meltdown. This requires a delicate balancing act, a willingness to adapt to changing circumstances, and a clear understanding of the potential consequences of each action.

The decision to forgo tariffs on nations buying Russian oil is not an endorsement of their actions, but rather a calculated assessment of the risks and rewards. It reflects a pragmatic approach to a complex problem, prioritizing long-term stability and the overall effectiveness of the response to Russia’s aggression. The coming months will be crucial in determining whether this strategy will succeed in isolating Russia and ultimately contributing to a peaceful resolution of the conflict.